Related Forms

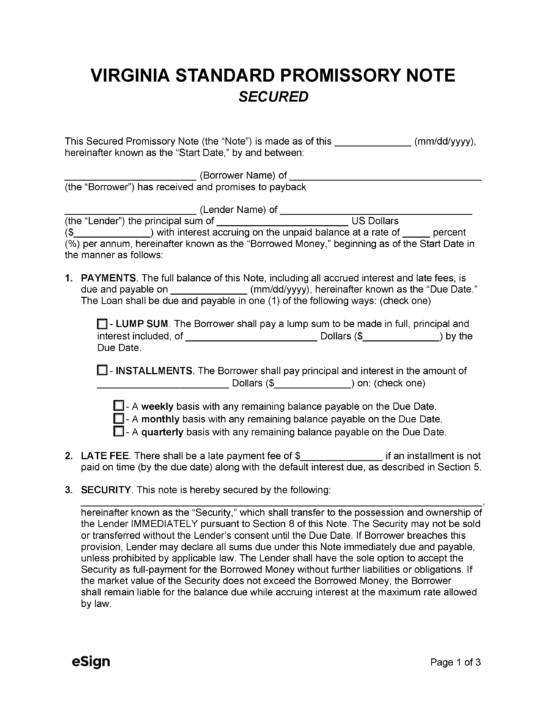

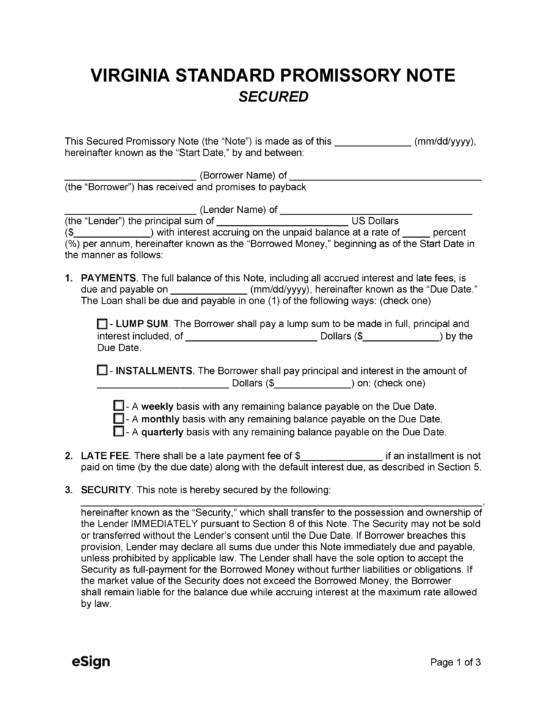

Secured Promissory Note – A personal loan with collateral provided by the borrower.

Secured Promissory Note – A personal loan with collateral provided by the borrower.

Download: PDF, Word (.docx), OpenDocument

A Virginia unsecured promissory note is a financial contract that relays the terms by which a borrower agrees to repay a loan that is not secured by collateral. The completed document will include the financial details of the agreement, including the original loan amount, the interest rate, and any fees that the borrower may be required to pay for late payments. Due to the fact that the borrower doesn’t promise any collateral, the only way for the lender to obtain recompense in the event of the loan’s default is to pursue legal action against the borrower.

Once both parties have provided their signatures, the contract becomes legally binding. If the borrower isn’t well known to the lender or isn’t trusted by them, a secured promissory note (see below) or formal loan agreement will give the lender more security on their expense.

A Virginia unsecured promissory note is a financial contract that relays the terms by which a borrower agrees to repay a loan that is not secured by collateral. The completed document will include the financial details of the agreement, including the original loan amount, the interest rate, and any fees that the borrower may be required to pay for late payments. Due to the fact that the borrower doesn’t promise any collateral, the only way for the lender to obtain recompense in the event of the loan’s default is to pursue legal action against the borrower.

Once both parties have provided their signatures, the contract becomes legally binding. If the borrower isn’t well known to the lender or isn’t trusted by them, a secured promissory note (see below) or formal loan agreement will give the lender more security on their expense.

Secured Promissory Note – A personal loan with collateral provided by the borrower.

Secured Promissory Note – A personal loan with collateral provided by the borrower.

Download: PDF, Word (.docx), OpenDocument