What’s Included (7 sections)

- Vehicle Details

- Make

- Model

- Year

- Color

- VIN

- Lender’s Details

- Name

- Address

- Borrower’s Details

- Name

- Address

- Loan Details

- Amount Borrowed

- Downpayment

- Interest Date

- Monthly Payment (use auto loan calculator)

- End Date

- Late Fees

- Trade-In Value

- Sales Tax

- Registration or Title Fees

Sample

Download: PDF, Word (.docx), OpenDocument

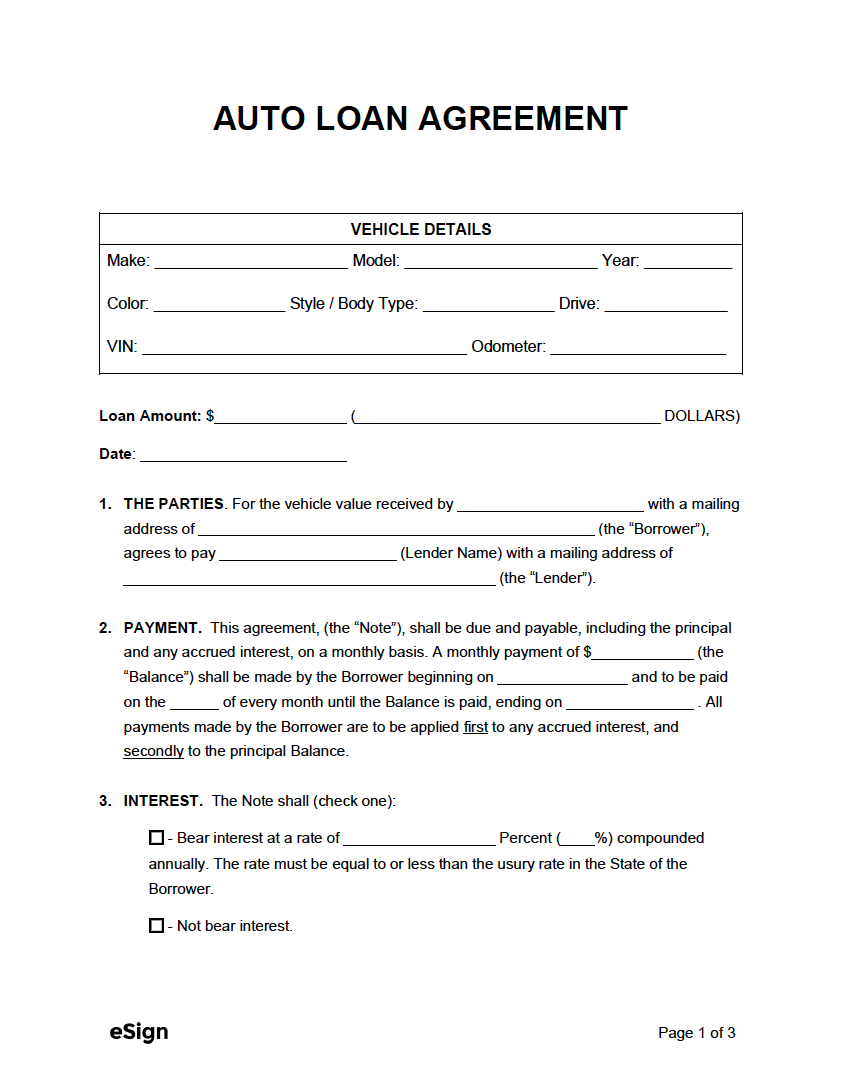

AUTO LOAN AGREEMENT

1. VEHICLE DETAILS.

Make: [VEHICLE MAKE]

Color: [VEHICLE COLOR]

VIN: [VEHICLE IDENTIFICATION NUMBER]

Hereinafter the “Vehicle”.

2. THE PARTIES. For the Vehicle received by [BORROWER NAME] with a mailing address of [BORROWER ADDRESS] (the “Borrower”), agrees to pay [LENDER NAME] with a mailing address of [LENDER ADDRESS] (the “Lender”).

3. PAYMENT. This agreement (the “Note”) shall be due and payable, including the principal and any accrued interest, on a monthly basis. The total amount borrowed is $[AMOUNT BORROWED] (the “Balance”). The Borrower shall make monthly payments of $[MONTHLY PAYMENT] beginning on [MM/DD/YYYY] and to be paid on the [#] of every month until the Balance is paid, ending on [MM/DD/YYYY]. All payments made by the Borrower are to be applied first to any accrued interest and secondly to the principal Balance.

4. INTEREST. The Note shall (check one):

☐ – Bear interest at a rate of [%] compounded annually.

☐ – Not bear interest.

5. LATE FEES. The Borrower agrees to pay $[LATE FEE] should they fail to pay the monthly Balance with interest within [#] days from the due date.

6. PREPAYMENT. The Borrower has the right to pay back the loan in full or make additional payments at any time without penalty.

7. COLLATERAL. The Borrower agrees to pledge the Vehicle, as described in Section 1, to ensure loan repayment. The Vehicle will only be transferred to the ownership of the Lender upon the Borrower’s default.

8. EVENTS OF ACCELERATION. The occurrence of any of the following shall constitute an “Event of Acceleration” by the Lender under this Note:

a) The Borrower fails to pay any part of the principal or interest as and when due under this Note; or

b) The Borrower becomes insolvent or does not pay their debts as they become due.

9. ACCELERATION. Upon the occurrence of an Event of Acceleration under this Note, and in addition to any other rights and remedies that the Lender may have, the Lender shall have the right, at its sole and exclusive option, to declare this Note immediately due and payable.

10. SUBORDINATION. The Borrower’s obligations under this Note are subordinated to all indebtedness, if any, of the Borrower, to any unrelated third party lender to the extent such indebtedness is outstanding on the date of this Note, and such subordination is required under the loan documents providing for such indebtedness.

11. WAIVERS BY BORROWER. The Borrower and the Borrower’s successors, heirs, and assigns hereby waive protest, presentment, notice of dishonor, and notice of acceleration of maturity and agree to continue to remain bound for the payment of principal, interest, and all other sums due under this Note, notwithstanding change by way of release, surrender, exchange, modification or substitution of any security for this Note or by way of any extension of time for the payment of principal and interest; and all such parties waive all and every kind of notice of such change and agree that the same may be made without notice or consent of any of them.

12. EXPENSES. In the event any payment under this Note is not paid when due, the Borrower agrees to pay, in addition to the principal and interest hereunder, reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate as permitted under state law, of the then outstanding balance owing on the Note, plus all other reasonable expenses incurred by Lender in exercising any of its rights and remedies upon default.

13. GOVERNING LAW. This Note shall be governed by, and construed in accordance with, the laws of the State of [STATE NAME].

14. SUCCESSORS. All of the foregoing is the promise of Borrower and shall bind Borrower and Borrower’s successors, heirs, and assigns.

IN WITNESS WHEREOF, Borrower has executed this Note as of the day and year first above written.

Borrower Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [BORROWER PRINTED NAME]

Lender Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [LENDER PRINTED NAME]