Laws

- Maximum Estate Value: $100,000[1]

- Mandatory Waiting Period: 45 days[2]

- Where to File: Circuit Court[3]

How to File (4 Steps)

Step 1 – Verify Filing Requirements

All of the following conditions must apply in order to qualify for the small estate process:

- No petition for the appointment of a personal representative has been filed or granted

- At least 45 days have passed since the decedent’s death

- The estate’s value is $100,000 or less, excluding the homestead and statutory allowances for a spouse or minor children

- No unpaid claims or demands exist against the decedent or the estate

- The Department of Human Services did not provide benefits to the decedent, or, if it did, the decedent repaid them

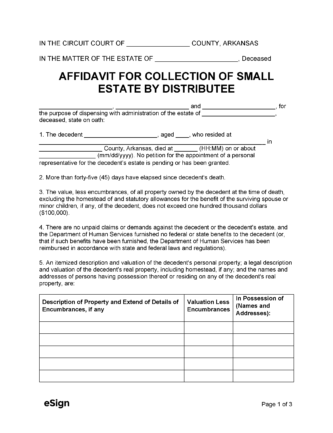

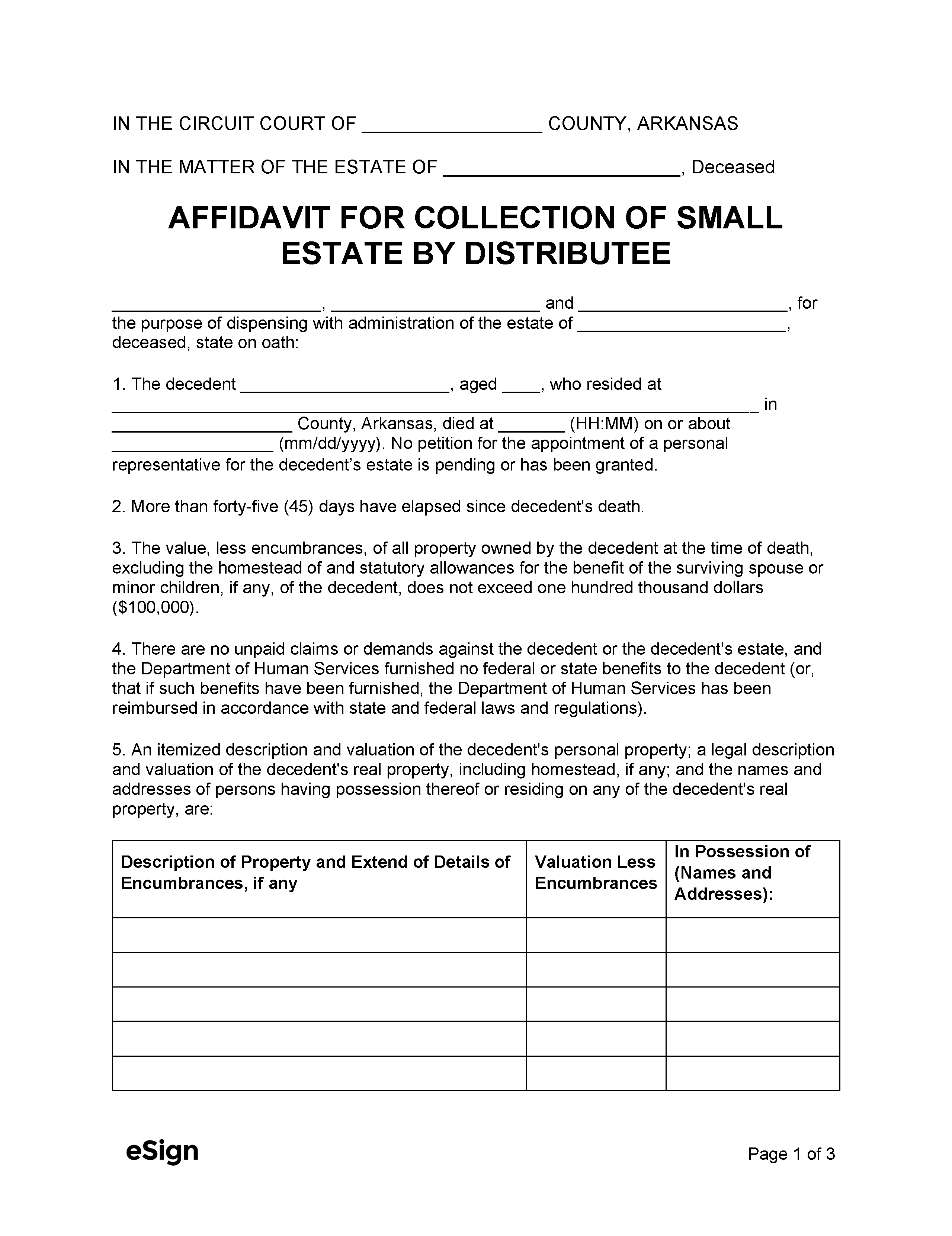

Step 2 – Complete and File Affidavit

An heir or beneficiary (“distributee”) must file an Affidavit for Collection of Small Estate by Distributee (Form 23) with the circuit court in the county where the decedent last resided. The probate clerk charges a $25 filing fee, plus $5 for each certified copy of the affidavit.[4]

If the decedent owned real estate, all other heirs may sign a Disclaimer relinquishing their interest in the property to the distributee. The Disclaimer (found on page 11 of this filing packet) must be filed together with the affidavit.

Step 3 – Publish Notice (if applicable)

If the estate includes real property, the distributee must publish a Notice of Publication (page 14 of the filing packet) within 30 days of filing the Affidavit. The notice must:

- Be published in a local newspaper once a week for two consecutive weeks, and

- Be mailed to all other heirs and any known creditors of the decedent.

After publication, the newspaper will issue proof of publication, which must be filed with the probate clerk.

Important: The distributee must wait three months from the date of the first publication before transferring any real property.[6]

Step 4 – Collect Assets

The distributee may collect estate assets by presenting a certified copy of the Affidavit to any person or business holding the decedent’s property.

If collecting real property, the distributee must complete a Deed of Distribution (page 16 of the filing packet) and provide notice of the transfer to the county assessor in the county where the property is located.