- Lien Waiver Form – A receipt signed by a contractor to waive their right to place a lien.

- Mechanic’s Lien Release Form – Cancels an existing lien after a property owner pays the amount due. Must be filed in the Registry of Deeds.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What is a Mechanic’s Lien?

Also known as a “construction lien,” “property lien,” or “lien claim form,” a mechanic’s lien is a legal document that helps contractors get paid for their work. If they do not receive payment for performing services or providing materials for a construction project, they can use the document to place a lien on the property owner’s home/structure to demand compensation. With the lien in place, a cloud is created on the property’s title so any prospective buyer or creditor can see it. This makes it extremely difficult for the property owner to refinance, transfer, or sell the property without paying off the lien first.

Even if a subcontractor had an agreement with the general contractor (instead of the owner), the lien falls on the property’s owner once filed. This gives the subcontractor the ability to circumvent the “chain of command,” drawing attention to their unpaid balance from those at the top.

Who’s it For?

The form is for anyone that helped increase the value of the property, whether they worked directly with the owner or not, including the following contributions:

- Labor

- Materials

- Tools

- Equipment

Mechanic’s lien laws vary from state to state but, in general, anyone who provided materials or services to the project has the right to file a lien. Some states even include equipment providers, architects, designers, and engineers. For example, suppose a subcontractor’s job was to build temporary scaffolding around the property. In that case, it can be presumed that they didn’t make a permanent improvement to the property. However, some states may still view this as vital to the progress of the job, and filing a lien would be in their right.

When to Use

The form should be used when the contractor has good reason to believe they won’t receive payment for the work or product they provided. There is no waiting period; in other words, a worker does not need to wait any amount of time (after having gone unpaid) before they can begin the lien process.

With that said, states have their own laws regarding how long the worker has to file the lien, with the average being between thirty (30) and ninety (90) days.

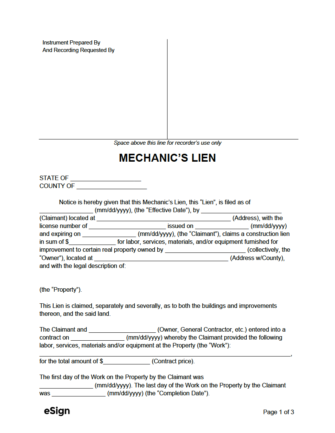

Sample

- Download (Blank): PDF, Word (.docx), OpenDocument

- Download (Sample Data): PDF, Word (.docx), OpenDocument

Instrument Prepared By: ______________

And Recording Requested By: ______________

Space above this line for recorder’s use only

MECHANIC’S LIEN

STATE OF [STATE]

COUNTY OF [COUNTY NAME]

Notice is hereby given that this Mechanic’s Lien, the “Lien,” is filed as of [MM/DD/YYYY], (the “Effective Date”), by [CLAIMANT NAME], located at [CLAIMANT ADDRESS], with the license number of [CLAIMANT LICENSE NUMBER] issued on [MM/DD/YYYY] and expiring on [MM/DD/YYYY], (the “Claimant”), claims a construction lien in the sum of $[LIEN AMOUNT] for labor, services, materials, and/or equipment furnished for improvement to certain real property owned by [PROPERTY OWNER] (collectively, the “Owner”), located at [PROPERTY ADDRESS], and with the legal description of:

[LEGAL DESCRIPTION OF PROPERTY] (the “Property”).

This Lien is claimed, separately and severally, as to both the buildings and improvements thereon and the said real property.

The Claimant and [OWNER/CONTRACTOR NAME] entered into a contract on [MM/DD/YYYY] whereby the Claimant provided the following labor, services, materials, and/or equipment at the Property (the “Work”): [DESCRIBE THE WORK PERFORMED], for the total amount of $[CONTRACT PRICE].

