Summary

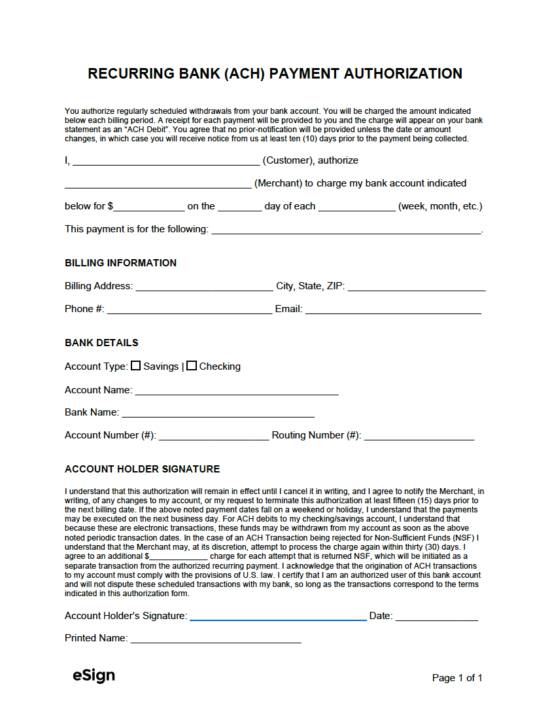

- Recommended for memberships/subscriptions that renew on a daily, weekly, or monthly basis.

- Helps to reduce the number of chargebacks a company receives.

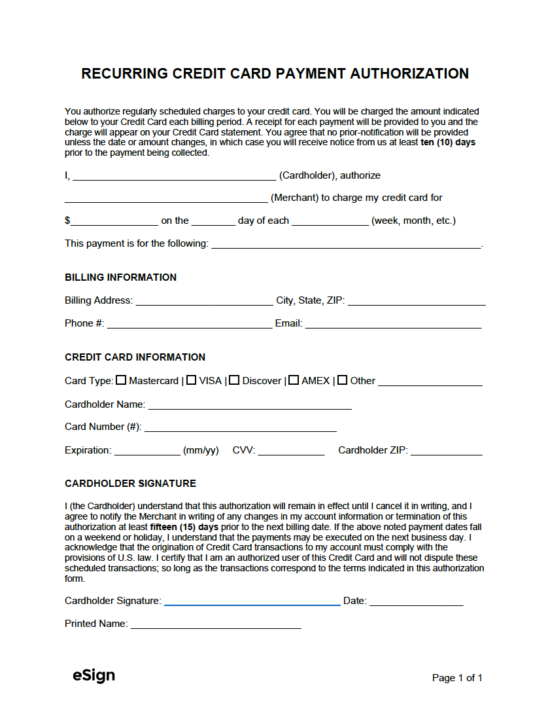

Credit Card Authorization Forms (2)

One (1) Time Credit Card Payment Authorization Form – For receiving the approval to charge a customer’s credit card ONCE.

One (1) Time Credit Card Payment Authorization Form – For receiving the approval to charge a customer’s credit card ONCE.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

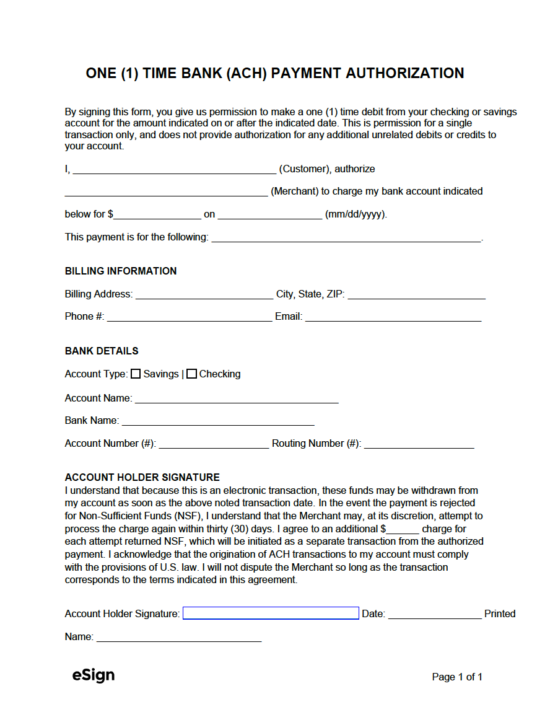

ACH Authorization Forms (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Contents |

