Related Forms

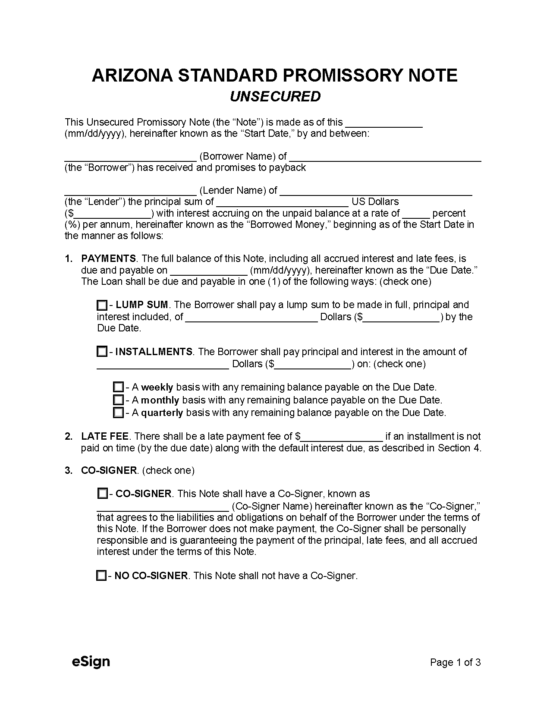

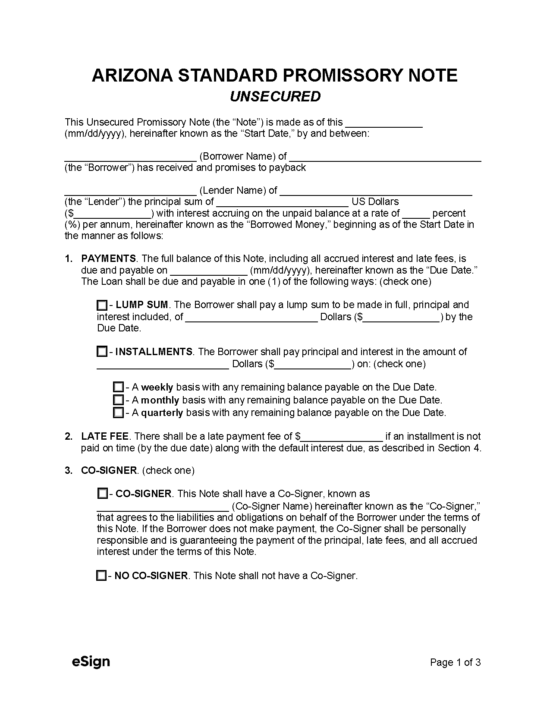

Unsecured Promissory Note – A moneylending agreement that does not require the loan to be secured with collateral.

Unsecured Promissory Note – A moneylending agreement that does not require the loan to be secured with collateral.

Download: PDF, Word (.docx), OpenDocument

An Arizona secured promissory note records a promise made by one party (the borrower) to repay a secured loan to another party (the lender) by a designated date. As suggested by its name, this promissory note is “secured,” meaning the borrower offered the lender collateral as assurance for repayment on the loan. Collateral for secured funds can be any property, real estate, investment, or other valuable asset. Should the borrower fail to pay off the debt by the due date, the lender can temporarily retain the collateral until the debt is repaid or sell it to cover the unpaid balance.

An Arizona secured promissory note records a promise made by one party (the borrower) to repay a secured loan to another party (the lender) by a designated date. As suggested by its name, this promissory note is “secured,” meaning the borrower offered the lender collateral as assurance for repayment on the loan. Collateral for secured funds can be any property, real estate, investment, or other valuable asset. Should the borrower fail to pay off the debt by the due date, the lender can temporarily retain the collateral until the debt is repaid or sell it to cover the unpaid balance.

Unsecured Promissory Note – A moneylending agreement that does not require the loan to be secured with collateral.

Unsecured Promissory Note – A moneylending agreement that does not require the loan to be secured with collateral.

Download: PDF, Word (.docx), OpenDocument