The first day of the Work on the Property by the Claimant was [MM/DD/YYYY]. The last day of the Work on the Property by the Claimant was [MM/DD/YYYY] (the “Completion Date”).

As of the Effective Date, the Claimant has: (check one)

☐ Received payment of $[AMOUNT RECEIVED].

☐ NOT received any payment.

The Owner has failed to pay the Balance Due despite demands and requests for payment. Accordingly, the Claimant declares that the claim amount of $[LIEN AMOUNT] is justly due to the Claimant.

The Claimant declares that the contents of this Lien are true and correct to the best of their knowledge. Subscribed and sworn to as of the Effective Date.

Claimant Signature: ____________________________ Date: [MM/DD/YYYY]

Claimant Printed Name: [CLAIMANT PRINTED NAME]

NOTARY ACKNOWLEDGMENT

State of [STATE]

County of [COUNTY]

The foregoing instrument was acknowledged before me this [MM/DD/YYYY], by the undersigned, [CLAIMANT NAME], who is personally known to me or satisfactorily proven to me to be the person whose name is subscribed to the within instrument.

____________________________

Notary Public

My Commission Expires: [NOTARY EXPIRATION]

How to Use a Mechanic’s Lien (6 Steps)

The steps below outline the basic process for using a mechanic’s lien. For detailed information on the process in each state, select one of the states from the list above.

Step 1 – Send the Preliminary Notice

Also known as a “Notice to Owner (NTO),” the preliminary notice is a form sent to the property owner shortly after work on the property begins. It is used for informing the owner (and general contractor) of the specifics regarding the work that the contractor will be performing on the property. The preliminary notice is a standard form that should be sent for every construction project, not just when payment is late.

For many states, issuing a preliminary notice is required to secure the subcontractor’s right to file a lien on the property. Many states also require the notice to be sent within a specific amount of time. This can range anywhere from a few to sixty (60) or more days after work begins.

A preliminary notice generally includes the following basic information:

- The name, address, and phone number of the parties involved:

- The worker (contractor) and their company.

- The person or company that hired the worker.

- The general contractor.

- The property owner.

- The entity that provided funding for the project (if applicable).

- The duties the worker will be performing on the property.

- An (estimated) amount of the cost of the worker’s services/materials.

- The address of the property where work will be conducted.

Once complete, the notice should be sent via certified mail to the property owner. This ensures proof that the contractor sent the notice within the confines of state requirements (if any).

Step 2 – Send the Notice of Intent

The “Notice of Intent” is a warning sent to the owner, informing them that a lien will be placed on their property unless payment is received ASAP. Like the preliminary notice, the notice of intent should be sent via certified mail. There are ten (10) states that require the letter to be sent before filing a mechanics lien: Arkansas, Colorado, Connecticut, Illinois, Maryland, Missouri, North Dakota, Pennsylvania, Wisconsin, and Wyoming.

Regardless if it is a state requirement or not, it is highly recommended that this notice be sent, as it often leads to the collection of payment without the need to move forward with the lien process.

Step 3 – Complete & Notarize the Mechanic’s Lien

If the contractor is still awaiting payment after having sent the Notice of Intent, it’s time to file the mechanic’s lien. For detailed information on completing the notice, see the How to Write section below.

Once all fields of the form have been completed, the contractor (known as the “Claimant” in the document) will need to sign their name in the presence of a Notary Public. Having a document notarized involves an official 3rd party witnessing the contractor sign the form, thus verifying the identity of the signatory and validity of the signature.

The easiest way to have the document notarized is to go to the eSign, upload the form, and have a licensed notary public acknowledge the document online. Alternatively, the contractor can bring the completed form to a notary in person to have it acknowledged. In-person notaries can be found at post offices, libraries, and government offices, to name a few.

Step 4 – Record It

After notarization, the contractor will need to go to the Registrar of Deeds in the county that the property is located. Here, they will need to pay a small fee to file the lien in the county records. Once recorded, the lien will be visible in the records, thereby “clouding” the title. Because the act of selling or refinancing the property requires a clean title, the owner would be required to pay off the lien before they could attempt either.

