Sample

Download: PDF, Word (.docx), OpenDocument, PDF (Sample)

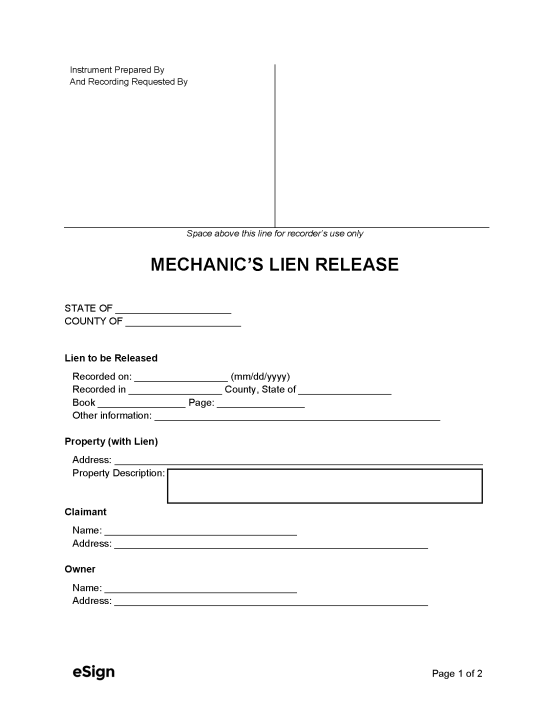

Instrument Prepared By: ______________

And Recording Requested By: ______________

__________________________________________

Space above this line for recorder’s use only

MECHANIC’S LIEN RELEASE

STATE OF [STATE NAME]

COUNTY OF [COUNTY NAME]

Lien to be Released

Recorded on: [MM/DD/YYYY]

Recorded in [COUNTY NAME] County, State of [STATE NAME]

Book [BOOK #] Page: [PAGE #]

Other information: [ADD ANY OTHER INFORMATION HERE]

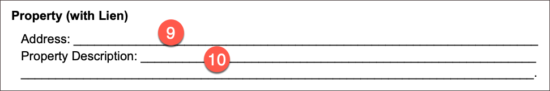

Property (with Lien)

Address: [PROPERTY ADDRESS]

Property Description: [LEGAL DESCRIPTION OF PROPERTY]

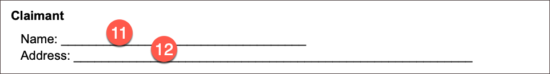

Claimant

Name: [CLAIMANT NAME]

Address: [CLAIMANT ADDRESS]

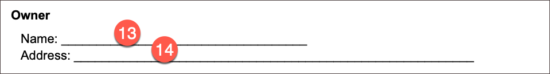

Owner

Name: [OWNER NAME]

Address: [OWNER ADDRESS]

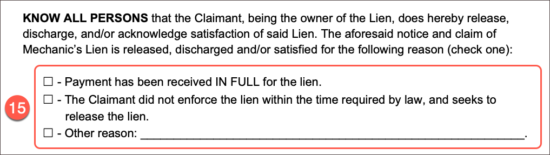

KNOW ALL PERSONS that the Claimant, being the owner of the Lien, does hereby release, discharge, and/or acknowledge satisfaction of said Lien. The aforesaid notice and claim of Mechanic’s Lien is released, discharged and/or satisfied for the following reason (check one):

☐ – Payment has been received IN FULL for the lien.

☐ – The Claimant did not enforce the lien within the time required by law and seeks to release the lien.

☐ – Other reason: [OTHER REASON (OPTIONAL)]

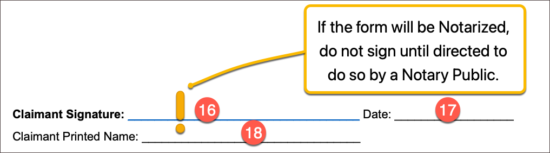

Claimant Signature: __________________________ Date: [MM/DD/YYYY]

Claimant Printed Name: [CLAIMANT PRINTED NAME]

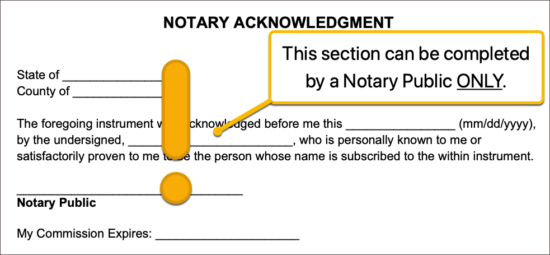

NOTARY ACKNOWLEDGMENT

State of [STATE]

County of [COUNTY]

The foregoing instrument was acknowledged before me this [MM/DD/YYYY], by the undersigned, [CLAIMANT NAME], who is personally known to me or satisfactorily proven to me to be the person whose name is subscribed to the within instrument.

_________________________________

Notary Public

My Commission Expires: [NOTARY EXPIRATION]

How to Release a Mechanic’s Lien (3 steps)

Step 1 – Negotiate with the Property Owner

More often than not, the property owner will reach out to the worker (claimant) to resolve the lien. Depending on the value of the lien, the owner may attempt to pay a lower amount than owed. While accepting the owner’s offer can resolve the situation faster, it is ultimately up to the claimant to decide if the lower amount is acceptable.

