A lien waiver is a document that “waives” a worker’s right to record a lien against a property. It is used in construction after payment is made to a subcontractor, supplier, or day laborer.

The form is often issued by the general contractor (GC) to those working on the construction site as a type of ‘receipt’ towards the payment made to the worker. There are four (4) types of lien waivers that can be used depending on the progress of the project and the amount the worker has been paid so far.

By Type (4)

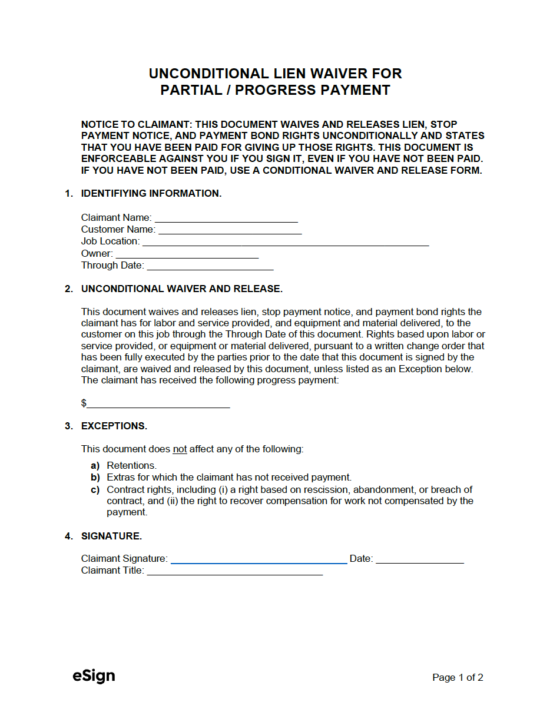

Conditional Lien Waiver (PARTIAL Payment) – Used when making a progress payment to a contractor BEFORE payment has been released.

Conditional Lien Waiver (PARTIAL Payment) – Used when making a progress payment to a contractor BEFORE payment has been released.

Download: PDF, Word (.docx), OpenDocument

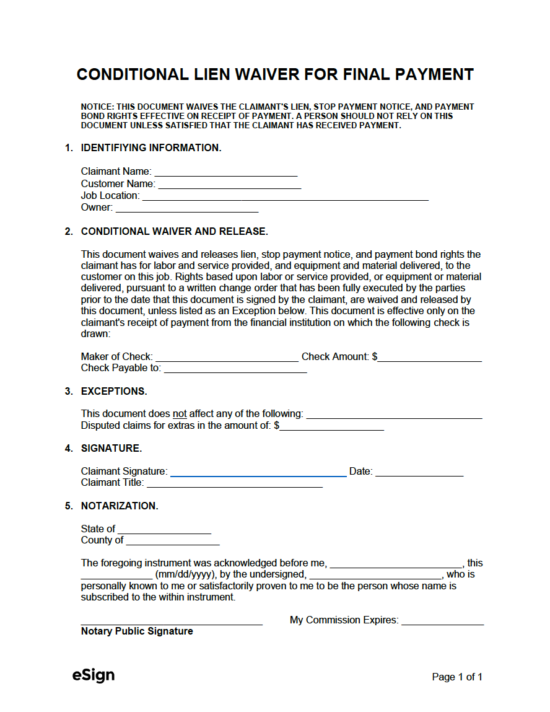

Conditional Lien Waiver (FINAL Payment) – Used when making the last payment to a contractor BEFORE payment has been released.

Conditional Lien Waiver (FINAL Payment) – Used when making the last payment to a contractor BEFORE payment has been released.