Step 5 – Work out a Solution

Once the lien has been filed, the subcontractor/contractor should reach out (via phone/email) to the property owner, and anyone else that can aid in getting their invoice paid. Then, the parties will often negotiate until they settle on a fair payment plan. Each state has its own deadlines before which action must be taken before the lien expires. “Action” in this case refers to a lawsuit. It is very rare a lien escalates to the point of foreclosure, although it’s important to understand subcontractors have this option if they cannot reach an agreement with the property owner.

Step 6 – Release the Lien

Once the contractor has received payment in full, it’s their obligation to release the mechanic’s lien on the property. This is done by completing and recording a release of lien form. It is important to have the lien released even if the lien is close to expiring, as the expired lien will still appear in a title search, and could cause uneasiness for the person or entity conducting the search.

Mechanic’s Lien Laws: By State

The following table contains the general laws for mechanic liens in each state:

Notice of Intent to Lien: By State

It is a legal requirement in ten (10) states that contractors send a Notice of Intent. Contractors working on property located in one of the states not listed are not required to send this notice before filing a mechanic’s lien (although sending one is highly recommended).

| STATE | REQUIRED NOTICE | STATUTE |

| Arkansas | 10 days | § 18-44-114 |

| Colorado | 10 days | § 38-22-109 |

| Connecticut | 90 days | § 49-35 |

| Illinois | 90 days | 770 ILCS 60/24 |

| Maryland | 120 days | § 9-104 |

| Missouri | 10 days | § 429.100 |

| North Dakota | 10 days | § 35-27-02 |

| Pennsylvania | 30 days | § 501 |

| Wisconsin | 30 days | § 779.06(2) |

| Wyoming | 20 days | § 29-2-107(a) |

Time Limit for Recording Lien: By State

The table below displays the number of days contractors/subcontractors have to record a lien on a property. Note that many states require “preliminary notice” to be given to the owner at the start of construction; if this hasn’t been provided, the subcontractor may have waived their ability to file a lien.

| STATE | TIME LIMIT | STATUTE |

| Alabama | Day laborers: 30 days Subcontractors: 120 days Contractors: 180 days |

§ 35-11-215 |

| Alaska | 120 days (If a “Notice of Completion” is filed, the subcontractor has 15 days to file.) | § 34-35-068 |

| Arizona | 120 days | § 33-993 |

| Arkansas | 120 days | § 18-44-117 |

| California | 90 days | § 8460 |

| Colorado | With materials provided: 120 days Without materials: 60 days |

§ 38-22-109 |

| Connecticut | 90 days | § 49-34 |

| Delaware | Direct contractors: 180 days Subcontractors/suppliers: 120 days |

§ 2711 |

| Florida | 45 days | § 713.06 |

| Georgia | 90 days | § 44-14-361.1 |

| Hawaii | 45 days | § 507-43(b) |

| Idaho | 90 days | § 45-507 |

| Illinois | 120 days | § 770 ILCS 60/7 |

| Indiana | Residential: 60 days Non-residential: 90 days |

§ 32-28-3-3 |

| Iowa | 90 days | § 579.9 |

| Kansas | Subcontractors: 90 days Prime contractors: 120 days |

§ 60-1102 |

| Kentucky | 180 days | § 376-010 |

| Louisiana | 60 days | § 4822 |

| Maine | Direct contractors: 120 days All others: 90 days |

§ 3253 & § 3255 |

| Maryland | 180 days | § 9-105 |

| Massachusetts | After notice of substantial completion: 60 days After notice of termination is filed: 90 days After last labor/materials furnished: 90 days |

