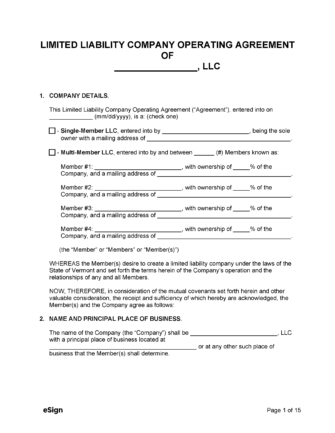

The provisions included in this type of agreement are company and member information, member contributions and distributions, management structure, meetings and voting rights, and what happens in the case of dissolution.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 11, Chapter 25

- Definitions: § 4001

- Formation: § 4022

- Naming of LLCs: § 4005

How to File (5 Steps)

- Step 1 – Naming the Company

- Step 2 – Nominating/Hiring a Registered Agent

- Step 3 – Forming the LLC

- Step 4 – Executing an Operating Agreement

- Step 5 – Applying for an EIN

Step 1 – Naming the Company

An LLC, like any other entity operating in Vermont, must have a unique name. The LLC name must also comply with state statute § 4005.

To find out which business names have already been taken, the SOS provides a business search engine that can be used to look through all companies registered with the state.

Note on Name Reservations:

A name can be reserved before an LLC is officially formed for a period of one hundred and twenty (120) days. This can be done online by creating a client account on the SOS Corporations Division website. Alternatively, a paper form can be requested through this webpage and mailed to the address below. The cost for reserving a name online or by mail is $20.

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, Vermont 05633-1104

Step 2 – Nominating/Hiring a Registered Agent

All states require businesses to select a registered agent to receive important legal and tax-related documents on behalf of the company.

A registered agent can be an individual, a member of the LLC, or a business entity that specializes in professional registered agent services.

It’s most common for the members to appoint the company accountant or attorney as the registered agent.

Step 3 – Forming the LLC

New LLCs must register with the Vermont Secretary of State by completing and filing the Articles of Organization online or by mail.

Online

An account must be created to file the Articles of Organization online. Visit the SOS Online Business Service Center and click Create a User Account. On the following pages, information pertaining to the business or individual creating the account will have to be entered, and a password will have to be created.

Once the account is created, the Articles of Organization can be completed online and the filing fee of $125 can be paid by credit card.

By Mail

Download and complete the Articles of Organization and mail it to the address below with a check or money for $125 made payable to VT SOS.

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, Vermont 05633-1104

Note on Foreign LLCs:

Foreign LLCs must register online by filing an Application for Certificate of Authority through the SOS Business Service Center. The cost for registering is $125.

A foreign LLC will also need to request and file a Certificate of Good Standing for $25, which can be accomplished using the online business service center as well.

Step 4 – Executing an Operating Agreement

The members of the LLC should create an operating agreement to help govern the internal affairs of the business and set forth the terms of membership and management.

The operating agreement is kept internally with each member of the LLC and at the registered office; it needn’t be filed with the SOS.

