Contents |

Types (2)

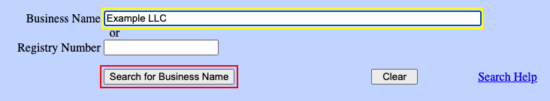

Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one (1) member.

Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one (1) member.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 63 (Limited Liability Companies)

- Definitions: § 63.001

- Formation: § 63.044

- Naming of LLCs: § 63.094

How to File (5 Steps)

- Step 1 – Find a Unique Business Name

- Step 2 – File Articles of Organization/Application for Authority

- Step 3 – Make an LLC Operating Agreement

- Step 4 – Apply for Employer ID Number (EIN)

- Step 5 – Annual Report

Step 1 – Find a Unique Business Name

Before forming an LLC, the company members will need to decide on a business name that fulfills state requirements. Entity names are are required to be unique (not already registered in the state) and include one of the following designations:

- LLC

- L.L.C.; or

- Limited Liability Company.

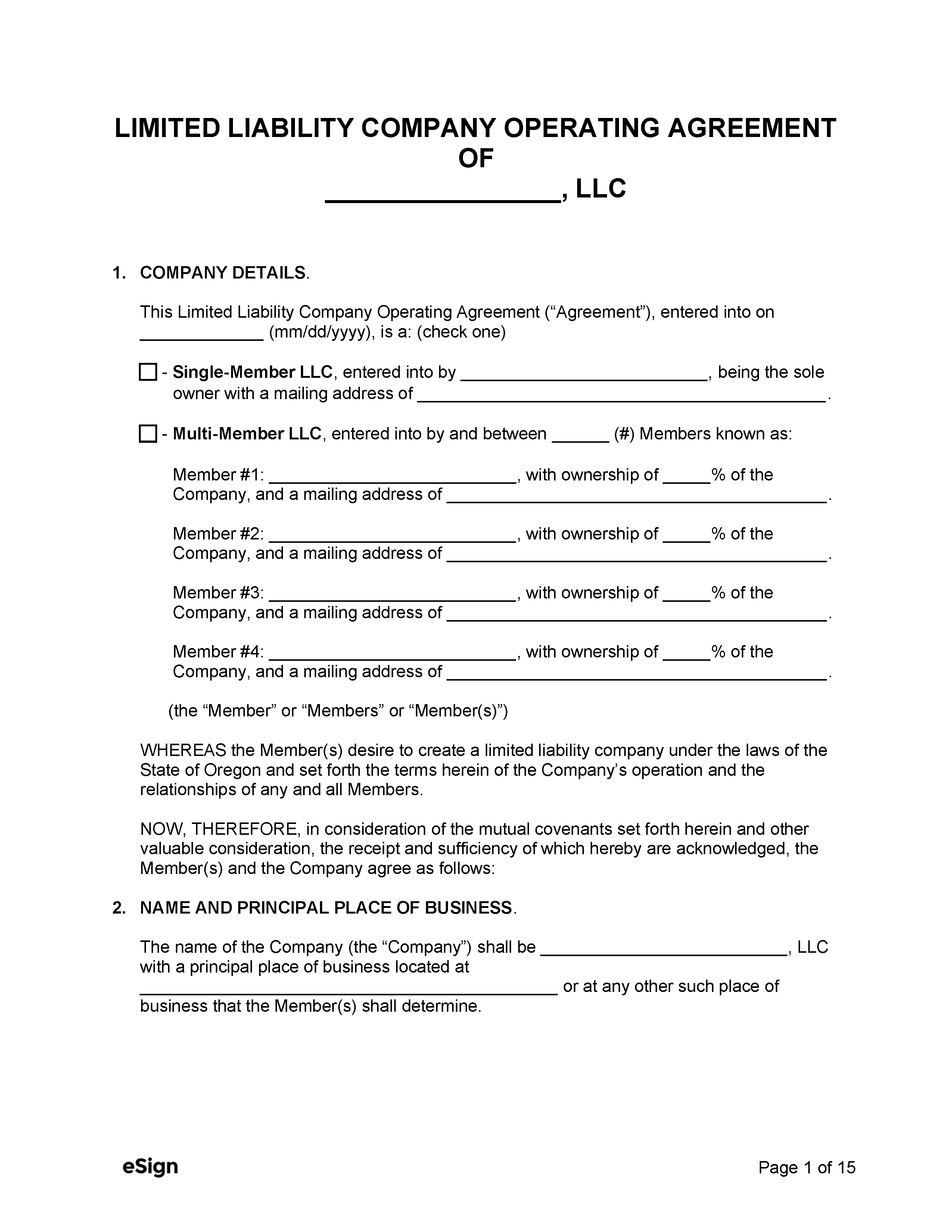

To verify if the chosen name is registered in Oregon, go to the Business Registry Database webpage, enter the name in the “Business Name” field and click Search for Business Name. If another company has already registered the name, repeat the process until a unique name is found.