Ch. 254 § 2 |

| Michigan | 90 days | § 570.1111 |

| Minnesota | 120 days | § 514.08 |

| Mississippi | 90 days | § 85-7-405(b) |

| Missouri | 180 days | § 429.080 |

| Montana | 90 days | § 71-3-535 |

| Nebraska | 120 days | § 52-137 |

| Nevada | 90 days | § 108.226 |

| New Hampshire | 120 days | § 447:9 |

| New Jersey | Non-residential: 90 days Residential: 120 days |

§ 2A:44A-20 & § 2A:44A-21 |

| New Mexico | Original contractors: 120 days Everyone else: 90 days |

§ 48-2-6 |

| New York | 8 months (240 days) | § 10 |

| North Carolina | 120 days | § 44A-12 |

| North Dakota | 90 days | § 35-27-14 |

| Ohio | Residential: 60 days Everything else: 75 days |

§ 1311.06 |

| Oklahoma | Prime contractors: 120 days Subcontractors: 90 days |

§ 142 & § 143 |

| Oregon | 75 days | § 87.035 |

| Pennsylvania | 180 days | § 502 |

| Rhode Island | 200 days | § 34-28-4 & § 34-28-9 |

| South Carolina | 90 days | § 29-5-90 |

| South Dakota | 120 days | § 44-9-15 |

| Tennessee | Prime contractors: 1 year (365 days) Subcontractors: 90 days |

§ 66-11-106 & § 66-11-112 |

| Texas | Residential: 15th day of the 3rd month after last materials/labor furnished Non-residential: 15th day of the 4th month after last materials/labor furnished |

§ 53.052 |

| Utah | 90 days | § 38-1a-502 |

| Vermont | 180 days | § 1921 |

| Virginia | 90 days | § 43-4 |

| Washington | 90 days | § 60.04.091 |

| West Virginia | 100 days | § 38-2-7 |

| Wisconsin | 180 days | § 779.06 |

| Wyoming | 120 days | § 29-2-106 |

Instructions (How to Write)

Fields 1 – 2

1. Type (or write, if printed) the state in which the property is located. The “property” is the site where work was conducted that the claimant did not receive payment for.

2. Enter the name of the county in which the property is located.

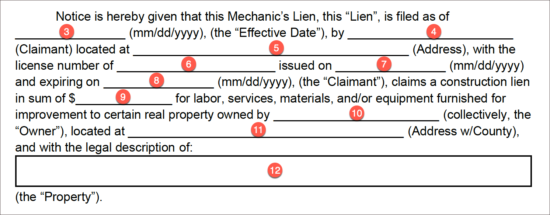

Fields 3 – 12

In this section, the claimant will need to enter the following pieces of information:

3. The date (mm/dd/yyyy) they are filing the lien.

4. The full name of the claimant (the person completing the form).

5. The claimant’s full mailing address.

6. The claimant’s license number (if applicable).

7. The date the claimant’s license was issued.

8. The date the license will expire.

9. The amount ($) of the construction lien claim.

10. The full name of the person that owns the property on which construction took place.

11. The address of the property (with the county included).

12. The full legal description of the property. This can be found in current/previous deeds (and can often be found online).

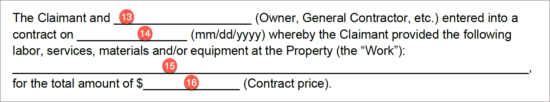

Fields 13 – 16

13. Provide the name of the person the claimant entered into a work contract with.

14. Enter the date (mm/dd/yyyy) the contract was entered into.

15. Describe the type(s) of services, labor, equipment, or materials the claimant provided to the work site.

16. Enter the amount of money ($) the claimant charged for their services or materials listed on line 15.

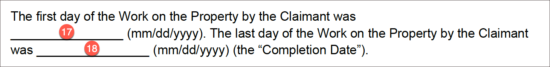

Fields 17 – 18

17. Enter the date (mm/dd/yyyy) the claimant began work on the property.

18. Enter the date (mm/dd/yyyy) the claimant finished work on the property.

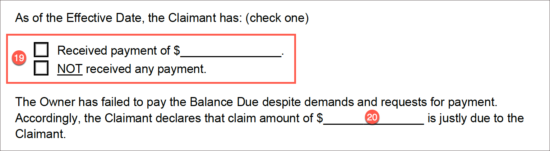

Fields 19 – 20

19. If the claimant received partial payment from the owner/general contractor, check the first box and enter the amount ($) they received so far. If no payment was received, check the second box.

