Is an Operating Agreement Required?

No – Although executing an LLC operating agreement is typically recommended, it is not a legal requirement under Utah law.

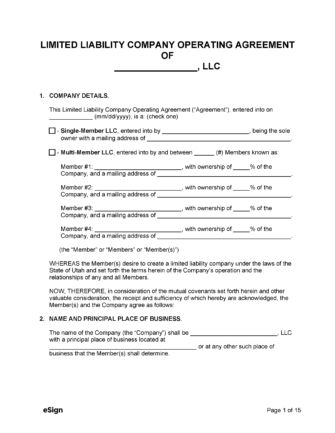

Types (2)

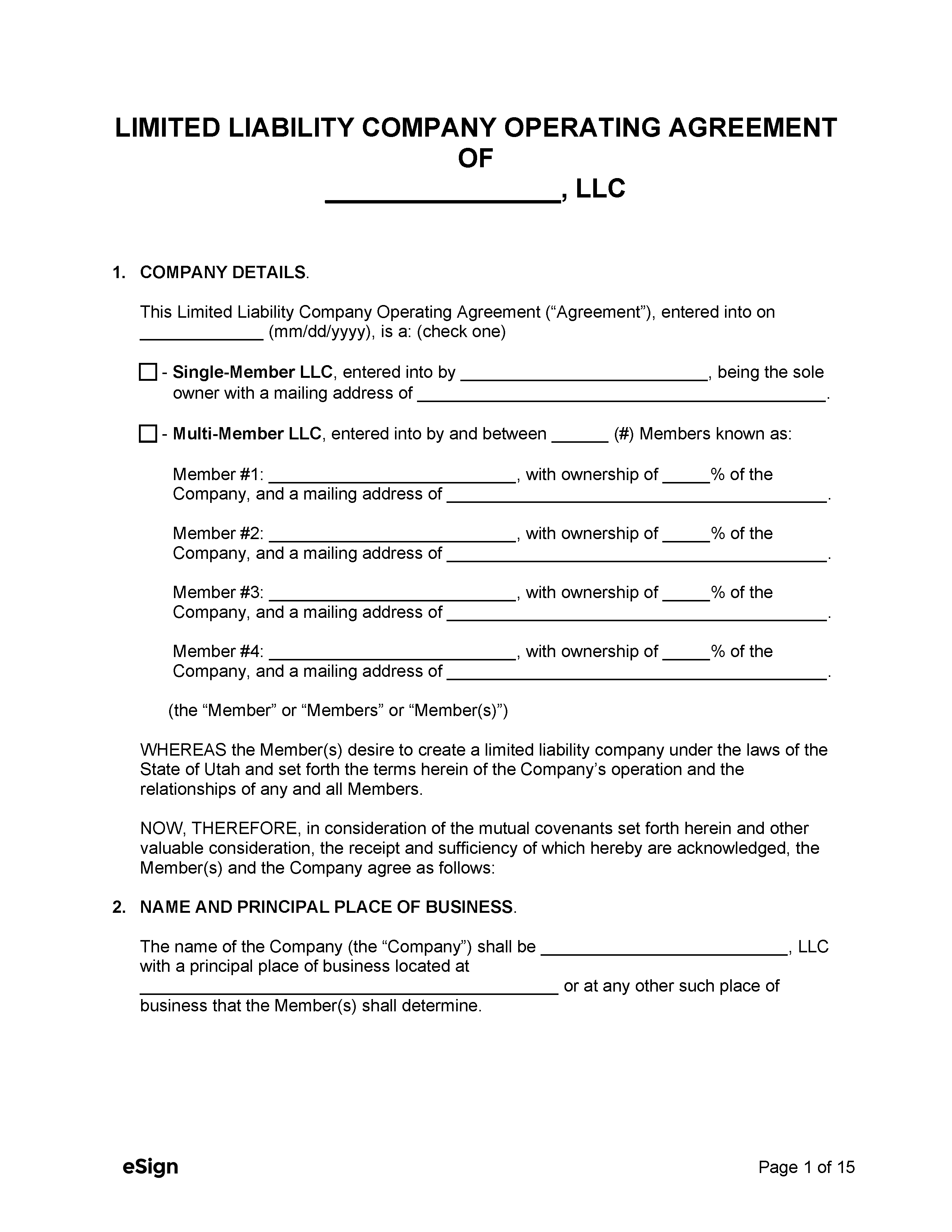

Single-Member LLC Operating Agreement – Used to establish the governance of an LLC with a sole member. Single-Member LLC Operating Agreement – Used to establish the governance of an LLC with a sole member.

|

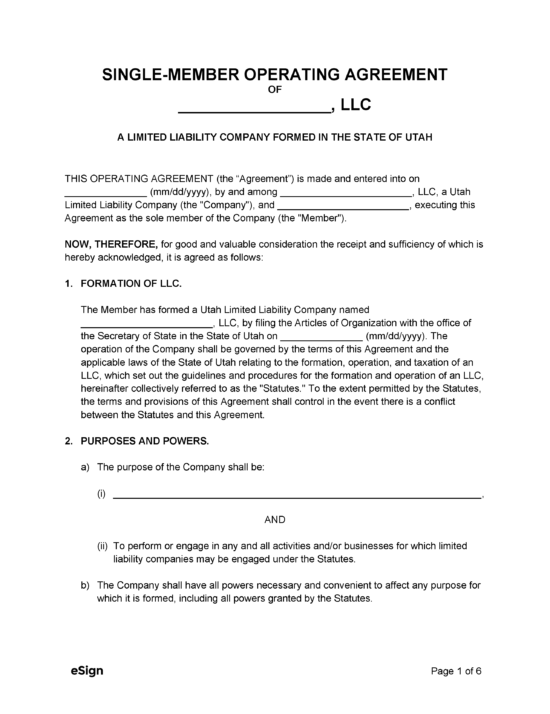

Multi-Member LLC Operating Agreement – Used to establish the internal affairs of an LLC with two or more members. Multi-Member LLC Operating Agreement – Used to establish the internal affairs of an LLC with two or more members.

|