When forming an LLC, it is not required by law that the members establish an operating agreement. However, when an operating agreement isn’t in place, the applicable provisions of Texas statutes will govern the internal affairs of the company. Should a legal dispute arise, the broadness of the state statutes might not serve the LLC and its members in the most beneficial capacity.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Bus. Org. Code, Title 3, Chapter 101

- Definitions: § 101.001

- Formation: § 3.001, 3.005, and 3.010

- Naming of LLCs: § 5.056 and Chapter 79, Subchapter C (Admin. Code)

How to File (5 Steps)

- Step 1 – Choose a Name

- Step 2 – Elect a Registered Agent

- Step 3 – File Certificate of Formation

- Step 4 – Draft Operating Agreement

- Step 5 – Apply for an EIN

Step 1 – Choose a Name

Before an LLC can be formed, the members must come up with a name for the company.

The name needs to be unique while also complying with state requirements, which can be referred to in § 5.056 of the Texas Business Organization Code and Chapter 79, Subchapter C of the Administrative Code.

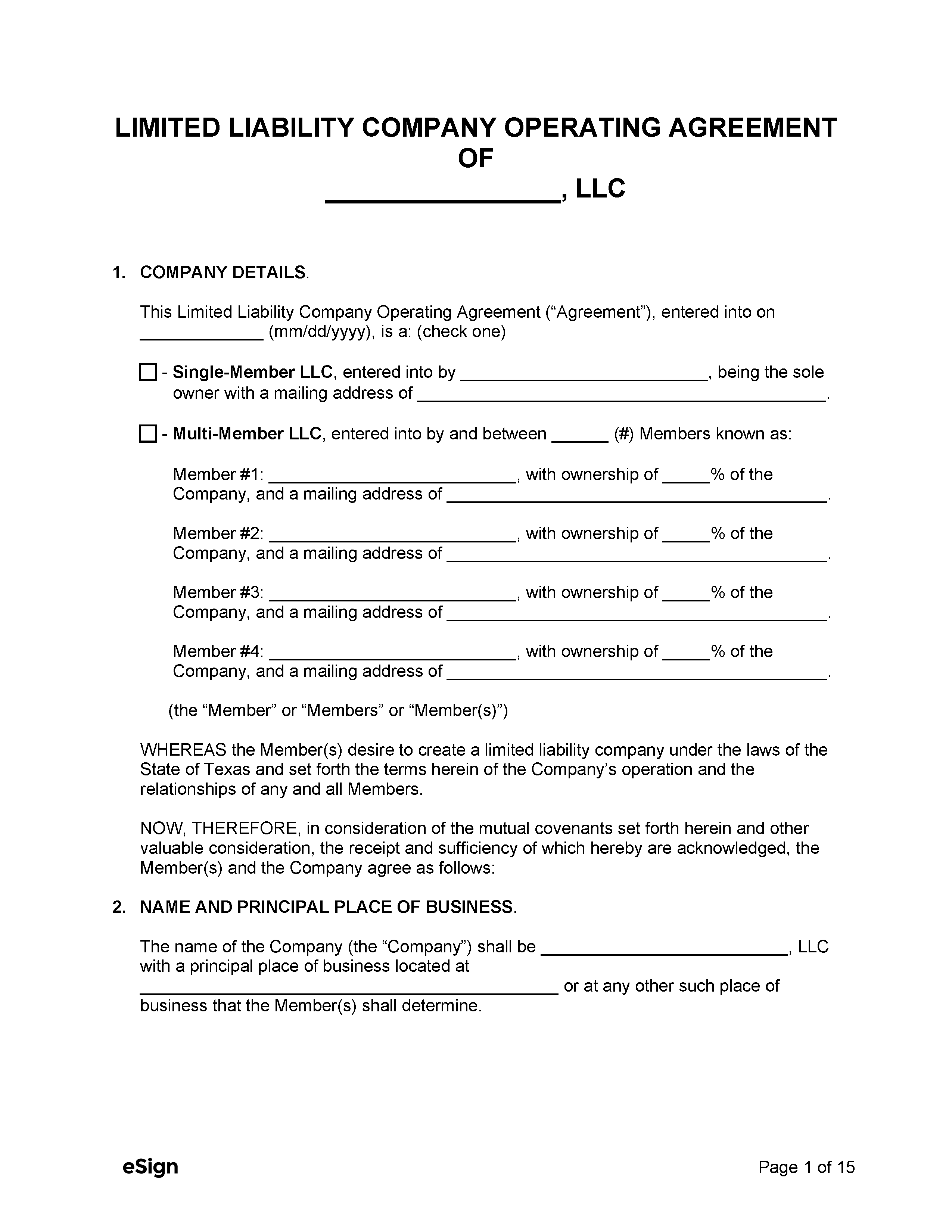

To ensure a name is unique, a search can be performed on the Comptroller of Public Accounts Taxable Entity Search page (or the Secretary of State’s SOSDirect portal for a small fee).

Name Reservations

To reserve a name before registering the LLC for up to one hundred and twenty (120) days, an Application for Reservation or Renewal of Reservation of an Entity Name (Form 501) can be completed. This form, along with the $40 filing fee, can be filed online at SOSDirect (after creating an account) or mailed to the following address:

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Step 2 – Elect a Registered Agent

A limited liability company must always maintain a registered agent, and the agent must consent before the LLC is formed.