20. Enter the total ($) amount the claimant is due. This is the amount ($) the lien will be for.

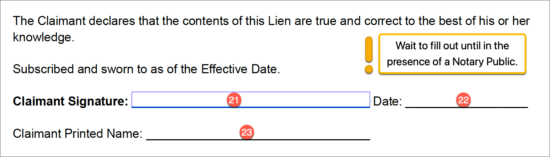

Fields 21 – 23 (Claimant Signature)

21. The claimant will need to sign their name on line 21. Their signature can be inscribed by hand (by printing the document) or it can be signed digitally with eSign (suggested option). If the claimant will be notarizing the form (which is highly recommended), they will need to wait until they are in the presence of a Notary Public.

22. Record the date (mm/dd/yyyy) the claimant signed the lien.

23. Enter the full printed name of the claimant.

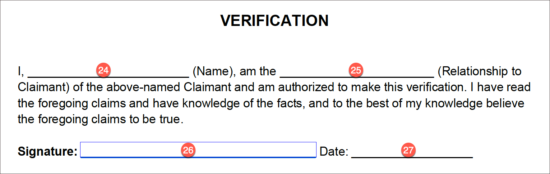

Fields 24 – 27 (Verification)

This area is rarely required by state law, but is included should the claimant want additional proof (in addition to Notarization) that their claims regarding payment are true. To complete this area, the following fields will need to be completed:

24. The full name of the verifier (the person verifying the worker’s claims).

25. How the verifier is related/associated with the claimant (e.g., “Coworker”).

26. The signature of the verifier (signed by hand or with eSign).

27. The date (mm/dd/yyyy) the verifier signed their name to the form.

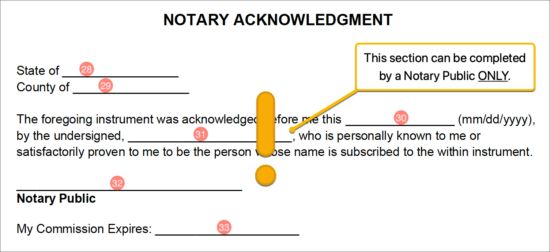

Fields 28 – 33 (Notary Acknowledgment)

28 – 33. Fields 28 through 33 are to be completed by a Notary Public only. When (or if) the claimant has their signature notarized, the Notary will complete the fields listed here.

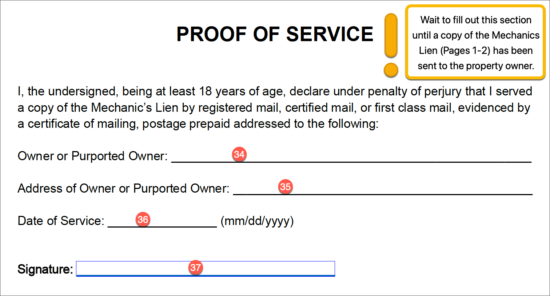

Fields 34 – 37 (Proof of Service)

The last page of the form, the “Proof of Service,” is a section completed by the claimant guaranteeing that a copy of the lien was indeed sent to the property owner. This form is not given to the county recorder when recording the document. The following fields will need to be completed on this page:

34. Name of the person that received the copy of the notice (should be the owner’s full name).

35. The address that the letter was delivered to.

36. The date of service (when the letter was sent).

37. The signature of the claimant. (This can be signed with eSign or by hand.)