Download: PDF, Word (.docx), OpenDocument

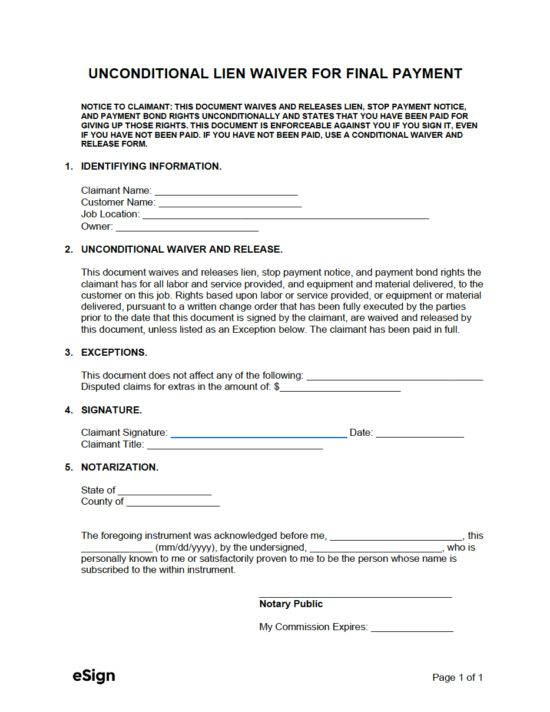

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Contents |

What is a Lien Waiver?

A lien waiver is a written contract in which a worker relinquishes their right to file a lien on real property. The form is mainly used in the construction industry. It prevents a worker (such as a subcontractor) from getting paid and then filing a lien on a property in an attempt to get paid a second time.

Lien Waiver vs. Lien Release

Although the terms “Lien Waivers” and “Lien Release Forms” are often used interchangeably, they are substantially different forms.

Lien Waivers are issued before any non-payment issues have arisen to ensure unnecessary liens and additional payments don’t occur.

Lien Releases are documents used by contractors (claimants) to remove an existing lien on a property. They are recorded with the county clerk in the county where the property is located.

Statutory Lien Waivers: By State

The twelve (12) states in the table below provide their own guidelines for the structure of a lien waiver.

