Related Forms

Download: PDF, Word (.docx), OpenDocument

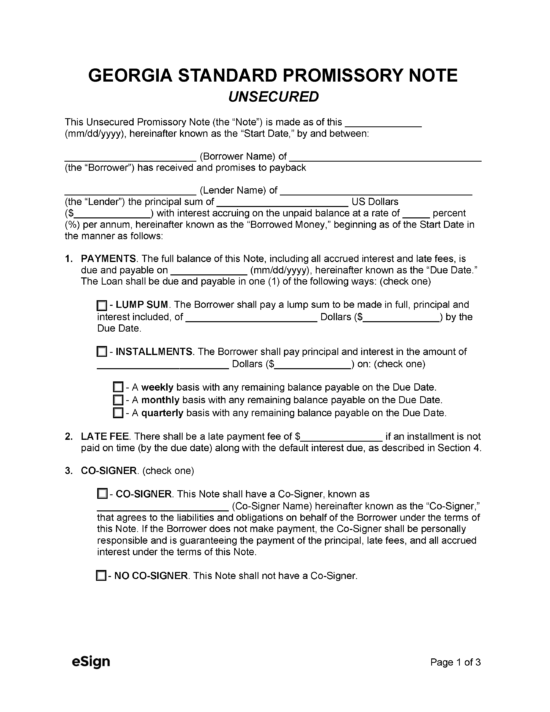

A Georgia secured promissory note is a financial contract for the borrowing of funds that allows the lender to secure collateral should the borrower default on payments. By receiving security on their investment, the lender ensures that they won’t be left empty-handed if the loan isn’t repaid. Furthermore, the borrower will be motivated to repay their loan on time to avoid losing their personal property. In addition to detailing the amount of the loan and the collateral provided, the contract will include the interest rate and payment schedule, which can be weekly, bi-weekly, monthly, or a single lump sum.

If the borrower refuses to comply with the terms of the promissory note, the lender can begin legal action should they see fit to do so.

A Georgia secured promissory note is a financial contract for the borrowing of funds that allows the lender to secure collateral should the borrower default on payments. By receiving security on their investment, the lender ensures that they won’t be left empty-handed if the loan isn’t repaid. Furthermore, the borrower will be motivated to repay their loan on time to avoid losing their personal property. In addition to detailing the amount of the loan and the collateral provided, the contract will include the interest rate and payment schedule, which can be weekly, bi-weekly, monthly, or a single lump sum.

If the borrower refuses to comply with the terms of the promissory note, the lender can begin legal action should they see fit to do so.

Download: PDF, Word (.docx), OpenDocument