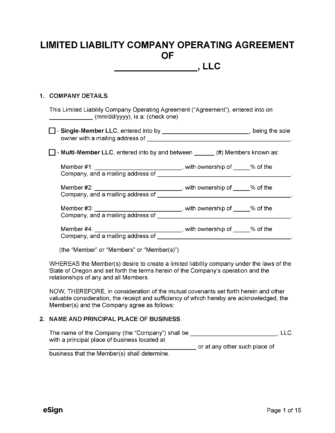

Is an Operating Agreement Required?

No – Like most states, Oregon doesn’t require LLCs to have operating agreements; however, they are often necessary if applying for financing and are commonplace.

Types (2)

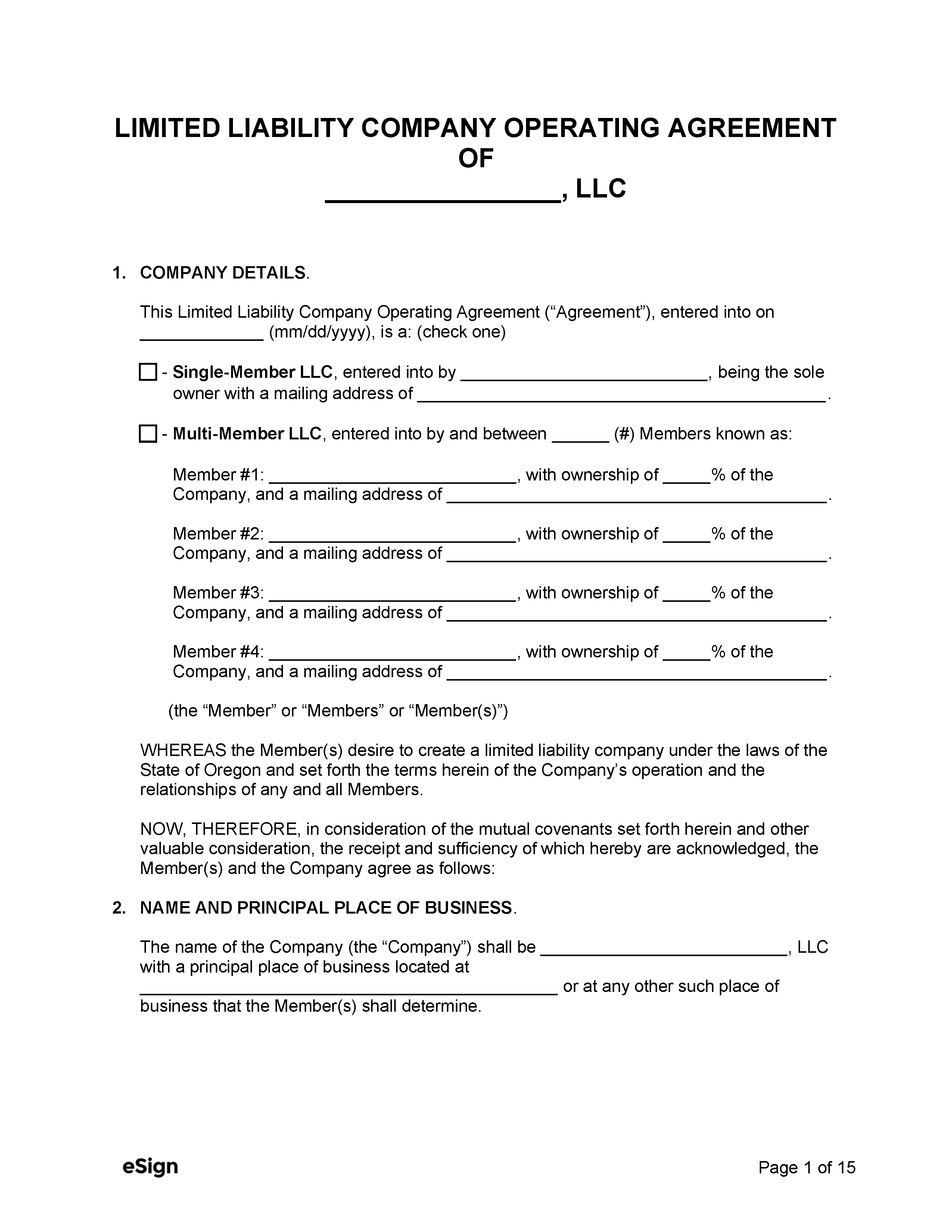

Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one member. Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one member.

|

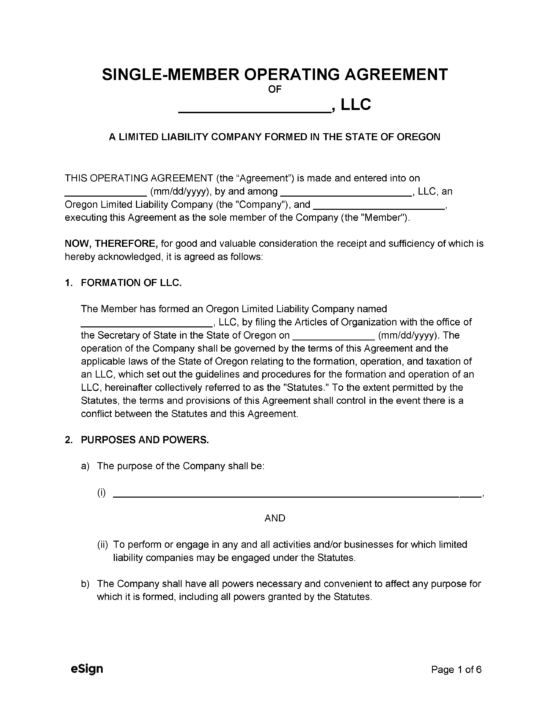

Multi-Member LLC Operating Agreement – An agreement between the members of an LLC with two or more members. Multi-Member LLC Operating Agreement – An agreement between the members of an LLC with two or more members.

|