The registered agent, who can be an individual or an organization, will receive important tax and legal documents on behalf of the company.

To obtain consent from the registered agent, the elected individual must complete an Acceptance of Appointment and Consent to Serve as Registered Agent (Form 401-A), but is not required to be filed with the SOS.

Step 3 – File Certificate of Formation

Once a unique name has been chosen and a registered agent has been nominated, the members of the LLC can register the company with the Secretary of State.

A Certificate of Formation – Limited Liability Company (Form 205) must be completed and submitted to the SOS.

The Certification of Formation can be submitted online through the SOSDirect portal (requires account setup) or by mail to the address below. The filing fee is $300 for either registration option.

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Foreign LLCs

For LLCs looking to expand to Texas from another state or country, the Application for Registration of a Foreign Limited Liability Company (Form 304) must be executed. It can be filed in the same manner (either online or by mail) as a domestic LLC, but the cost of filing is $750. A Certificate of Good Standing (referred to as a Certificate of Fact – Status in Texas) must be requested from the entity’s home state and provided to the Texas SOS.

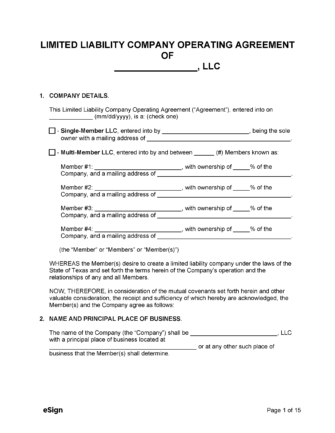

Step 4 – Draft Operating Agreement

A limited liability company operating agreement can be created at any point during or after the course of the business registration process. This document does not need to be filed with the Secretary of State, but should be kept in the company’s records for reference and potential amendment from time to time.

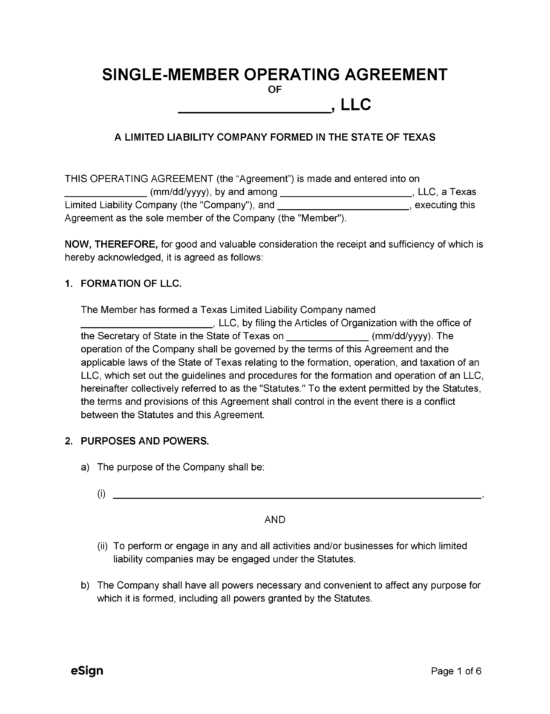

- Single-Member LLC Operating Agreement

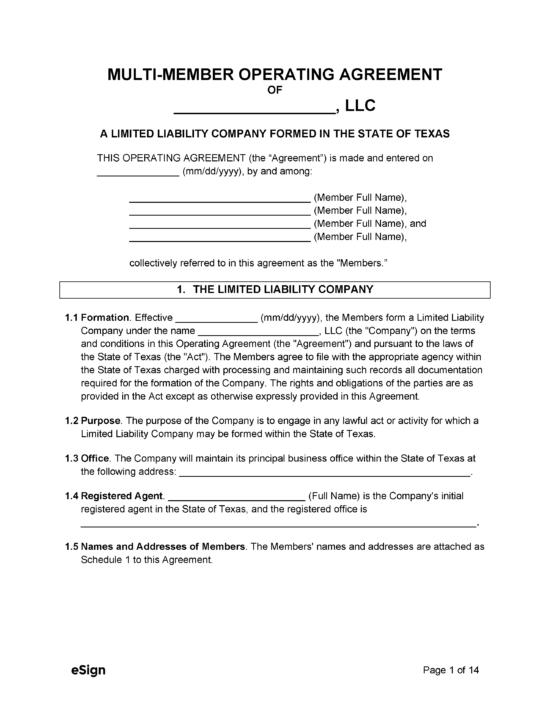

- Multi-Member LLC Operating Agreement

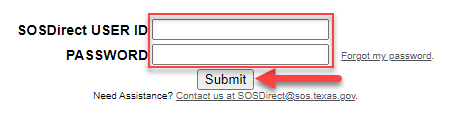

Step 5 – Apply for an EIN

An Employer Identification Number (EIN) is assigned to companies by the IRS to keep track of their tax reporting. All LLCs, with a few exceptions, must apply for an EIN by going to the IRS website or by completing Application for Employer Identification Number (Form SS-4) and mailing it to the following address:

Internal Revenue Service

ATTN: EIN Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|