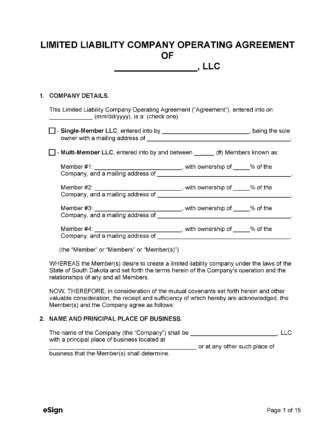

An LLC operating agreement will contain provisions such as member ownership percentages, management and voting rights, capital contributions, distributions, and the dissolution of the company. Creating a written document with all the necessary provisions and stipulations will help prevent conflict amongst the members and protect the company’s the limited liability status.

Contents |

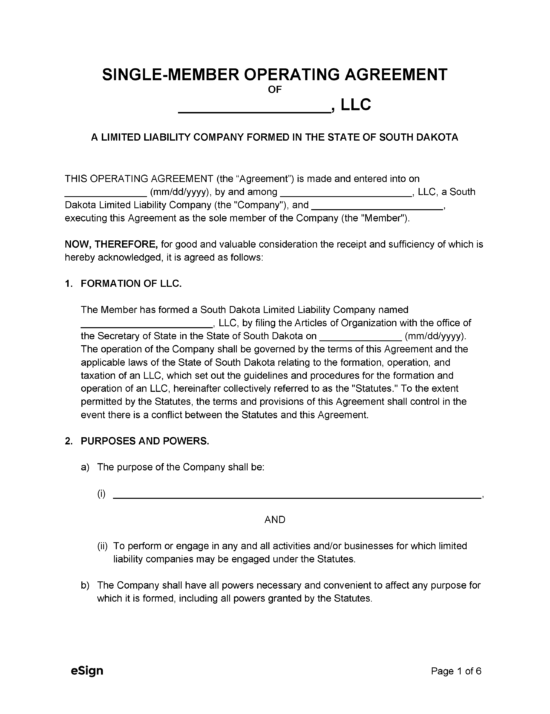

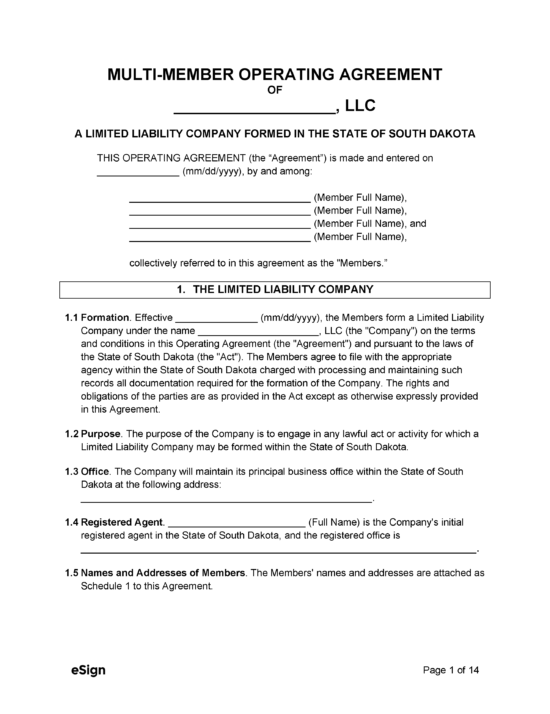

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 47, Chapter 34A

- Definitions: § 47, 34A, 101

- Formation: § 47, 34A, 202.1

- Naming of LLCs: § 47, 34A, 105, 106, and 107

How to File (5 Steps)

- Step 1 – Name the LLC

- Step 2 – Nominate Registered Agent

- Step 3 – File Articles of Organization

- Step 4 – Create Operating Agreement

- Step 5 – Obtain an EIN

Step 1 – Name the LLC

An LLC needs a name that is both unique and complies with state law (a complete list of requirements is outlined in § 47, 34A, 105).

