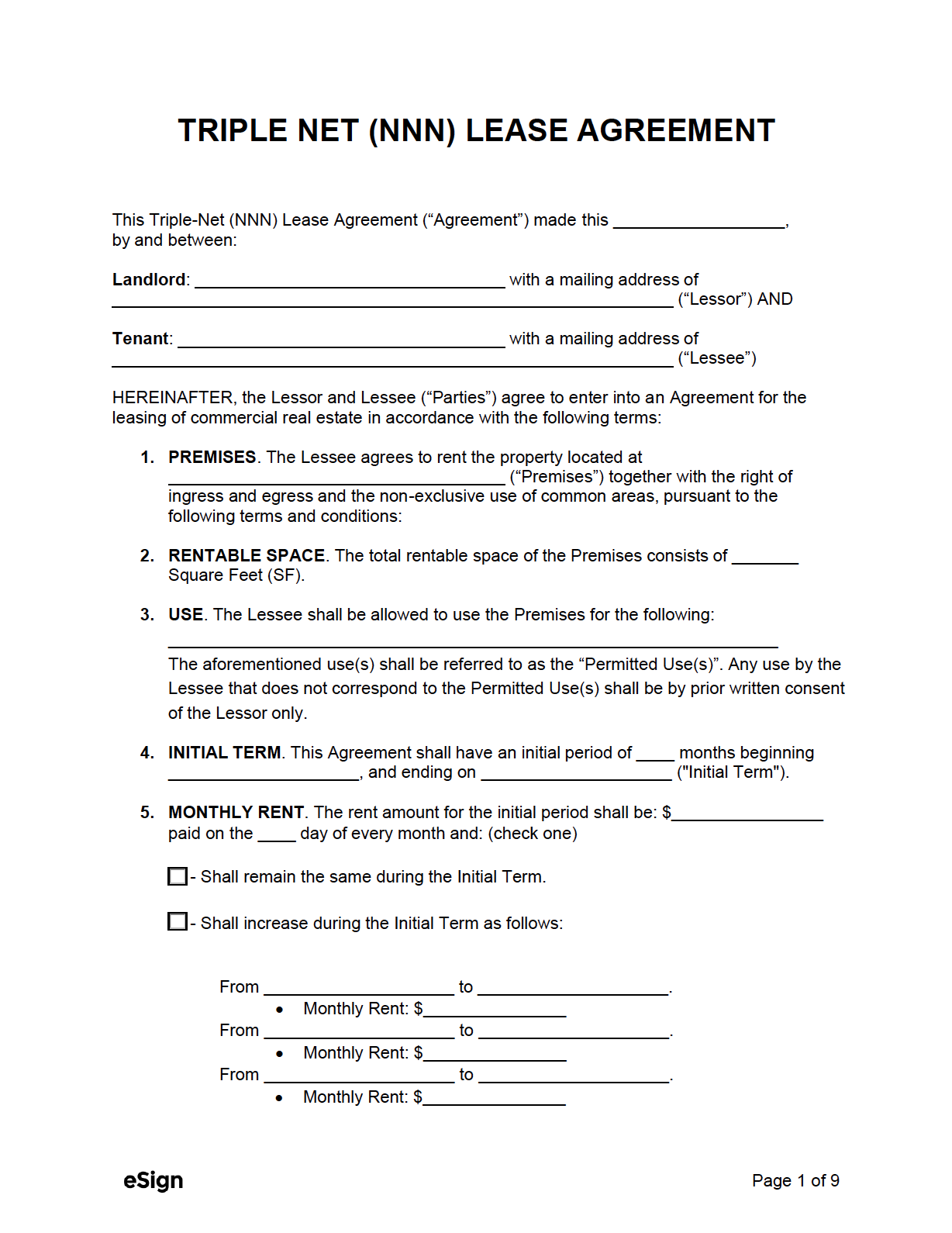

Triple Net (NNN) Defined – Triple net refers to the three expense categories the tenant is responsible for:

- N – Property taxes

- N – Insurance

- N – Maintenance & repairs

Who Pays What?

Under a triple net lease (NNN), the landlord is only responsible for making monthly mortgage payments while the tenant will be required to cover the following expenses:

- Base rent

- Property and business taxes

- Utilities

- Maintenance and repairs

- Insurance

Benefits of a Triple Net Lease

Landlord Benefits

- Removes uncertainty – Because the landlord doesn’t need to pay variable costs such as utilities and HVAC, they can expect to earn a consistent income from the property.

- Easier to manage – With all of the costs and maintenance on the tenant, the rental property is virtually duty free.

- Typically long-term – The average NNN lease extends for 10 to 20 years.

- Lower risk – An unexpected, costly repair to the property won’t interfere with the landlord’s earnings.

Tenant Benefits

- Lower rent – The rent for the property will be significantly lower than if the lease was gross or modified gross. Even with the expenses included, tenants will often pay less per month due to the benefits provided to the landlord.

- Tax opportunities – The additional costs incurred by the tenant can be deducted from their business’ operating expenses, making swings in utilities and other costs less impactful.