| STATE | STATUTE |

| Arizona | § 33-1008 |

| California | §§ 8132, 8134, 8136, 8138 |

| Florida | § 713.20 |

| Georgia | § 44-14-366 |

| Massachusetts | § 32 |

| Michigan | § 570.1115 |

| Mississippi | § 85-7-433 |

| Missouri | § 429.016 |

| Nevada | § 108.2457 |

| Texas | § 53.284 |

| Utah | § 38-1a-802 |

| Wyoming | § 29-10-101 |

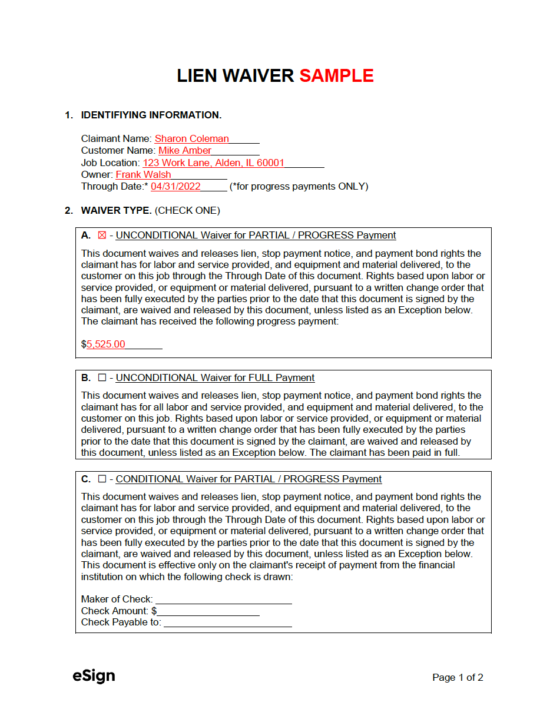

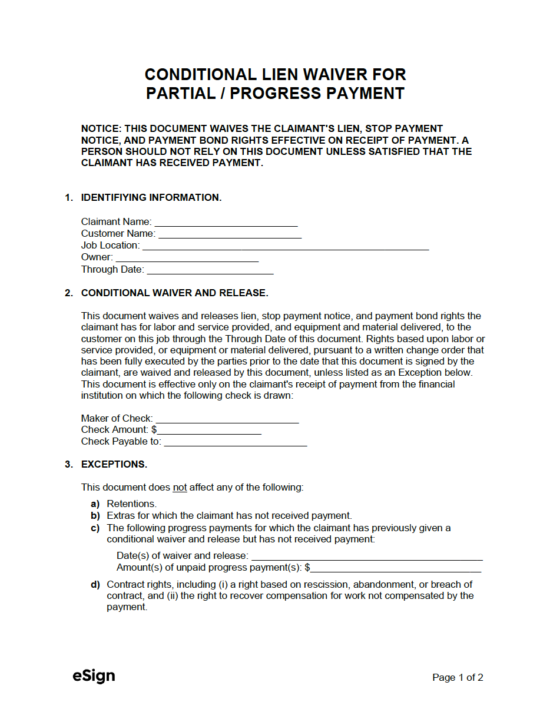

Sample

In the sample waiver below, the claimant (the person that performed the work) has been paid in full for work they performed up to a certain date. In other words, the project has not been completed entirely but the claimant has completed a milestone that they have already been paid for. Thus, the owner/general contractor is having them sign the waiver to prevent them from filing a lien on the property in the amount they have already been paid.

Download: PDF, Word (.docx), OpenDocument

How to Write

Download: PDF, Word (.docx), OpenDocument

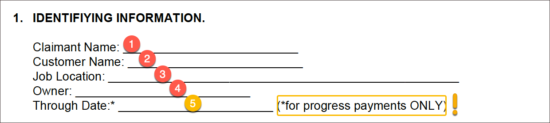

Step 1 – Identifying Information

1. Enter the full name of the person that is waiving their rights to filing a lien. They can be a subcontractor, supplier, day laborer, or any other type of construction worker.

2. Enter the full name of the person that hired the claimant. For example, if the claimant was hired by a general contractor, the full name of the general contractor would go here.

3. Record the full address of the property where the worker contributed their services.

4. The full name of the person that owns the property must be provided here.

5. This field should only be completed if the claimant received a progress payment. In other words, if the claimant finished all of their work on the property and has received (or will be receiving) their last payment, this field should be left blank.

