Related Forms

Download: PDF, Word (.docx), OpenDocument

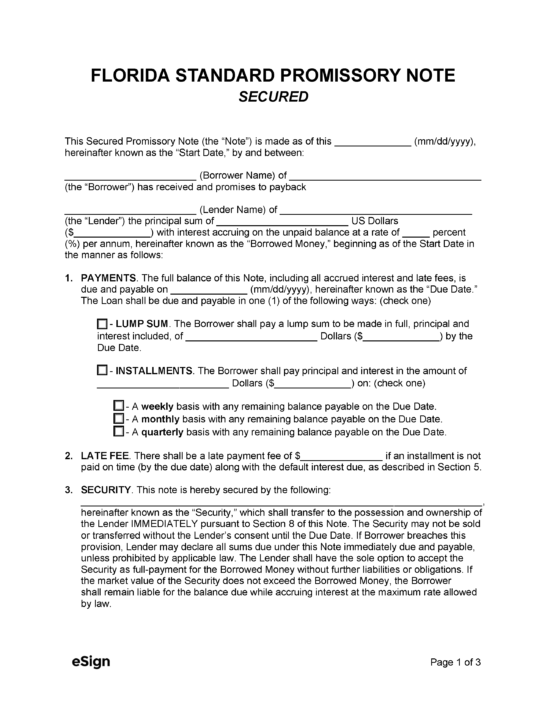

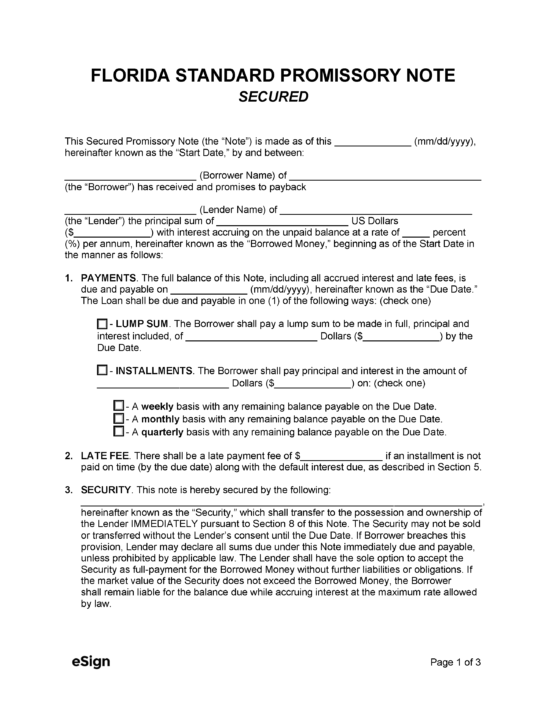

A Florida unsecured promissory note allows a lender and borrower to enter into an agreement regarding the terms of a personal loan that doesn’t require the borrower to provide collateral. The completed document will relay the loan amount, interest rate, and payment schedule (or “payment date” if repayment is to be made in a single lump sum). Once both parties have signed the contract, its terms become legally binding and the principal will transfer to the borrower. If the loan defaults, the lender can use the promissory note as proof of the agreement should they choose to pursue legal recourse.

A Florida unsecured promissory note allows a lender and borrower to enter into an agreement regarding the terms of a personal loan that doesn’t require the borrower to provide collateral. The completed document will relay the loan amount, interest rate, and payment schedule (or “payment date” if repayment is to be made in a single lump sum). Once both parties have signed the contract, its terms become legally binding and the principal will transfer to the borrower. If the loan defaults, the lender can use the promissory note as proof of the agreement should they choose to pursue legal recourse.

Download: PDF, Word (.docx), OpenDocument