Contents |

Types (2)

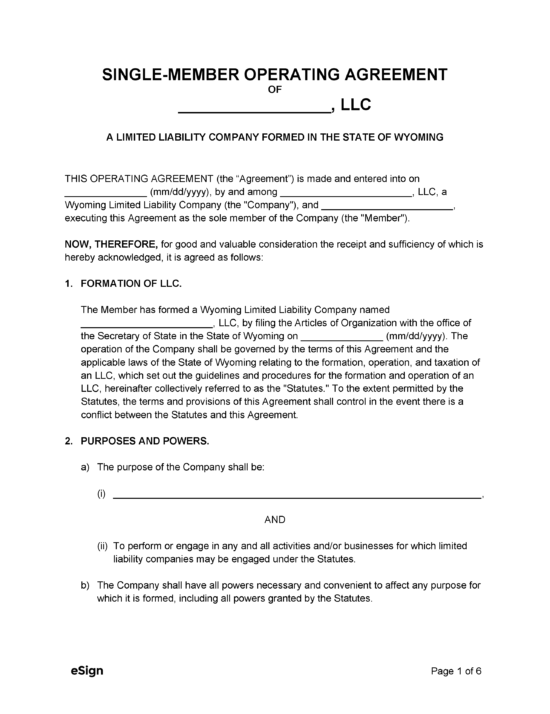

Single-Member LLC Operating Agreement – Used for the governance of an LLC that has only one (1) member.

Single-Member LLC Operating Agreement – Used for the governance of an LLC that has only one (1) member.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 17, Chapter 29

- Definitions: § 17-29-102

- Formation: § 17-29-201

- Naming of LLCs: § 17-29-108

How to File (5 Steps)

- Step 1 – Choose a Company Name

- Step 2 – Appoint a Registered Agent

- Step 3 – Register the Company

- Step 4 – Draft an Operating Agreement

- Step 5 – Apply for an EIN

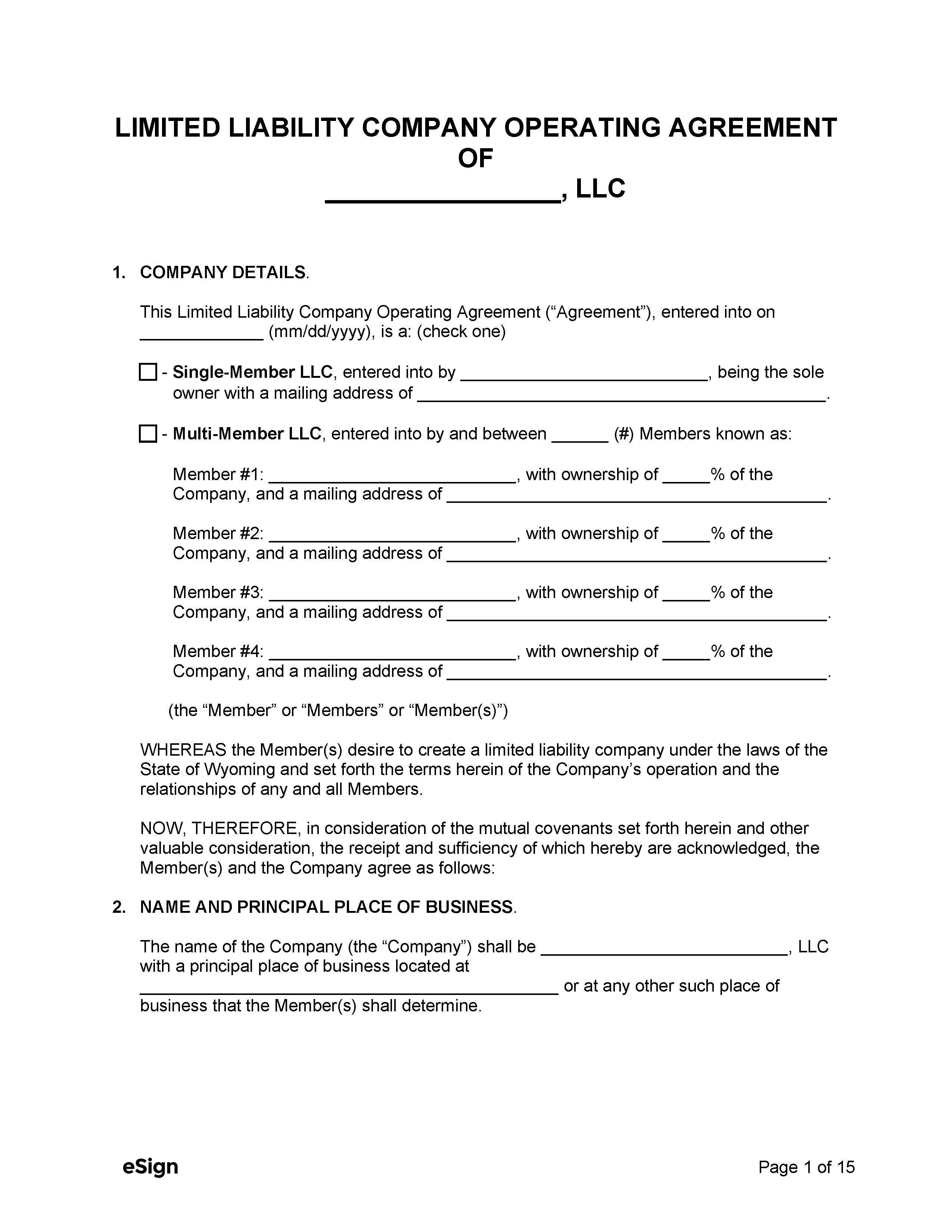

Step 1 – Choose a Company Name

Each LLC must have a unique name that also complies with state requirements as set forth in § 17-29-108.