To ensure uniqueness, the Secretary of State’s Business Name Availability web portal can be used to conduct an exact search for a business name. Alternatively, the Business Information Search can be used to enter one (1) or more keywords to bring up a list of all business names that contain those search words.

An Application for Reservation of Name can be filed with the SOS along with a $25 fee to hold the name for one hundred and twenty (120) days.

Step 2 – Nominate a Registered Agent

A registered agent is an individual or entity responsible for receiving tax forms, legal documents, and other government or official correspondence on behalf of the LLC.

A member of the LLC can be selected as the registered agent for the company as long as they are eighteen (18) years or older, have a physical address in South Dakota, and they’re available in person during normal business hours.

It is recommended that the LLC hire a commercial registered agent as the benefits often greatly outweigh the cost, which ranges from $50 to $300 annually. The Secretary of State provides a comprehensive list of all Commercial Registered Agents in the state of South Dakota.

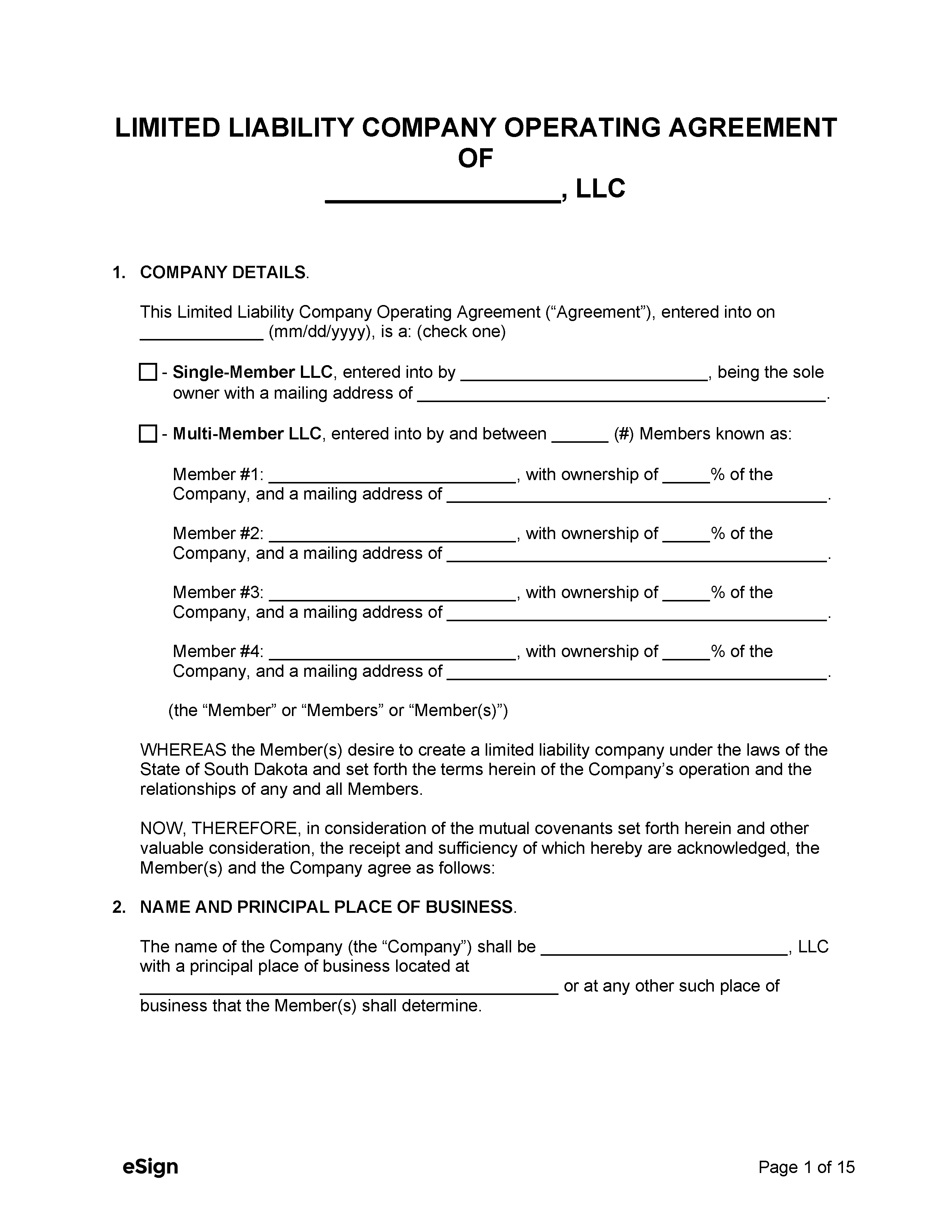

Step 3 – File the Articles of Organization

In order to register an LLC in the state, members must file the Articles of Organization (or an Application for Certificate of Authority for foreign entities). This form is made up of eight (8) articles that provide pertinent information concerning the company.

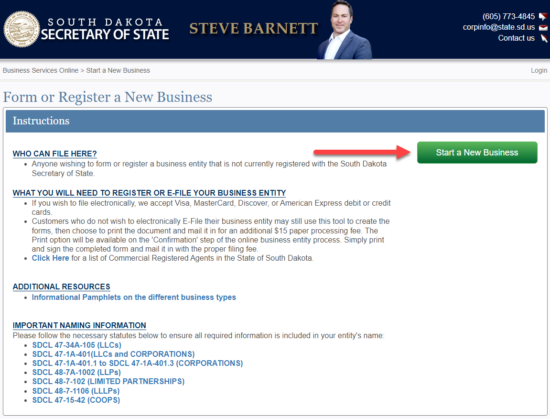

Online

