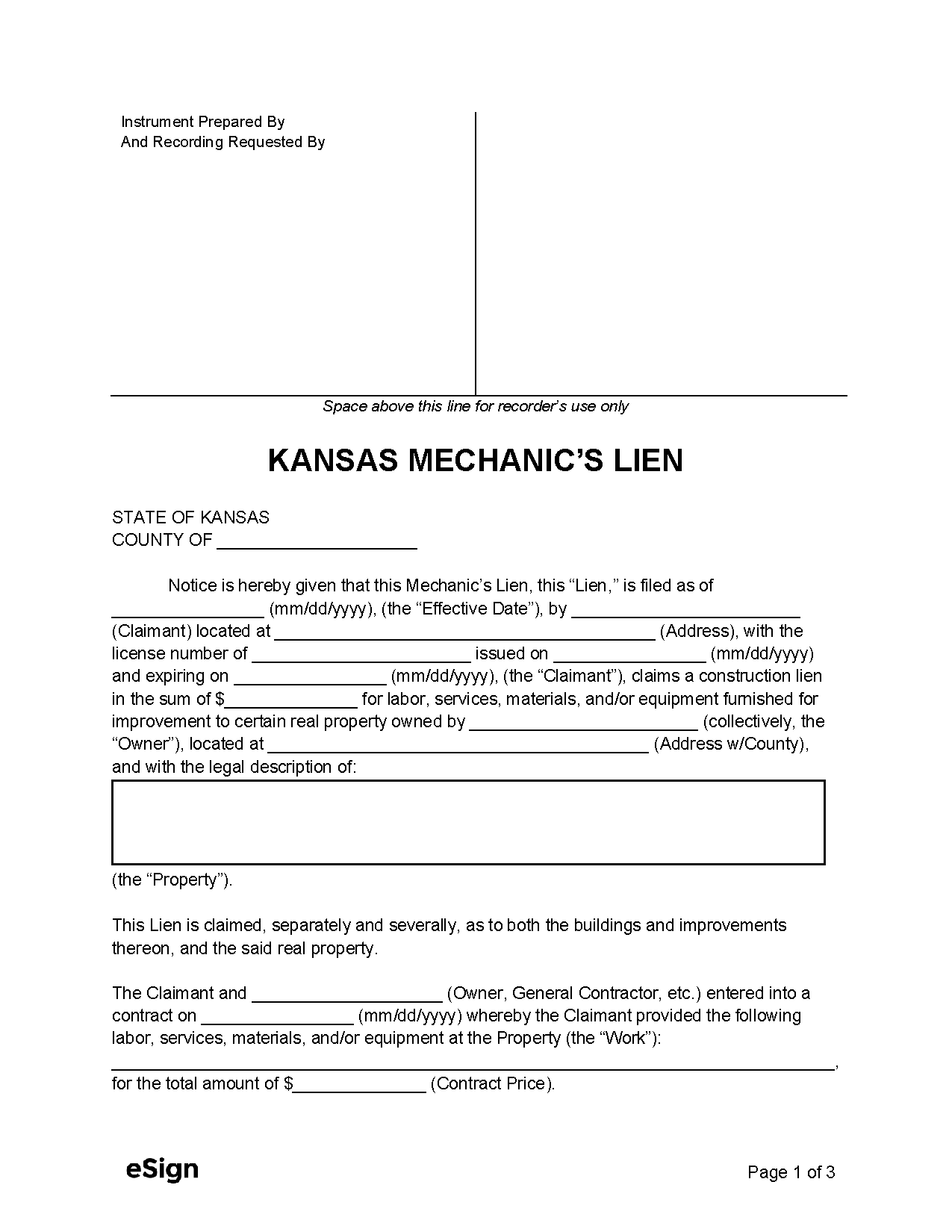

If the owner does not deliver the owed payment after they have received notice of a filed lien, they risk the claimant enforcing the lien and initiating a foreclosure action. If the action is successful, the claimant will be compensated through the sale of the property.

Laws & Requirements

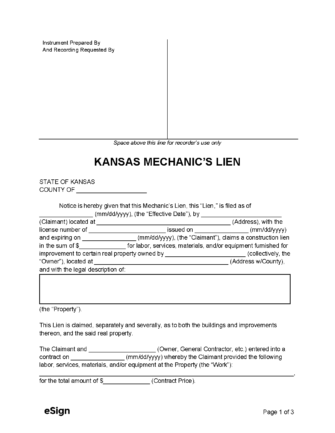

- Laws: Chapter 60, Article 11

- Signing Requirements (§ 60-1102(a)): Notary Public

- Time Limit for Recording Lien* (§ 60-1102(a) and § 60-1103(a)(1)):

- Original contractors – four (4) months

- Subcontractors and suppliers – three (3) months

- Deadline for Enforcing Lien (§ 60-1105(a)): One (1) year after the lien filing or, if a promissory note is attached to the lien statement, one (1) year after the maturity date thereof.

*A one (1) month extension may be provided if the claimant files a notice of extension within their time limit for recording the lien.