Related Forms

Download: PDF, Word (.docx), OpenDocument

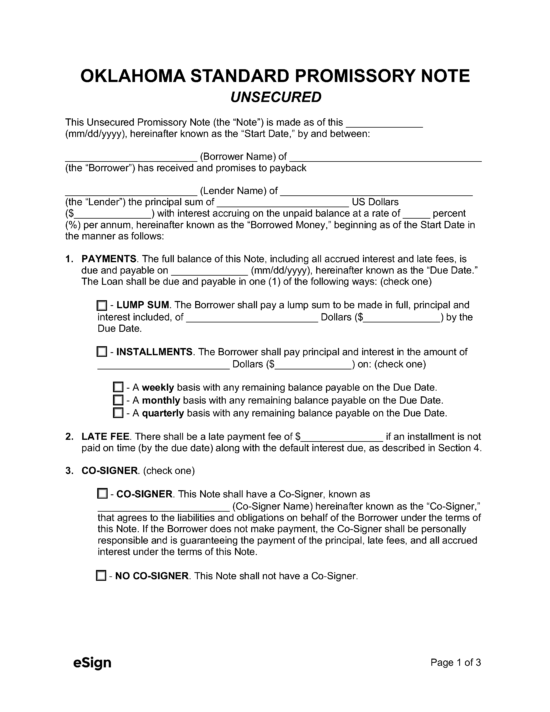

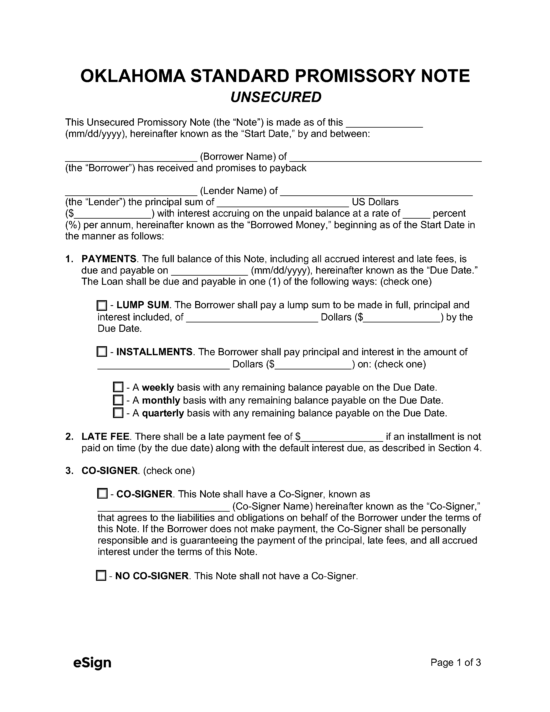

An Oklahoma secured promissory note describes loan repayment terms and the asset(s) provided as collateral by the borrower to secure the loan. Lenders will have more confidence in the borrower’s ability to pay them back if they put their assets at risk to obtain the financing. Most lenders will accept real estate, vehicles, equipment, jewelry, and shares of stock as collateral.

The note should detail the payment schedule, amount owing, penalties for missed payments, and interest rate. If the borrower is able to repay their debt as agreed upon, both parties will benefit as the lender will earn interest, while the borrower will have the cash flow to accomplish the loan’s intended purpose.

An Oklahoma secured promissory note describes loan repayment terms and the asset(s) provided as collateral by the borrower to secure the loan. Lenders will have more confidence in the borrower’s ability to pay them back if they put their assets at risk to obtain the financing. Most lenders will accept real estate, vehicles, equipment, jewelry, and shares of stock as collateral.

The note should detail the payment schedule, amount owing, penalties for missed payments, and interest rate. If the borrower is able to repay their debt as agreed upon, both parties will benefit as the lender will earn interest, while the borrower will have the cash flow to accomplish the loan’s intended purpose.

Download: PDF, Word (.docx), OpenDocument