Contents |

Types (2)

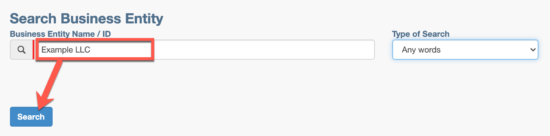

Single-Member LLC Operating Agreement – Relays the financial and logistical framework of an entity that has one (1) sole owner/member.

Single-Member LLC Operating Agreement – Relays the financial and logistical framework of an entity that has one (1) sole owner/member.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 88

- Definitions: § 8812

- Formation: § 8821

- Naming of LLCs: § 204

How to File (4 Steps)

- Step 1 – Find a Unique Entity Name

- Step 2 – File Forms with Department of State

- Step 3 – Create an Operating Agreement

- Step 4 – Apply for an EIN from the IRS

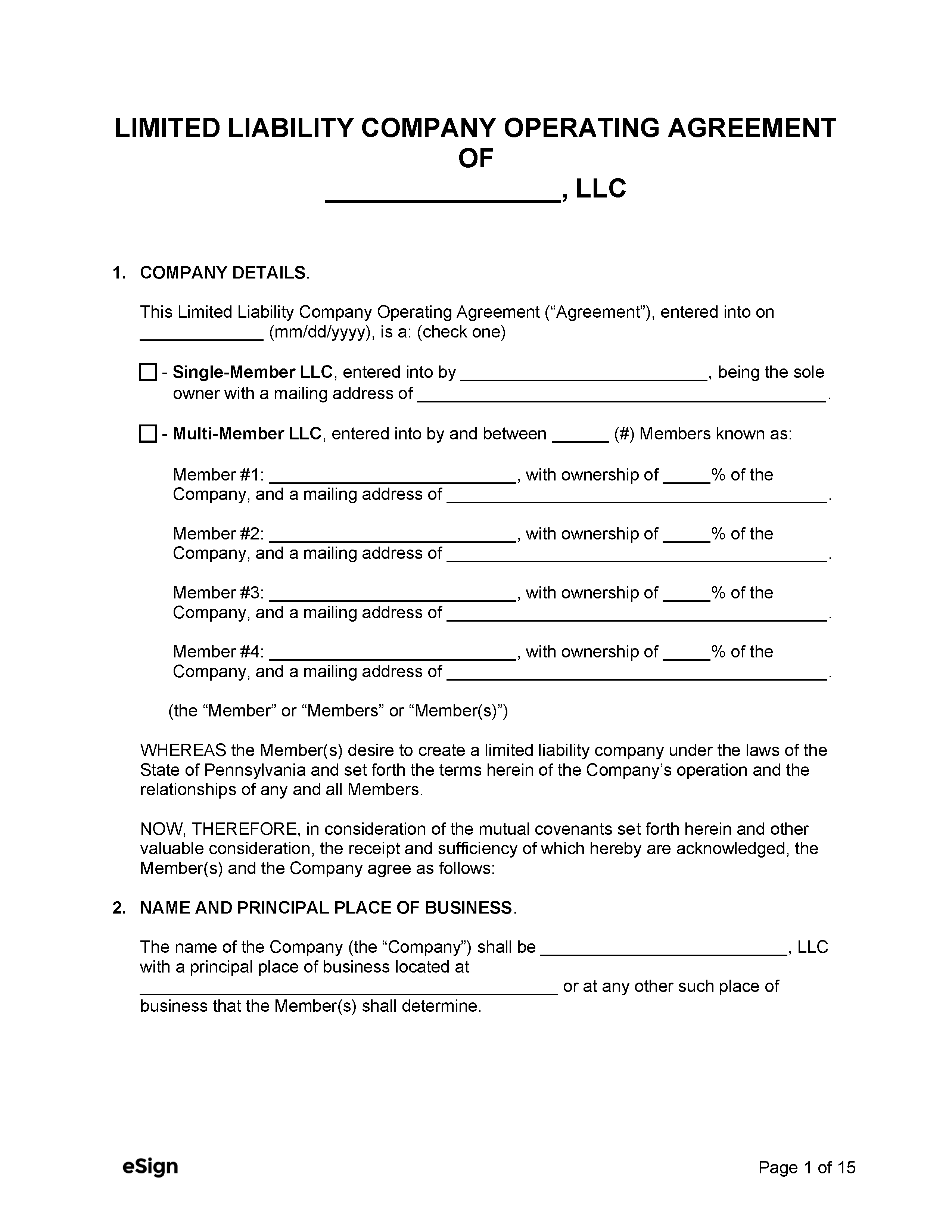

Step 1 – Find a Unique Entity Name

All LLCs are legally required to register their company with a unique business name that is not already reserved or registered in Pennsylvania. The name must include one of the following designations: “company,” “limited,” “limited liability company,” or an abbreviation of those words.

To check if an entity name is already taken, navigate to the Department of State Search Business Entity website, enter the name in the “Business Entity Name/ID” field and click Search. If the search results in any matches to the name, other names will need to be tested until a unique name has been found.

Entity names can be reserved for one hundred twenty (120) days by filing a Name Reservation form with the Bureau of Corporations with payment of the $70 fee. Name reservations can also be completed online.

Step 2 – File Forms with Department of State

An LLC is officially formed when it has been approved by the Department of State after the necessary documents have been filed with the Bureau of Corporations.

Domestic LLC

If the company is opening operations in Pennsylvania and will be based in the state, it is considered a “Domestic LLC” and is created with the filing of the Certificate of Organization. Filing may completed online or by mail.