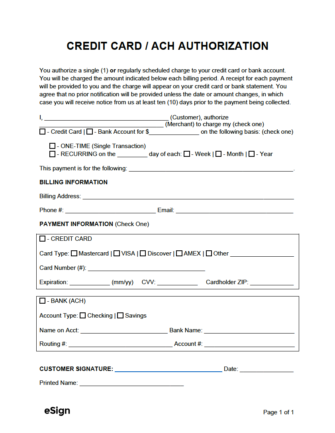

What to Include

To sufficiently protect the issuing company from a chargeback, the form should contain the following information (at a minimum):

Transaction Info

- Name of the merchant (company).

- The amount ($) of the charge.

- Whether the charge is one-time or recurring.

- The date of each recurring payment (if applicable)

- The reason for the payment.

Customer Info

- Full name of the customer.

- Billing address.

- Phone number and email (optional, but recommended).

Payment Type

- Whether payment will be made via credit card or bank (ACH).

- If by credit card:

- The type of card (VISA, AMEX, Mastercard, etc.).

- The card number (#).

- Expiration date (mm/yy).

- CVV (3-4 digits).

- Cardholder ZIP code.

- If via bank (ACH) withdrawals:

- The account type (savings or checking).

- The name of the person on the account (customer name).

- The name of the bank.

- The bank’s routing number (9 digits).

- The customer’s account number.

Customer Signature

- The signature of the customer (by hand or digitally via eSign);

- The date (mm/dd/yyyy) the customer signed the authorization form.

- The customer’s full printed name.

How to Use

Step 1 – Create Template

Once the customer opts to sign up for a membership or subscription with the merchant, they should be given the authorization form to complete. If the merchant will be using an authorization form for the same type of charge for multiple customers on a regular basis, they may choose to complete specific fields ahead of time so that they have a template they can keep reusing. Information such as the contact info of the merchant, the amount ($) of the charge, whether it is recurring or not, and the date of recurring payment (if applicable) can be filled in to make the template. Then, the merchant will only need to make a copy of the template for each future customer.

Step 2 – Customer Signs the Form

Once all other fields have been completed, the customer will need to input their payment method (credit card or bank info) followed by their signature. Their signature can be collected by uploading the authorization form to eSign or by printing the document and writing it by hand.

Step 3 – Charge Card / Withdraw from Bank

With the completed authorization in hand, the merchant can begin charging the customer’s credit card or withdrawing from their bank account. It is very important that the merchant charges the same amount ($) as was entered onto the form. If a charge is made in a greater or lesser amount than is specified on the document, the merchant will not be protected from the customer initiating a chargeback.

The form should be stored for at least three (3) months after the customer has been charged for the last time. For example, if the customer canceled their subscription, the merchant should keep their authorization form on file for at least ninety (90) days after their last payment.

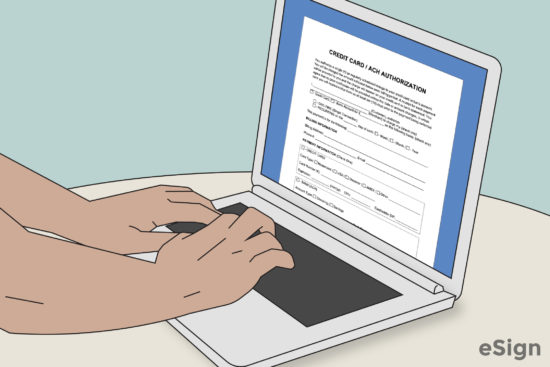

Sample

Download: PDF, Word (.docx), OpenDocument

How to Write

Download: PDF, Word (.docx), OpenDocument

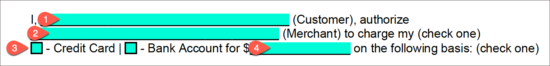

Step 1 – Customer + Merchant Info

At the top of the form, the following information will need to be provided:

- Enter the full name of the customer (the person authorizing the charge);

- Enter the name of the merchant (can be the name of a company or of a person);

- Check the box next to the payment method that will be used (CC or ACH); and

- Enter the amount ($) the customer will be charged (repeatedly or one-time).