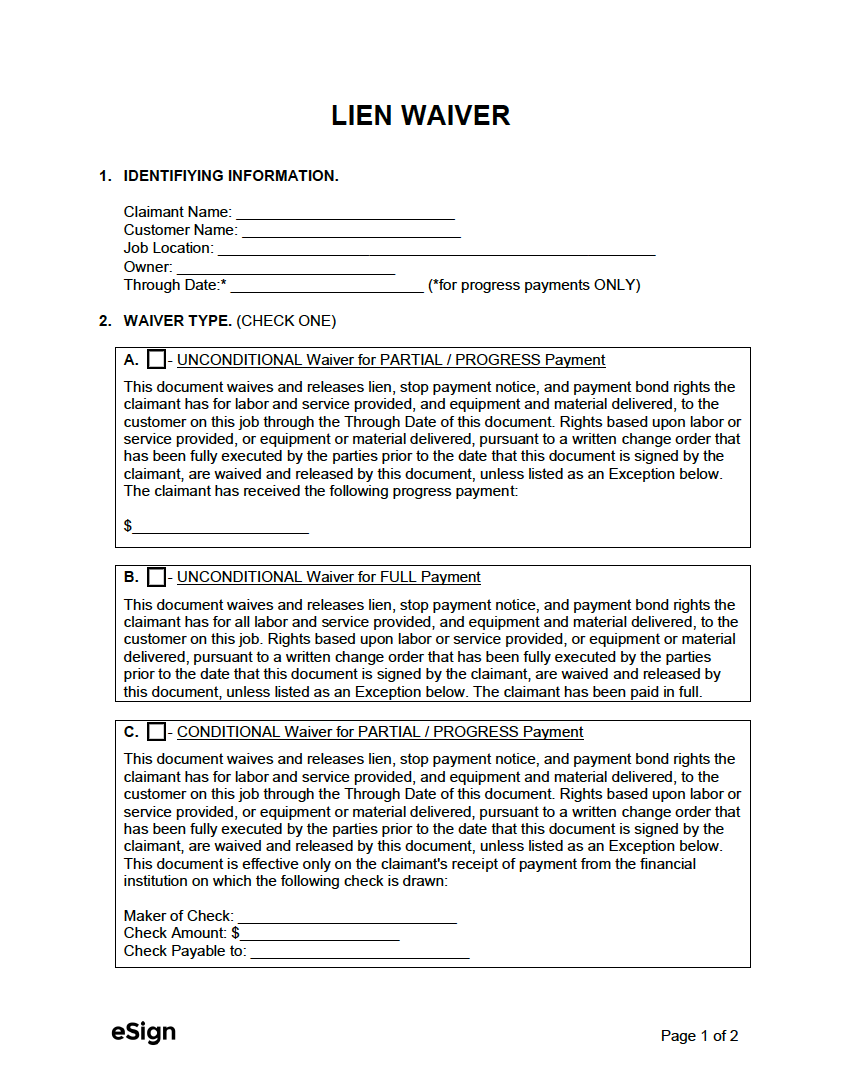

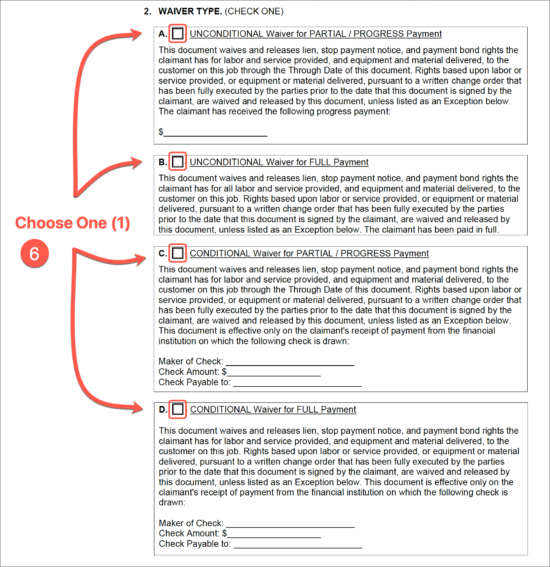

Step 2 – Waiver Type

6. There are four (4) types of waivers provided on this form, and only one (1) of the following options should be selected:

A – Select option “A” if the claimant already received payment for their work and will continue to perform services on the property.

B – Select option “B” if the claimant already received payment for their work and will not be performing any more services.

C – Select option “C” if the claimant has yet to receive payment for their work and they will continue to perform services on the property.

D – Select option “D” if the claimant has yet to receive payment for their work and will not be performing any more services.

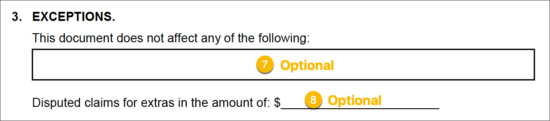

Step 3 – Exceptions (Optional)

7. Field #7 can be used for establishing rights that the lien waiver does not affect. For example, if the waiver is for a “progress/partial payment,” the person completing the form can add a statement similar to: “Extras for which the claimant has not received payment.” This means the claimant can still recover any money they have not received later on.

8. Additionally, if there are any item(s) that are currently being disputed, the amount ($) of the item(s) can be added to field #8 to preserve the claimant’s right to make a future claim on the disputed item(s).

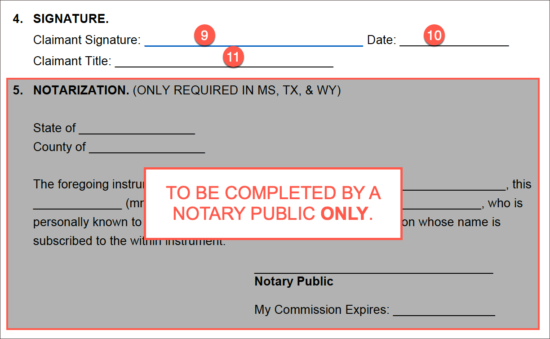

Step 4 – Signing & Notarization

9. The claimant will need to sign the form in order for it to be considered valid. The signature can be added digitally using eSign (free), or the completed form can be printed and signed by hand.

10. Enter the date (mm/dd/yyyy) that the claimant signed the form.

11. If the claimant is an entity, the title of the individual who is signing this form on behalf of the company should be provided.

If construction is taking place in Mississippi, Texas, or Wyoming, the claimant will need to have their signature notarized. This can also be done with eSign, or the claimant can bring the completed waiver to a Notary in person (often can be found in post offices and government offices). If the property is not located in one (1) of these three (3) states, notarization is recommended but not legally required.