Before filing the founding documents of an LLC, a name can be reserved for one hundred twenty (120) days to ensure that the name is not taken in the interim. To reserve a name, complete an Application for Name Reservation and file it by mail with the Secretary of State (address below). Include a $100 check or money order payable to “Corporate Division” to cover the filing fee.

Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

Step 2 – File Articles of Organization/Application for Authority

To create an LLC in Oregon, the company members will need to apply for acceptance by filing the necessary documents with the Secretary of State. New companies being formed in the state will file as a “Domestic LLC.” If the company is founded in another jurisdiction and expanding into Oregon, they will be considered a “Foreign LLC.” The fees and required forms are different for domestic and foreign companies.

Domestic LLC

- Form:

- Filing fee: $100

Foreign LLC

- Forms:

- Application for Authority to Transact Business

- Certificate of Existence (issued by state of origin)

- Filing fee: $275

The forms can be filed online through the Oregon Business Registry (requires the creation of an account) or by mail at the below address.

Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

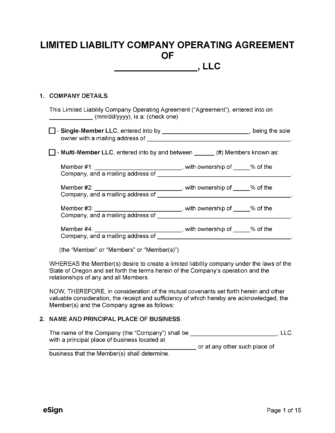

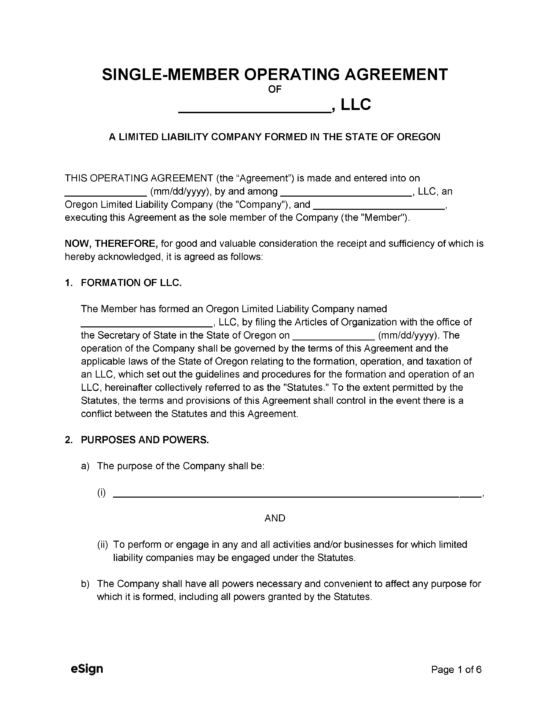

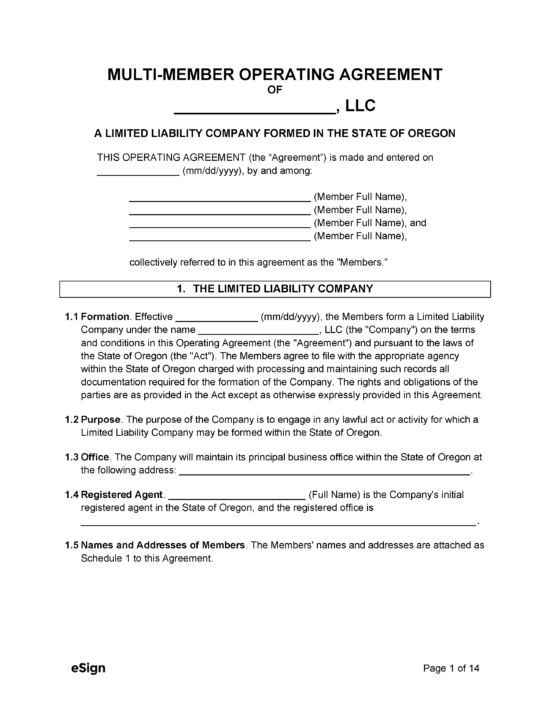

Step 3 – Draft an LLC Operating Agreement

While the forms filed with the Secretary of State form the register the business with the state, an operating agreement governs the company’s operations and internal structure. Unlike the Articles of Organization, it is not legally required or filed with the Secretary of State. However, an LLC operating agreement is essential in protecting its members from personal liability and internal conflict.

Step 4 – Apply for Employer ID Number (EIN)

Any company that has two (2) or more members is required to obtain an EIN from the IRS to identify the LLC for federal taxation. Applications can be completed online or by completing the Application for EIN (Form SS-4) and sending it to the address below this paragraph. There is no fee for EIN applications.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Step 5 – Annual Report

An Annual Report is a form that an LLC must fill out to keep the Secretary of State updated on the current status of the company. Every year following an LLC’s formation, the business will be required to file the Annual Report on the anniversary of the date that the Oregon Secretary of State approved the Articles of Organization. Filing must be completed online.

ResourcesFiling Options: Online / By Mail Costs:

Forms:

Links:

|