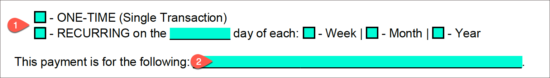

Step 2 – Transaction Type

Next, the frequency of billing will need to be selected.

- If the merchant will only be charging the customer one time, the first checkbox should be selected. If the merchant will be charging the customer’s card (or withdrawing from ACH) on a regular basis (such as monthly), the second checkbox should be selected.

- If the payment will be recurring, enter the day payment must be made and select either the week, month, or year checkbox to indicate the frequency of payment.

- Enter a brief description of the reason for the payment.

Step 3 – Billing Information

This section pertains to the customer’s billing information.

- Enter the full billing address of the customer (should match the CC billing address, if applicable).

- Enter the customer’s phone number (optional, but recommended).

- Enter the customer’s email address (also optional, but recommended).

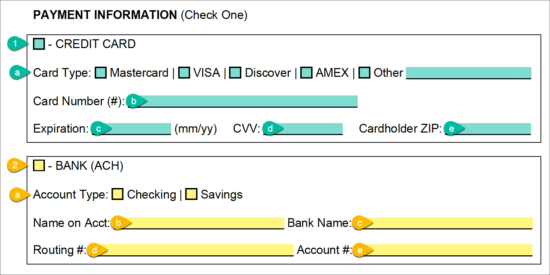

Step 4 – Payment Info

Select the appropriate checkbox to indicate the payment method the customer will be using.

1. If a credit card will be charged, select the “Credit Card” checkbox and provide the following information:

a) Card type (Mastercard, VISA, Discover, AMEX, or Other)

b) Card number (#)

c) Expiration date (mm/yy)

d) CVV (3-digit number on back of card)

e) Cardholder ZIP code

2. If a bank account will be charged directly, select the “Bank (ACH)” checkbox and provide the following information:

a) Account type (Checking or Savings)

b) Name on the account

c) Bank name

d) Routing number (#)

e) Account number (#)

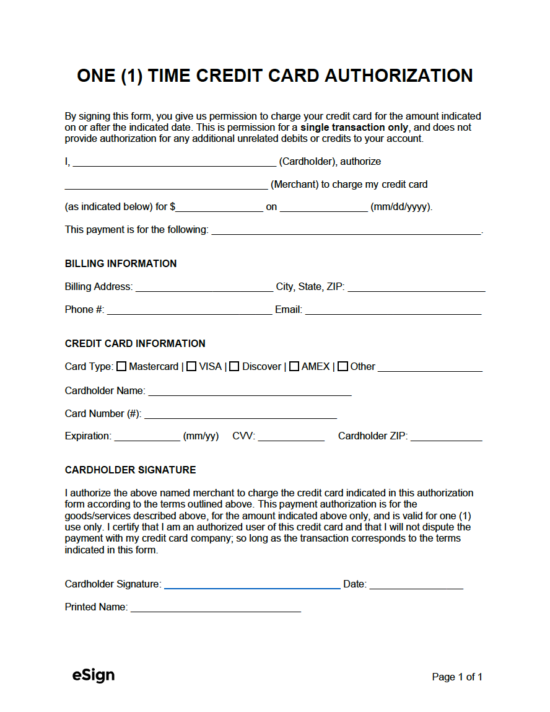

Step 5 – Customer Signature

Once the other fields have been completed, the customer will need to sign the form. This is a required step for making the form legally binding. The customer will need to provide the following information:

- Their signature (by hand or by using eSign);

- The date (mm/dd/yyyy) they inscribed their signature; and

- Their full printed name.