Once a name has been chosen, a name search can be performed on the Secretary of State’s (SOS) website to ensure it is an original name not being used by another Wyoming company.

A name can be reserved if it is available by completing an Application for Reservation of Name, attaching a check or money order for $60, and sending them by mail to the SOS office (Herschler Building East, Suite 101, 122 W 25th Street, Cheyenne, WY, 82002-0020).

Step 2 – Appoint a Registered Agent

All businesses formed in Wyoming need to elect a registered agent to receive service of process on behalf of the company.

In order to be appointed as a registered agent, the individual or business entity (such as a professional registered agent service) must have a physical address in the state (cannot be a PO box).

LLCs often use their accountant or attorney as their registered agent; however, it can be any individual as long as they are at least eighteen (18) years old, they reside in Wyoming, and have a physical address in the state.

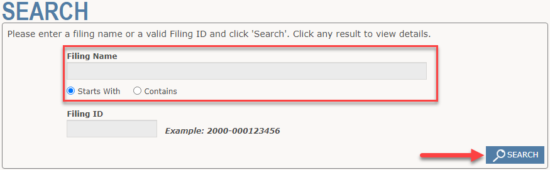

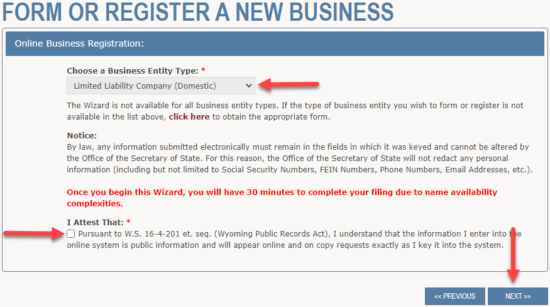

Step 3 – Register the Company

LLCs must be registered with the SOS in order to conduct business within Wyoming.

To create a domestic LLC, an organizer (individual selected by the members to register the company) must file the Articles of Organization online or by mail.

Foreign LLCs that are registered out-of-state must complete an Application for Certificate of Authority and file it by mail.

Domestic LLCs

Online

- Visit the Form or Register a New Business webpage on the SOS website.

- Select Limited Liability Company (Domestic) from the dropdown menu, select the attestation checkbox, then click Next>>.

- The subsequent nine (9) pages will ask for pertinent business information such as company name, registered agent information, addresses, members and organizers, and signatures.

- A $100 filing fee is required at the final step of the process; payment can be made using Visa or MasterCard.

By Mail

- Download the Articles of Organization form and complete all the required fields.

- The $100 filing fee can be paid by check or money order made payable to the Wyoming Secretary of State.

- The document and filing fee can be sent to the following address:

Wyoming Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

Foreign LLCs

By Mail Only

- Download the Application for Certificate of Authority and complete all necessary fillable fields.

- Obtain a Certificate of Existence/Good Standing from the state (or country) of formation.

- Make a check or money order to the Wyoming Secretary of State for the amount of $150.

- File both documents and the check/money order to the Secretary of State (address listed above).

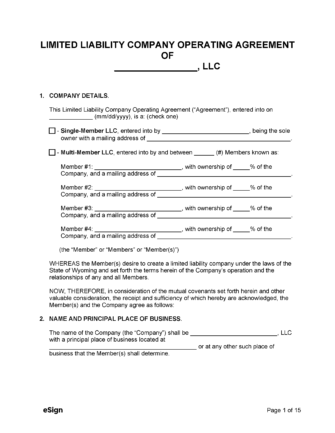

Step 4 – Draft an Operating Agreement

An operating agreement doesn’t need to be filed with the Secretary of State like the Articles of Organization; however, it is recommended that LLC members draft such an agreement and maintain a copy for their records.

- Single-Member Operating Agreement

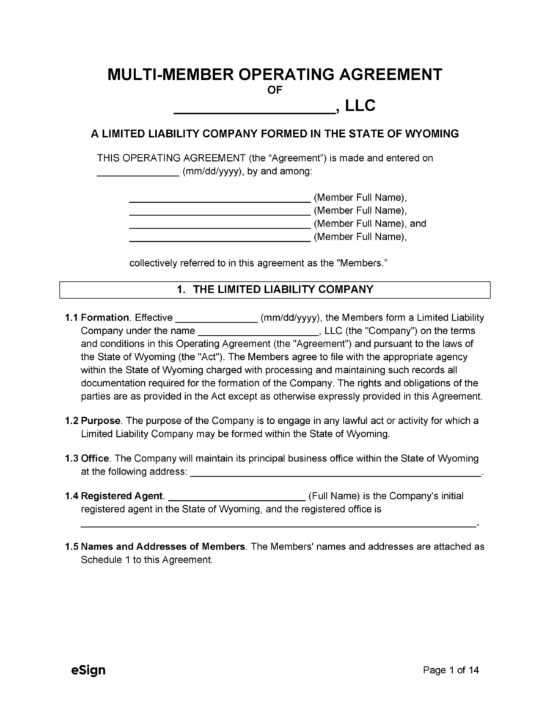

- Multi-Member Operating Agreement

Step 5 – Apply for an EIN

LLCs that have more than one (1) member must apply for an Employer Identification Number with the IRS regardless of if they intend on hiring employees or not. (If a single-member LLC has employees, they will also need to apply for an EIN). Applying for an EIN is free and can be done online or by mail.

To apply online, visit the IRS EIN Assistant webpage, follow the necessary steps, and applicants will receive their EIN immediately upon verification.

Alternatively, entities can apply by completing an Application for Employer Identification Number and sending it by mail to the address below.

Internal Revenue Service

ATTN: EIN Operation

Cincinnati, OH, 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|