Sample

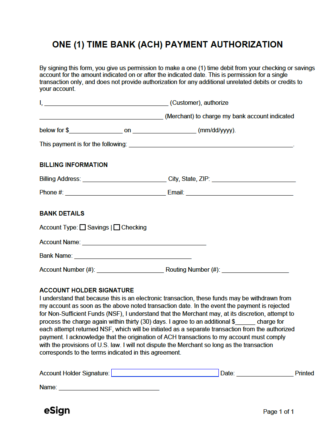

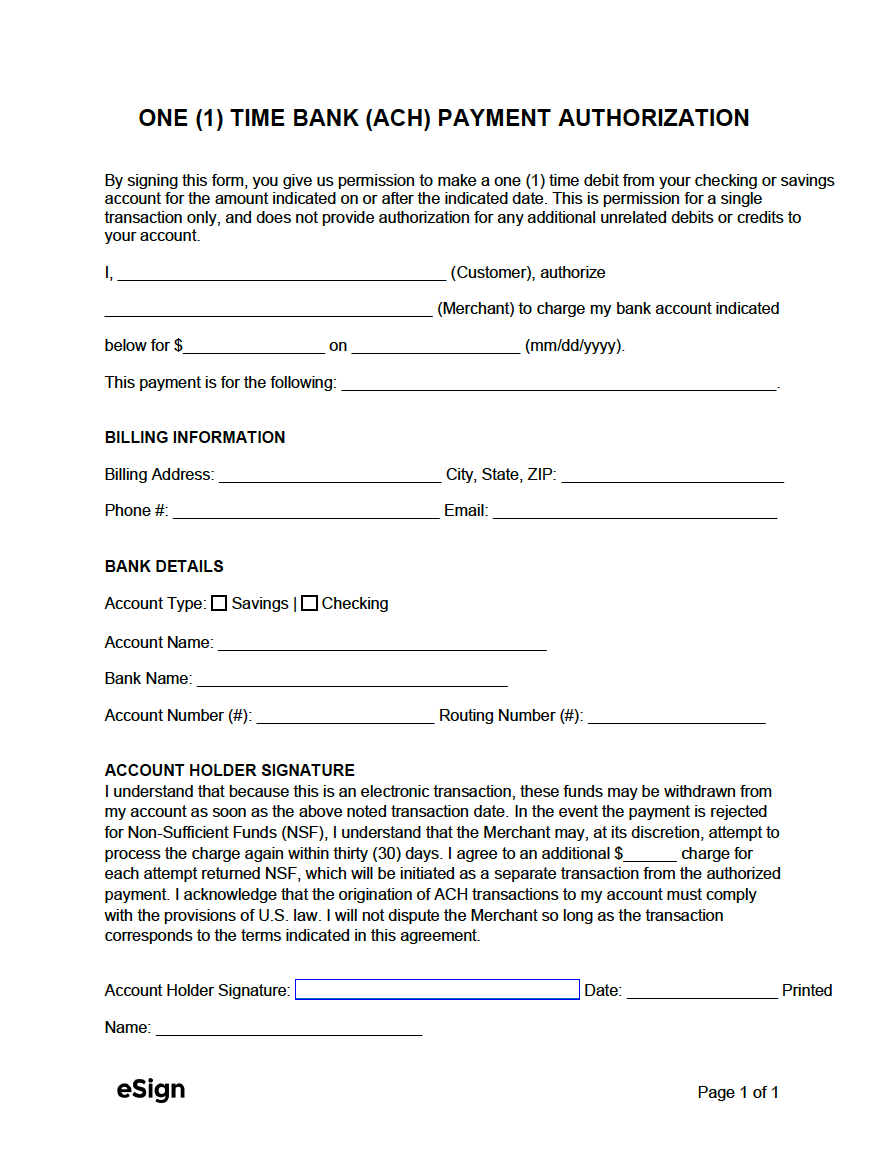

ONE (1) TIME BANK (ACH) PAYMENT AUTHORIZATION

By signing this form, you permit us to make a one (1) time debit from your checking or savings account for the amount indicated on or after the indicated date. This is permission for a single transaction only and does not provide authorization for any additional unrelated debits or credits to your account.

I, [CUSTOMER NAME], authorize [MERCHANT NAME] to charge my bank account indicated below for $[AMOUNT] on [MM/DD/YYYY].

This payment is for the following: [REASON FOR PAYMENT].

BILLING INFORMATION

Address: [STREET, CITY, STATE, ZIP]

Phone Number: [CUSTOMER PHONE #] Email: [CUSTOMER EMAIL]

BANK DETAILS

Account Type: ☐ Savings | ☐ Checking

Account Name: [ACCOUNT NAME]

Bank Name: [BANK NAME]

Account Number: [ACCOUNT #] Routing Number: [ROUTING #]

ACCOUNT HOLDER SIGNATURE

I understand that because this is an electronic transaction, these funds may be withdrawn from my account as soon as the above-noted transaction date. If the payment is rejected for Non-Sufficient Funds (NSF), I understand that the Merchant may, at its discretion, attempt to process the charge again within thirty (30) days. I agree to an additional $[NSF CHARGE] charge for each attempt returned NSF, which will be initiated as a separate transaction from the authorized payment. I acknowledge that the origination of ACH transactions to my account must comply with the provisions of U.S. law. I will not dispute the Merchant so long as the transaction corresponds to the terms indicated in this agreement.

Account Holder Signature: _________________________ Date: [MM/DD/YYYY]

Printed Name: [CUSTOMER PRINTED NAME]

How to Write

Download: PDF, Word (.docx), OpenDocument

Step 1 – General Info

To begin, enter the following information at the top of the page:

- The full name of the customer (person authorizing the withdrawal).

- The full name of the merchant (will most likely be the name of a company).

- The amount ($) of the withdrawal.

- The date (mm/dd/yyyy) the withdrawal will occur.

- The purpose of the payment (what the customer is receiving in exchange).

Step 2 – Billing Information

The next section is for recording the customer’s billing information. There are four (4) fields, two (2) of which are required.

- Provide the customer’s billing address.

- Enter the customer’s city, state, and ZIP code.

- Enter their phone number (optional).

- Provide their email address (also optional).

Step 3 – Bank Details

- Select whether the customer’s bank account is a checking or savings account.

- Type the name of the bank account (e.g., “Chase personal checking account”).

- Enter the name of the bank (e.g., “Chase”).

- Enter the account number.

- Provide the bank’s full routing number.

Step 4 – Customer Signature

Finally, the customer will need to sign their name onto the document, enter the date they signed, and write their full printed name. Signing can be done digitally through eSign or by printing the document and signing by hand.