Why Extend a Loan Agreement?

A borrower may request to have their loan extended for many reasons, including a life emergency, the loss of a job, an unexpected payment, or another event that leaves them unable to make their upcoming payment. While offering the borrower an extension or restructuring of terms is the lender’s choice, it is only recommended if the borrower has been consistent with their payments thus far. A loan extension can make a huge difference in a borrower’s life, as a missed payment can wreak havoc on one’s credit score, cause them to lose the collateral they put up for the loan, and many other unfavorable outcomes.

How to Write

Download: PDF, Word (.docx), OpenDocument

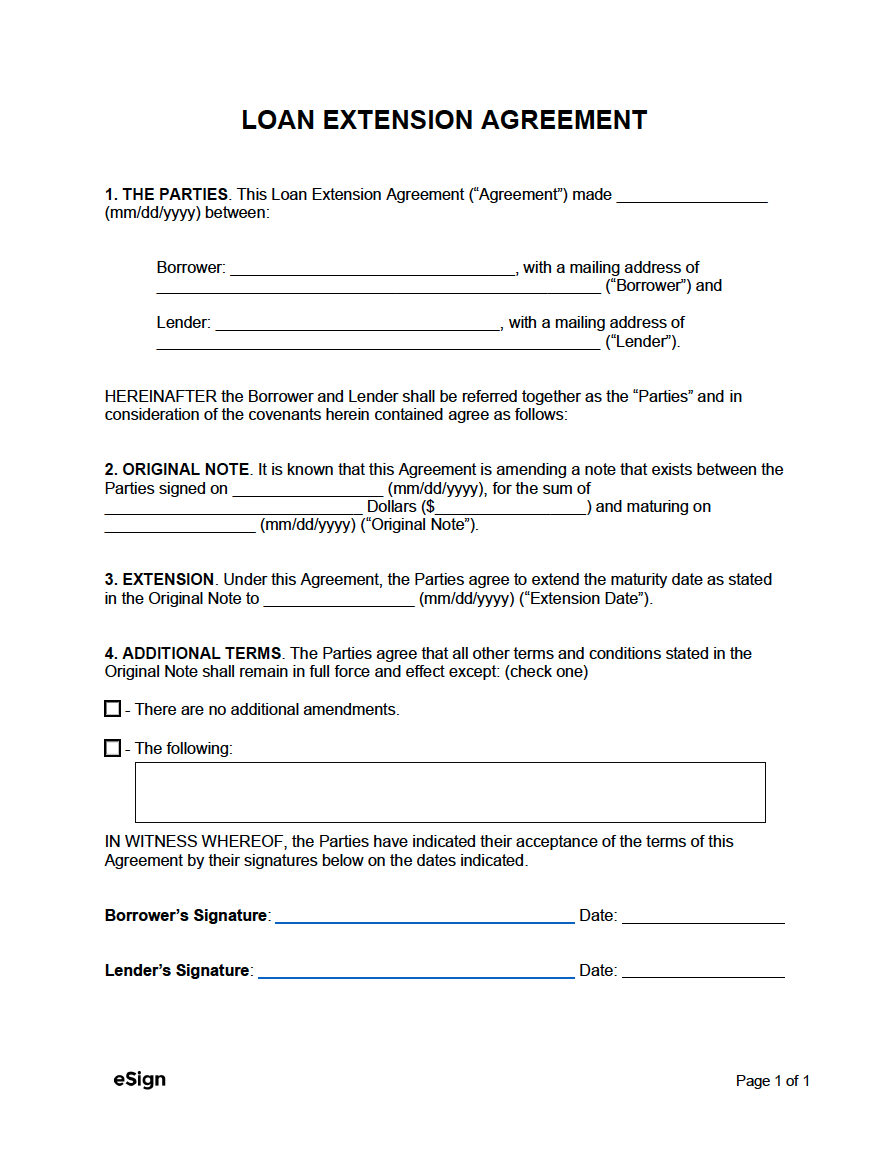

Step 1 – Parties

The first section of the agreement is for establishing the date the agreement was created as well as identifying the borrower and lender. The following information is required for this section:

- Agreement (creation) date.

- Borrower’s full name.

- Borrower’s mailing address.

- Lender’s name (if the lender is an entity, enter the company name).

- Lender address (principal business address).

Step 2 – Original Note

The second section is for recording the terms of the original loan agreement. Here the lender will need to enter the date (mm/dd/yyyy) the parties signed the original loan agreement, the amount ($) of money that was borrowed (write it out word-for-word as well as numerically), and the original maturity date (due date) of the loan.

Step 3 – Extension

Enter the new due date (mm/dd/yyyy) of the loan. For example, if the borrower will be “skipping” the next two (2) payments, and they make monthly payments, add two (2) months to the original maturity date entered in Step 2 and enter the result here.

Step 4 – Additional Terms

If the parties will be making any other changes to the original loan agreement, check the second box and list the changes in the box provided. If no other changes will be made, check the first box.

Step 5 – Signing

Both the borrower and lender will need to sign and print their names onto the form. This can be done by printing the form and signing by hand, or by uploading the form to eSign and digitally recording the signatures.