- Visit the Form or Register a New Business page on the SOS website.

- Click Start a New Business.

- Select the appropriate entity type from the dropdown menu (Domestic Limited Liability Company or Foreign Limited Liability Company) and click Next.

- Complete the necessary steps and pay the applicable fee ($150 for domestic LLC, $750 for foreign LLC).

By Mail

- Download and complete the appropriate registration form:

- Domestic – Articles of Organization

- Foreign – Application for Certificate of Authority

- Attach the applicable filing fee ($165 for domestic, $765 for foreign).

- Mail the form and the check to the following address:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501

Step 4 – Create an Operating Agreement

An operating agreement should be created and signed by the members to outline the internal affairs of the company. This document does not need to be filed with the Secretary of State, but it can be kept in a secure place for future reference.

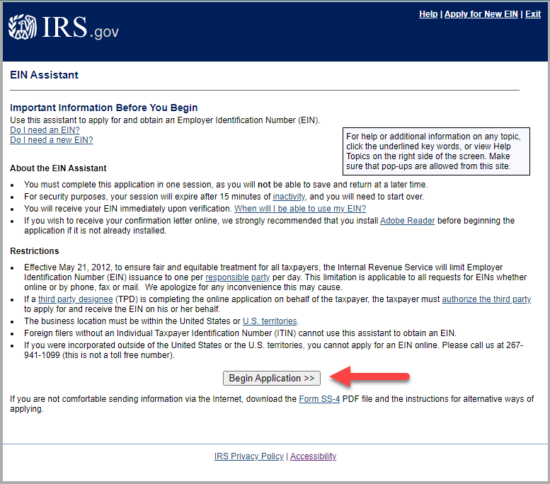

Step 5 – Obtain an EIN

In order for an LLC to open bank accounts, file taxes, and hire employees, the company must have an EIN, or Employer Identification Number. This is a 9-digit number assigned to the entity by the IRS for tax purposes.

The application for an EIN can be done online through the IRS web portal. Alternatively, an EIN can be obtained by completing the Application for Employer Identification Number (Form SS-4) and mailing it to the address below. Both methods of application are free.

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|