File Online

- Register a Keystone Login ID and Password.

- Access the PENN File business portal.

- Complete and file the online Certificate of Organization.

- Pay the $125 filing fee (credit card required).

File by Mail

- Download and complete the Certificate of Organization and New Entity Docketing Statement forms.

- Mail the completed documents along with payment of $125 to the address below.

Bureau of Corporations and Charitable Organizations

401 North Street, 206 North Office Building

Harrisburg, PA 17120

Foreign LLC

Companies with existing offices registered in other states are considered “Foreign LLCs.” To apply for the right to operate in Pennsylvania, foreign LLCs are required to file a Foreign Registration Statement with the Department of State.

File Online

Online filing of LLC forms is completed through the PENN File business portal. To access this service, users will need to register a Keystone Login ID and Password. The forms can be submitted through the portal and the $250 filing fee paid online. Foreign LLCs will be required to upload a Certificate of Good Standing (or equivalent document) issued by their state of origin.

File by Mail

- Obtain a Certificate of Good Standing issued by the state in which the LLC is already registered.

- Download and complete the Foreign Registration Statement and New Entity Docketing Statement forms.

- Mail the completed documents along with payment of $250 to the address below.

Bureau of Corporations and Charitable Organizations

401 North Street, 206 North Office Building

Harrisburg, PA 17120

Note on Expedited Service (Optional)

For an extra fee, the Department of State’s response can be accelerated by filing an Expedited Service Request Form along with the other required LLC forms. Ordinarily, a response will take seven (7) to ten (10) business days. Expedited service allows the applicant to receive a response on the same day as their filing.

The fee schedule for expedited service is as follows:

- Same day service: $100

- Three (3) hour service: $300

- One (1) hour service: $1,000

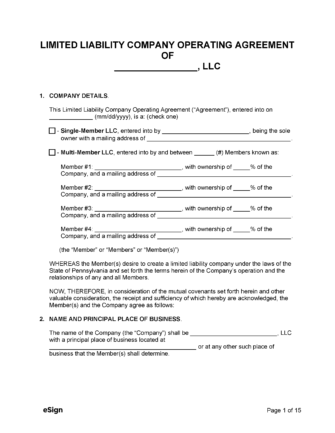

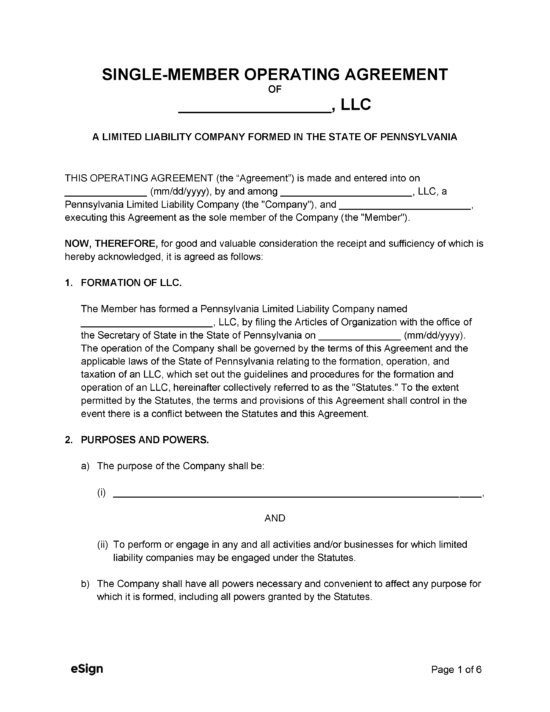

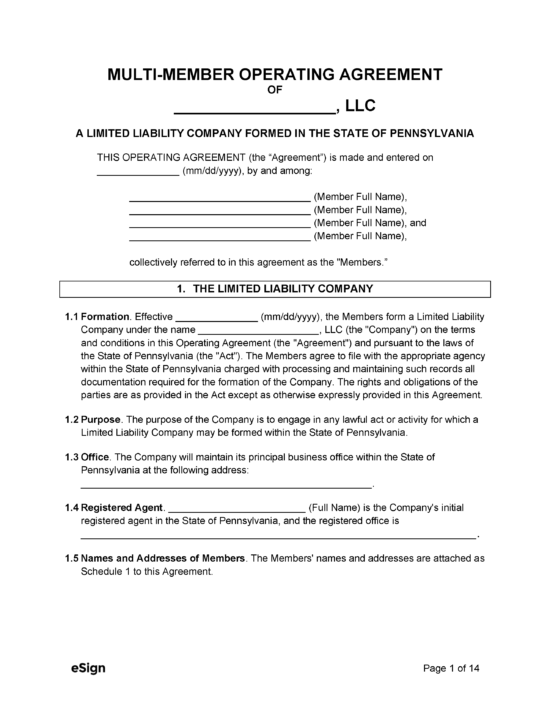

Step 3 – Create an Operating Agreement

An operating agreement is an internal document that defines the relationship between an LLC and its members. Although the agreement isn’t legally required, it is essential in laying the foundation for the company’s structure and operations.

Step 4 – Apply for an EIN from the IRS

If a new LLC has more than one (1) member, it must obtain an employer ID number (EIN) from the IRS. The EIN is a number that is assigned to businesses to identify them for federal taxation. Companies can apply online or by mailing a completed Application for EIN (Form SS-4) to the below address.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online / By Mail Costs:

Forms:

Links:

|