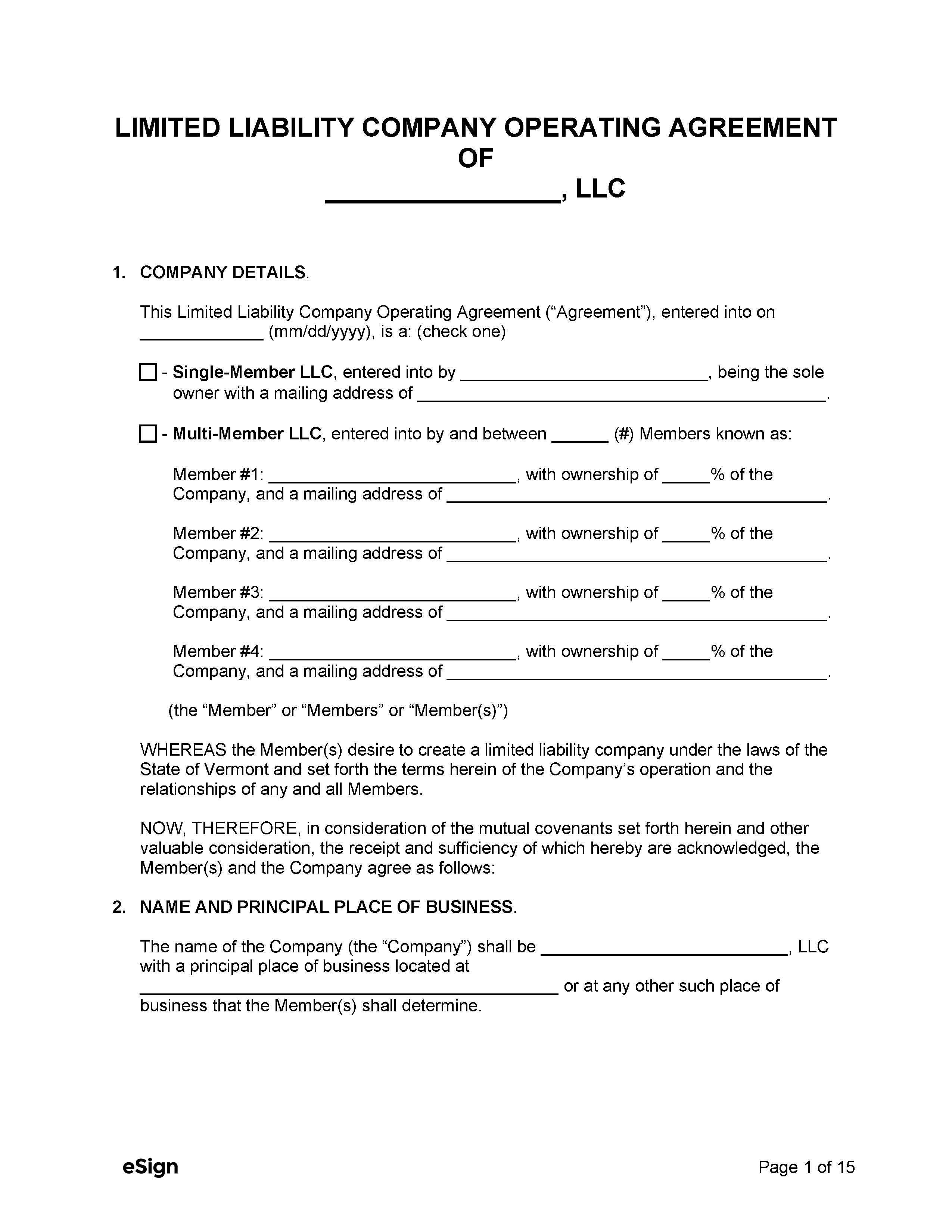

- Single-Member LLC Operating Agreement

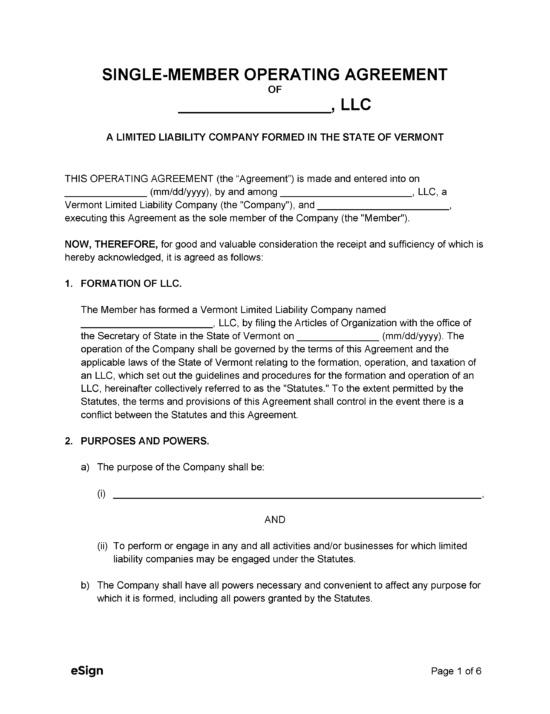

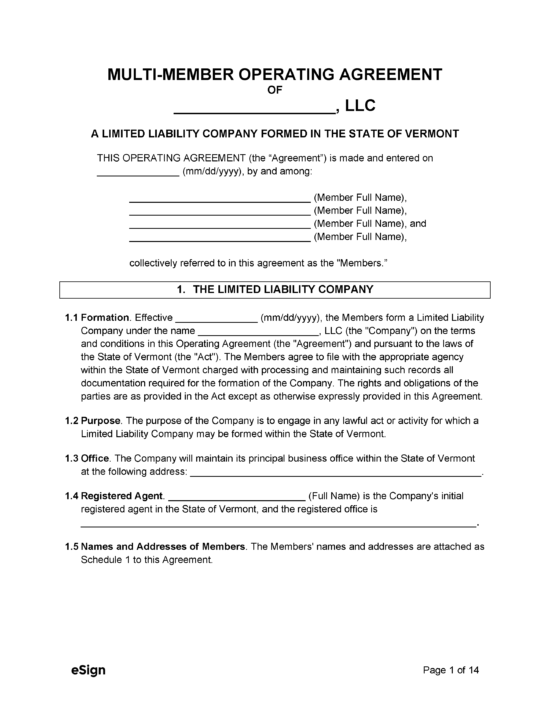

- Multi-Member LLC Operating Agreement

Step 5 – Applying for an EIN

Most businesses in Vermont (there are a few exceptions) must apply for an EIN (Employer Identification Number) with the Internal Revenue Service.

An EIN consists of 9-digits and is unique to each entity in the US for tax-reporting purposes.

LLCs can visit the IRS EIN Assistant webpage to apply or complete an Application for Employer Identification Number (Form SS-4) and mail it to the address below.

Internal Revenue Service

ATTN: EIN Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|