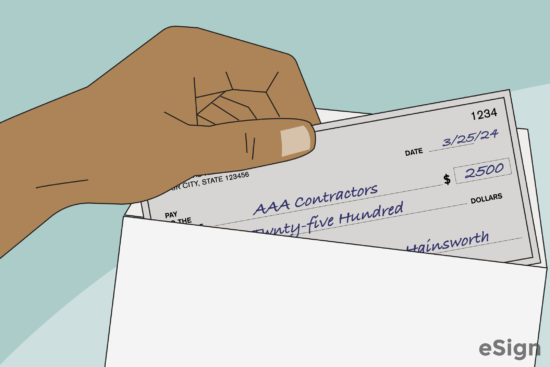

Step 2 – Receive Payment

The claimant should require the owner to pay them before releasing the lien. This is very important, as there is far less incentive for the property owner to pay if the lien is already released. Additionally, once payment is received, the claimant has no reason not to release the lien.

Step 3 – Complete & Record the Release

Once the claimant has been paid for the total value of the lien (or a lesser, agreed-upon amount), they will need to complete the lien release. If the claimant had to notarize the mechanic’s lien when they initially filed it, they will most likely need to notarize the release form as well.

The completed release form must be recorded at the public land records office (e.g., recorder of deeds) to finish the lien release process. A copy should then be sent to the owner via certified mail to inform them that the lien is officially released.

Lien Release Deadlines: By State

View Deadlines |

|||

| STATE | RELEASE DEADLINE | STATUTE | |

| Alabama | 30 days after receiving written demand | § 35-11-231(b) | |

| Alaska | None | N/A | |

| Arizona | 20 days after receiving payment | § 33-1006(A) | |

| Arkansas | 10 days after receiving payment | § 18-44-131(b) | |

| California | None | N/A | |

| Colorado | 10 days after receiving written demand | § 38-22-118 | |

| Connecticut | None | N/A | |

| Delaware | None | N/A | |

| Florida | None | N/A | |

| Georgia | None | N/A | |

| Hawaii | None | N/A | |

| Idaho | None | N/A | |

| Illinois | 10 days after receiving written demand | 770 ILCS 60/35(a) | |

| Indiana | None | N/A | |

| Iowa | 30 days after receiving written demand | § 572.23(1) | |

| Kansas | None | N/A | |

| Kentucky | 30 days after receiving payment | § 382.365(1) | |

| Louisiana | 10 days after receiving written demand | § 4833(3) | |

| Maine | 60 days after receiving payment | § 4013(1) | |

| Maryland | None | N/A | |

| Massachusetts | None | N/A | |

| Michigan | None | N/A | |

| Minnesota | None | N/A | |

| Mississippi | 15 days after receiving written demand | § 85-7-421(3) | |

| Missouri | 10 days after receiving written demand | § 429.130 | |

| Montana | 30 days after receiving payment | §§ 71-3-537, 71-3-131 | |

| Nebraska | None | N/A | |

| Nevada | 10 days after receiving payment | § 108.2437(1) | |

| New Hampshire | None | N/A | |

| New Jersey | 30 days of payment OR within 7 days of demand | § 2A:44A-30(a) | |

| New Mexico | None | N/A | |

| New York | None | N/A | |

| North Carolina | None | N/A | |

| North Dakota | None | N/A | |

| Ohio | 30 days after receiving payment | § 1311.20 | |

| Oklahoma | Immediately after receiving payment | 42 § 102 | |

| Oregon | 10 days after receiving written demand | § 87.076(4)(a) | |

| Pennsylvania | None | N/A | |

| Rhode Island | None | N/A | |

| South Carolina | Immediately after receiving payment | § 29-5-430 | |

| South Dakota | 10 days after receiving written demand | § 44-9-22 | |

| Tennessee | 30 days after receiving written demand | § 66-11-135(a) | |

| Texas | 10 days after receiving written demand | § 53.152(a) | |

| Utah | 10 days after request | § 38-1a-803(2) | |

| Vermont | None | N/A | |

| Virginia | None | N/A | |

| Washington | Immediately upon receiving payment and demand | § 60.04.071 | |

| West Virginia | Immediately upon receiving demand | § 38-2-36(a) | |

| Wisconsin | Upon receiving payment and demand | § 779.13(1) | |

| Wyoming | 30 days after receiving payment | § 29-1-313(a) | |

How to Write

View Instructions |

|

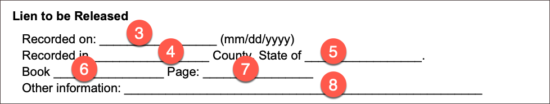

Step 1 – State & County1. Enter the name of the state where the lien was originally recorded. Step 2 – Lien to be Released3. Type the date (mm/dd/yyyy) on which the original lien was recorded. Step 3 – Property (with Lien)9. Provide the full address of the property where the work was completed (the property with the lien to be released). Step 4 – Claimant11. Enter the full name of the claimant, the person who completed the work. Step 5 – Owner13. Type the full name of the owner of the property that has the lien. Step 6 – Reason for Release15. Check the box corresponding to the reason the claimant is releasing the lien. If the “Other reason” box is checked, describe why the claimant is releasing the lien. Step 7 – Claimant Signature16. The claimant must sign their name on this blue line. If the claimant intends on having the form notarized (required in some states; highly recommended for all states), they will need to wait to sign until they are in the presence of a notary public. Step 8 – Notarization19 – 24. These fields are for notary public completion ONLY. |

|