Types (2)

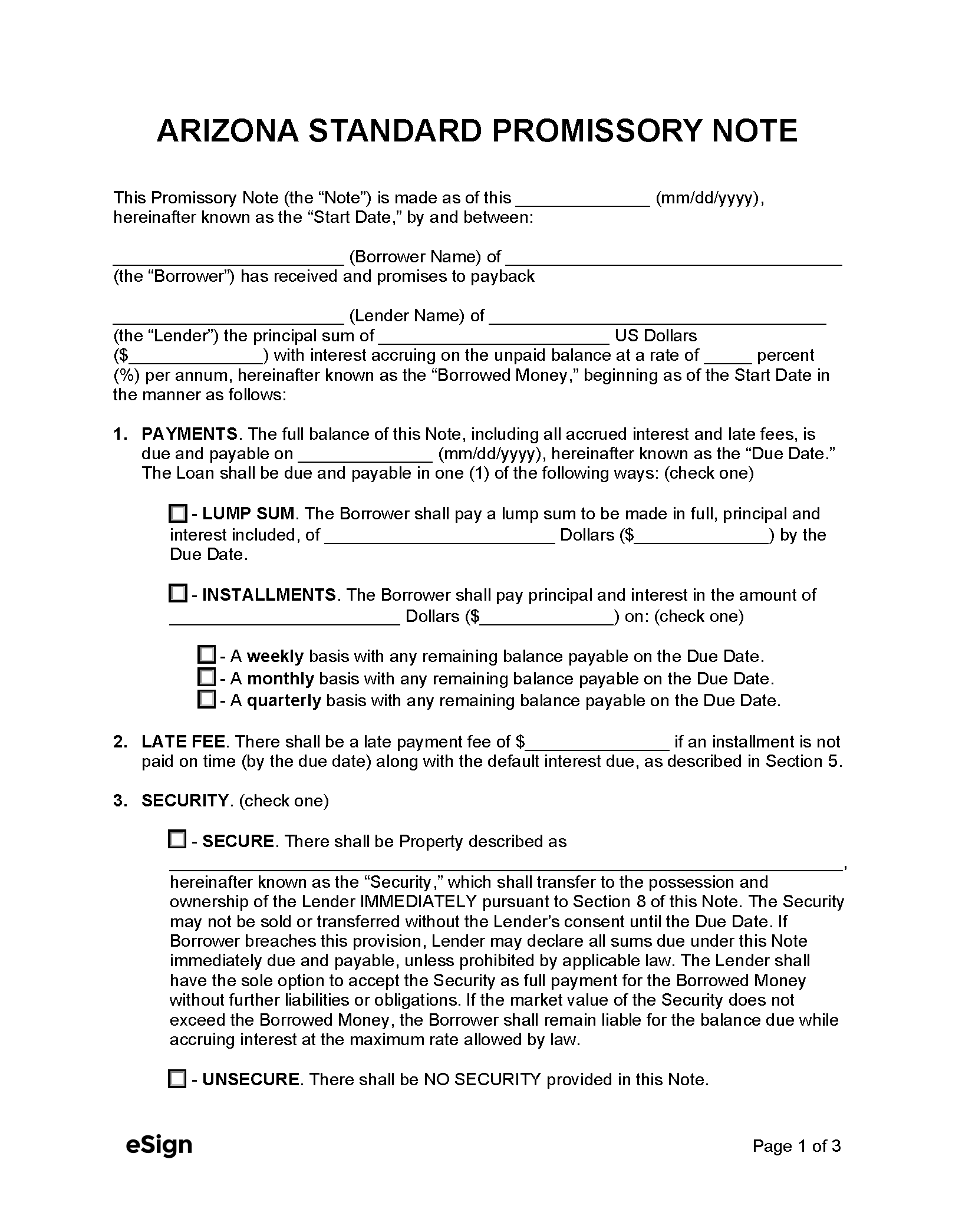

Download: PDF, Word (.docx), OpenDocument

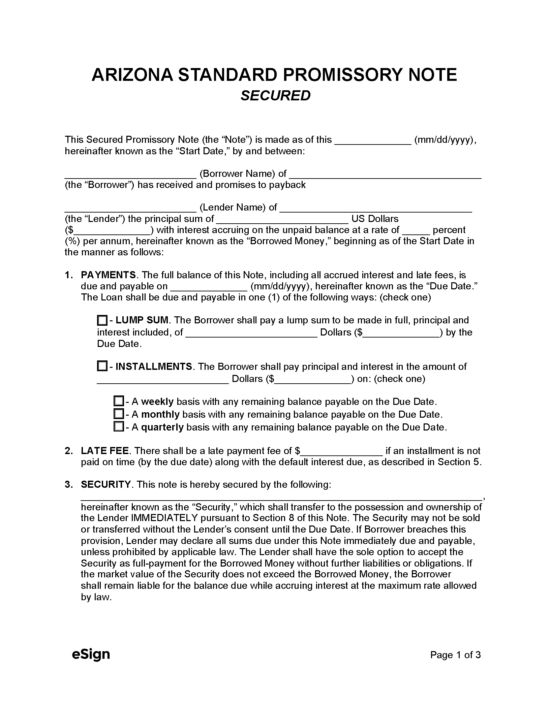

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 44, Chapter 9, Article 1

- Usury Rate With Contract (§ 44-1201(A)): No maximum.

- Usury Rate Without Contract (§ 44-1201(A)): 10% (excluding medical debts)

- Usury Rate on Judgments (§ 44-1201(B)): 10% or 1% plus prime rate, whichever is less (excluding medical debts).