Types (2)

Download: PDF, Word (.docx), OpenDocument

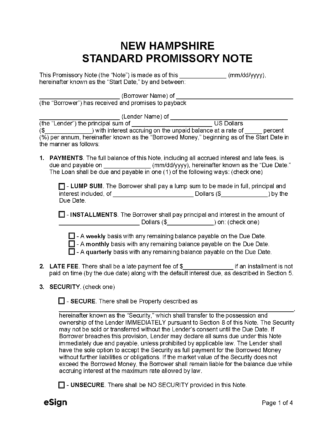

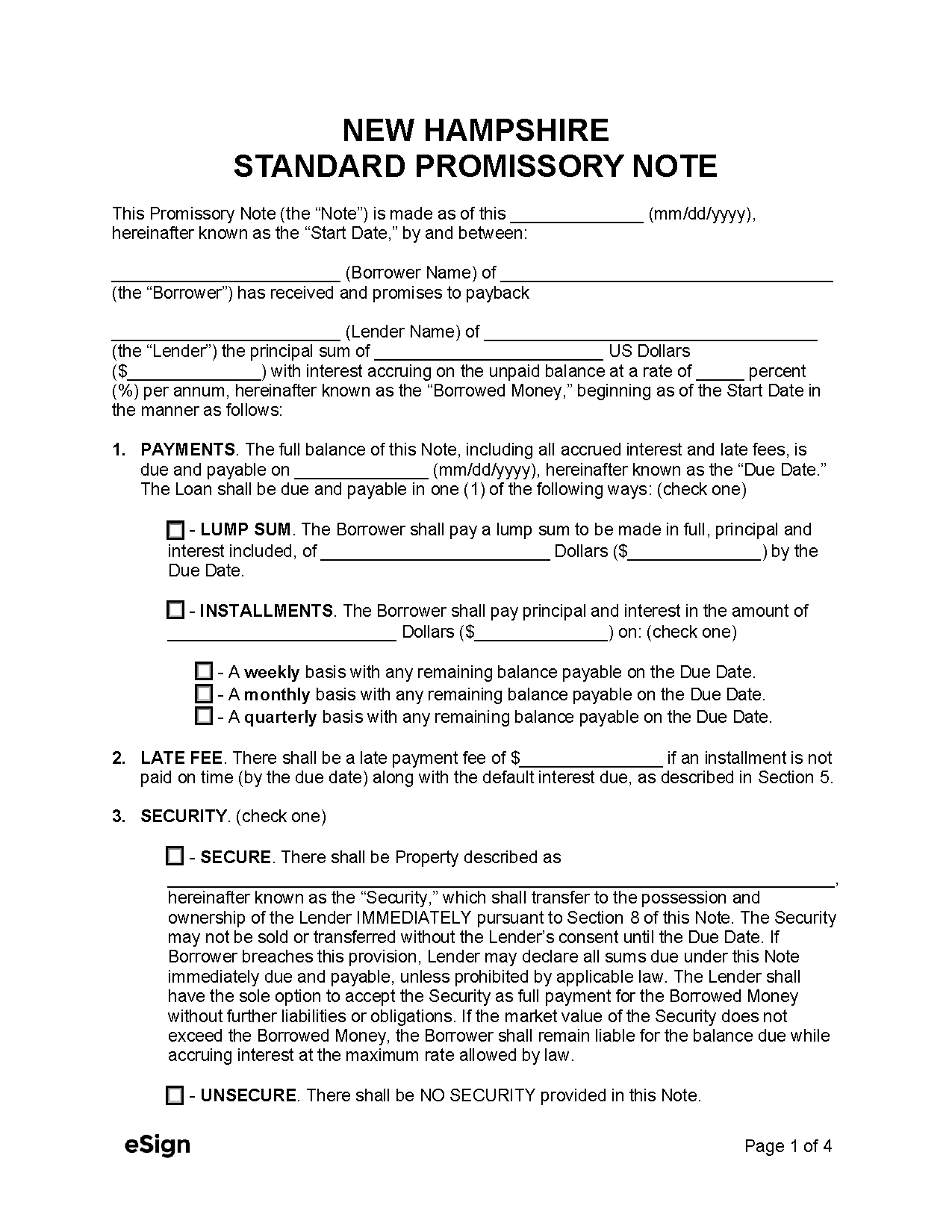

![]() Unsecured Promissory Note – Allows a borrower to receive a loan without needing to commit any property as collateral.

Unsecured Promissory Note – Allows a borrower to receive a loan without needing to commit any property as collateral.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title XXXI, Chapter 336

- Usury Rate with a Contract (§ 336:1): No limit

- Usury Rate without a Contract (§ 336:1): 10%

- Usury Rate for Judgements (§ 336:1): 2% above the discount rate of interest on twenty-six (26) week United States Treasury bills.