Related Forms

Download: PDF, Word (.docx), OpenDocument

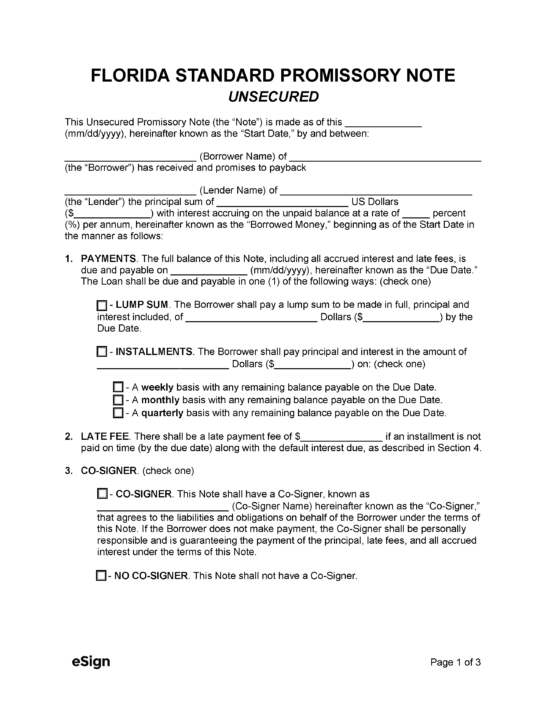

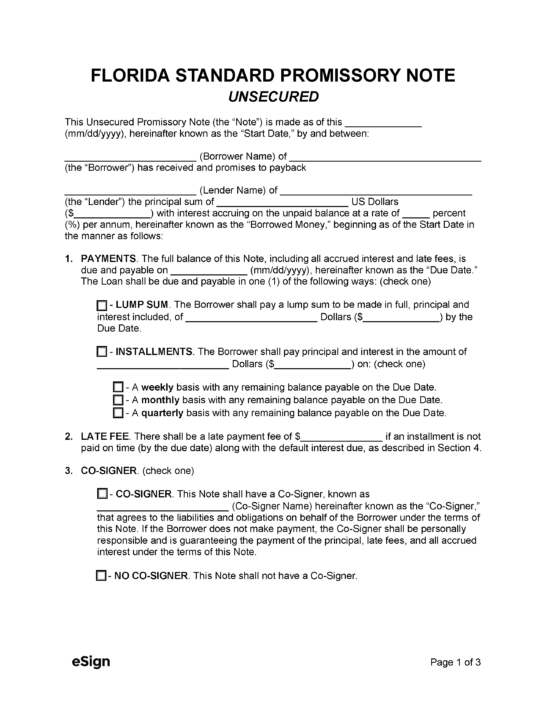

A Florida secured promissory note is a debt instrument in which the borrower offers a physical asset to the lender as security on repayment. The document relays the terms of the loan, including the total principal sum, interest rate, payment due dates, late fees, and the specifics of the personal property offered as security. In some circumstances, the lender may demand that they hold the asset in their possession until the balance has been paid. If the borrower is unable to repay the loan on time, the collateral becomes the lender’s property.

A Florida secured promissory note is a debt instrument in which the borrower offers a physical asset to the lender as security on repayment. The document relays the terms of the loan, including the total principal sum, interest rate, payment due dates, late fees, and the specifics of the personal property offered as security. In some circumstances, the lender may demand that they hold the asset in their possession until the balance has been paid. If the borrower is unable to repay the loan on time, the collateral becomes the lender’s property.

Download: PDF, Word (.docx), OpenDocument