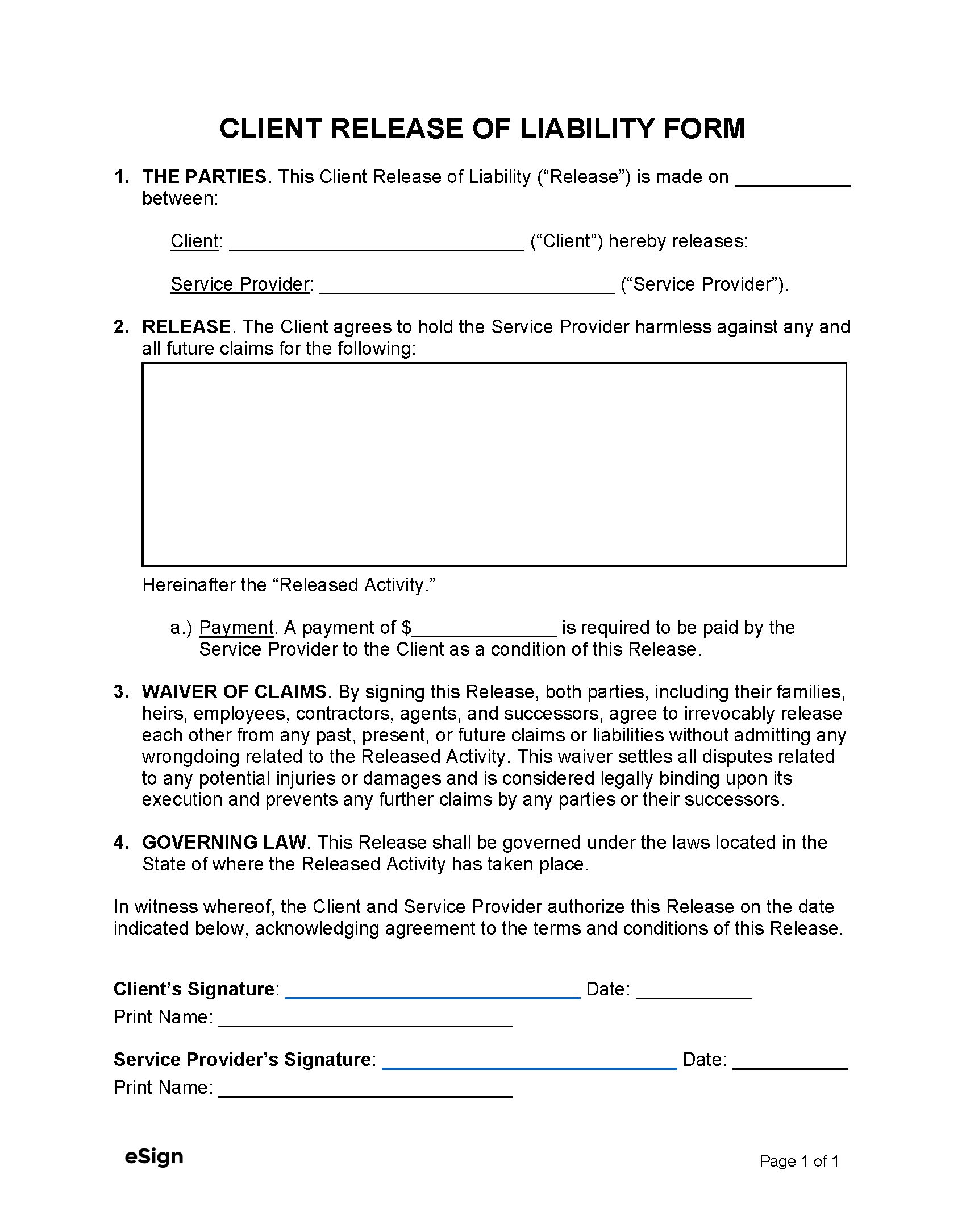

Key Considerations for a Release of Liability

Insurance Involvement

Before signing a release, the service provider might have to inform their insurance company about the incidents leading to the client’s damages. Failing to report these events could breach the terms and conditions of their insurance policy.

Extent of Damages

The service provider will have to compensate the client in exchange for being freed from liability. Therefore, assessing the scope of damages will be necessary to ensure the payment accurately covers the client’s losses. Damages are usually evaluated through these methods:

- Review Documents – Any documents related to the client’s damages should be reviewed, including receipts, invoices, medical bills, and any other paperwork showing loss or negative impact.

- Look at Similar Cases – Understanding how damages were assessed in similar cases can set a standard for what might be deemed fair.

- Independent Evaluation – An independent assessment by an expert provides an objective perspective on the damages, which can be persuasive in justifying the suggested compensation.

It’s Final and Legally Binding

A release of liability form is a final, legally binding contract between both parties. Should the service provider later discover the client’s damages are less severe than first believed, they cannot reduce the payment or pursue legal action.