Types (2)

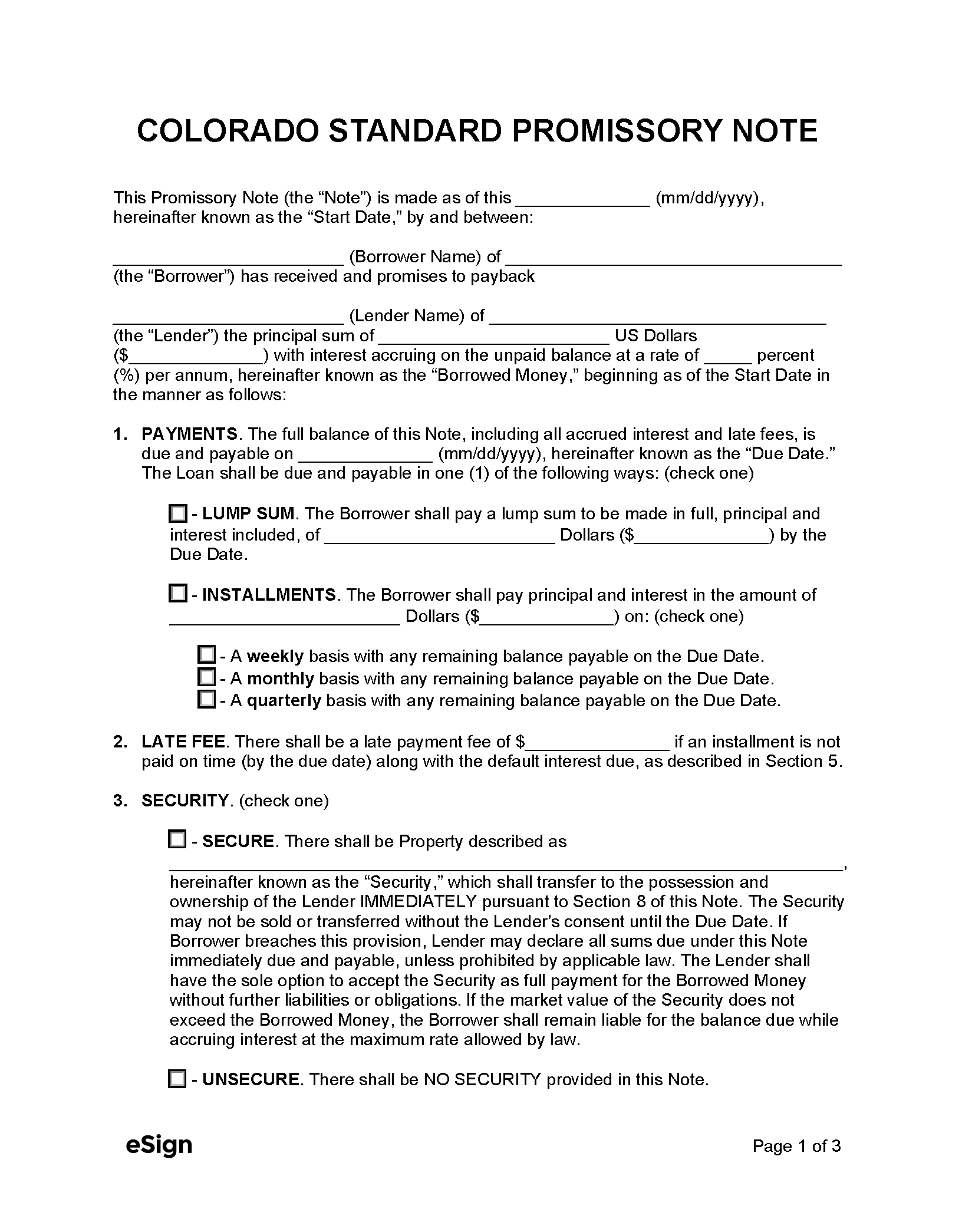

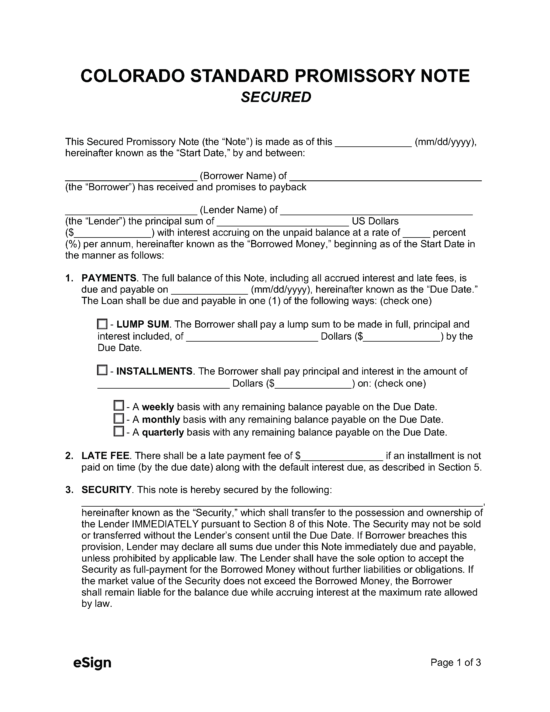

Download: PDF, Word (.docx), OpenDocument

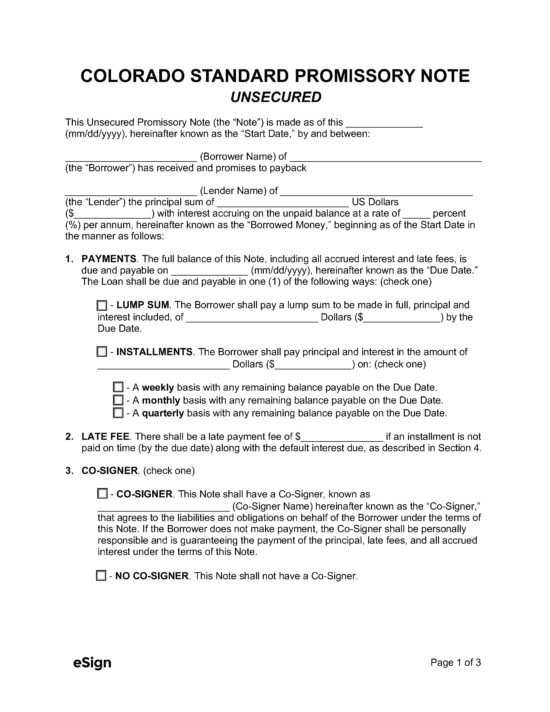

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 5, Articles 1-9 and Article 12

- Usury Rate With Agreement (§ 5-12-103): 45%

- Usury Rate Without Agreement (§ 5-12-101): 8%

- Usury Rate for Municipal Indebtedness (§ 5-12-104): 6%

- Usury Rate for Commercial Credit Plans (§ 5-12-107(2)(a)): 45%

- Usury Rate for Unsupervised Consumer Loan (§ 5-2-201(1)): 12%

- Usury Rate for Supervised Consumer Loan (§ 5-2-201(2)): 21% on the total loan OR 36% on $1,000 or less + 21% on $1,001-$3,000 + 15% above $3,000, whichever is greater.

- Usury Rate for Deferred Deposit/Payday Loan (§ 5-3.1-105): 36%

- Usury Rate for Judgment for Damages (§ 13-21-101(1)): 9%