Related Forms

Download: PDF, Word (.docx), OpenDocument

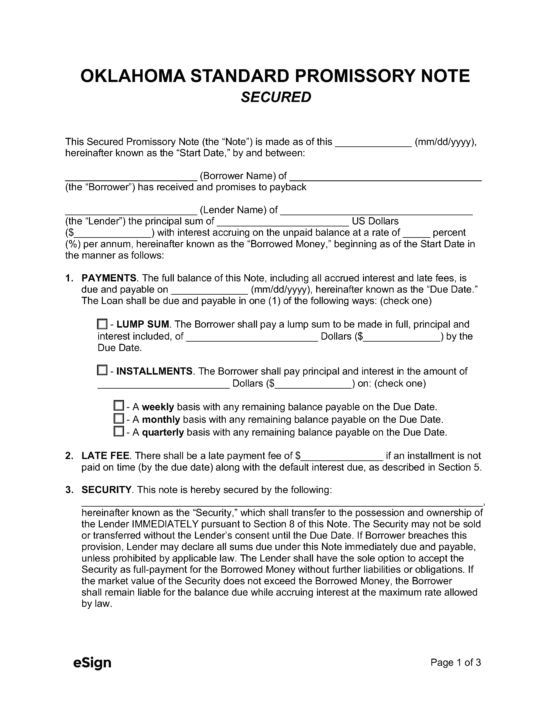

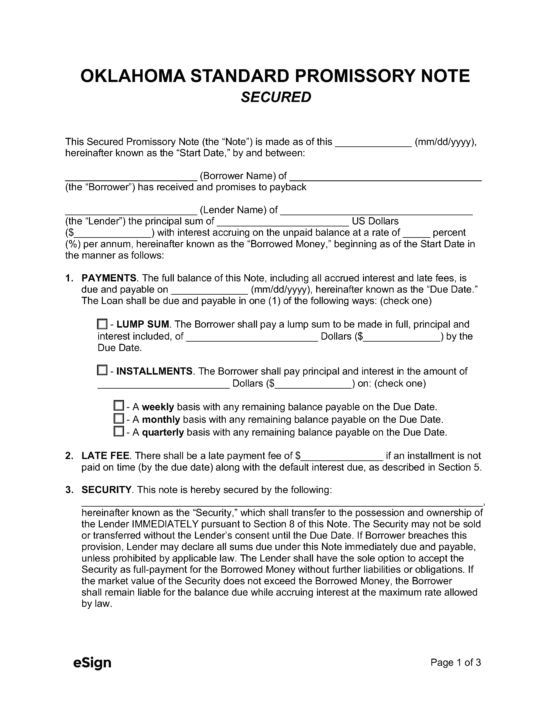

An Oklahoma unsecured promissory note is a financial agreement where a financier agrees to a loan without the borrower pledging their assets as collateral. Similar to the secured note, the document establishes the details of the loan and the terms in which the borrower agrees to repay the amount owing. Since no collateral is used to secure this type of loan, the financier is at a higher risk and may charge interest at a higher rate. The lender may also require a co-signer to enter the agreement on behalf of the borrower to mitigate their financial risk.

An Oklahoma unsecured promissory note is a financial agreement where a financier agrees to a loan without the borrower pledging their assets as collateral. Similar to the secured note, the document establishes the details of the loan and the terms in which the borrower agrees to repay the amount owing. Since no collateral is used to secure this type of loan, the financier is at a higher risk and may charge interest at a higher rate. The lender may also require a co-signer to enter the agreement on behalf of the borrower to mitigate their financial risk.

Download: PDF, Word (.docx), OpenDocument