Laws

- Statute: § 28-41-101

- Maximum estate value (§ 28-41-101(a)(1)(C)): $100,000, excluding the decedent’s homestead (real property lived in by decedent and dependents) and any statutory allowances for the decedent’s dependents (spouse, minor children, etc.).

- Mandatory waiting period (§ 28-41-101(a)(1)(B)): Forty-five (45) days

- Where to file (§ 28-41-101(a)(1)(D)): With the circuit court clerk in the decedent’s county of residence at the time of their death.

How to File (4 Steps)

- Step 1 – Requirements

- Step 2 – Complete and File Affidavit

- Step 3 – Publish Notice (If Applicable)

- Step 4 – Distribute Assets

Step 1 – Requirements

In order to use a small estate affidavit, the distributees must first ensure the decedent’s estate meets the following requirements:

- A petition for the appointment of a personal representative has not been granted and is not currently pending.

- Forty-five (45) days have passed since the decedent died.

- The value of the estate is equal to or less than $100,000 (excluding the homestead and any allowances for a spouse or minor children).

- There are no unpaid claims or demands against the estate or the decedent.

- The Department of Human Services did not furnish any benefits to the decedent, or, if they did, the decedent reimbursed the department.

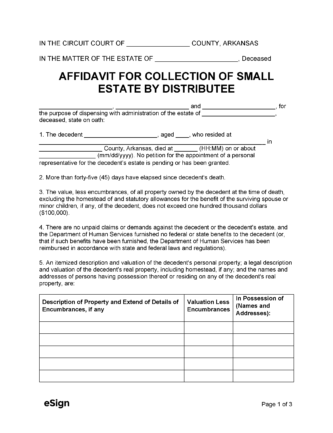

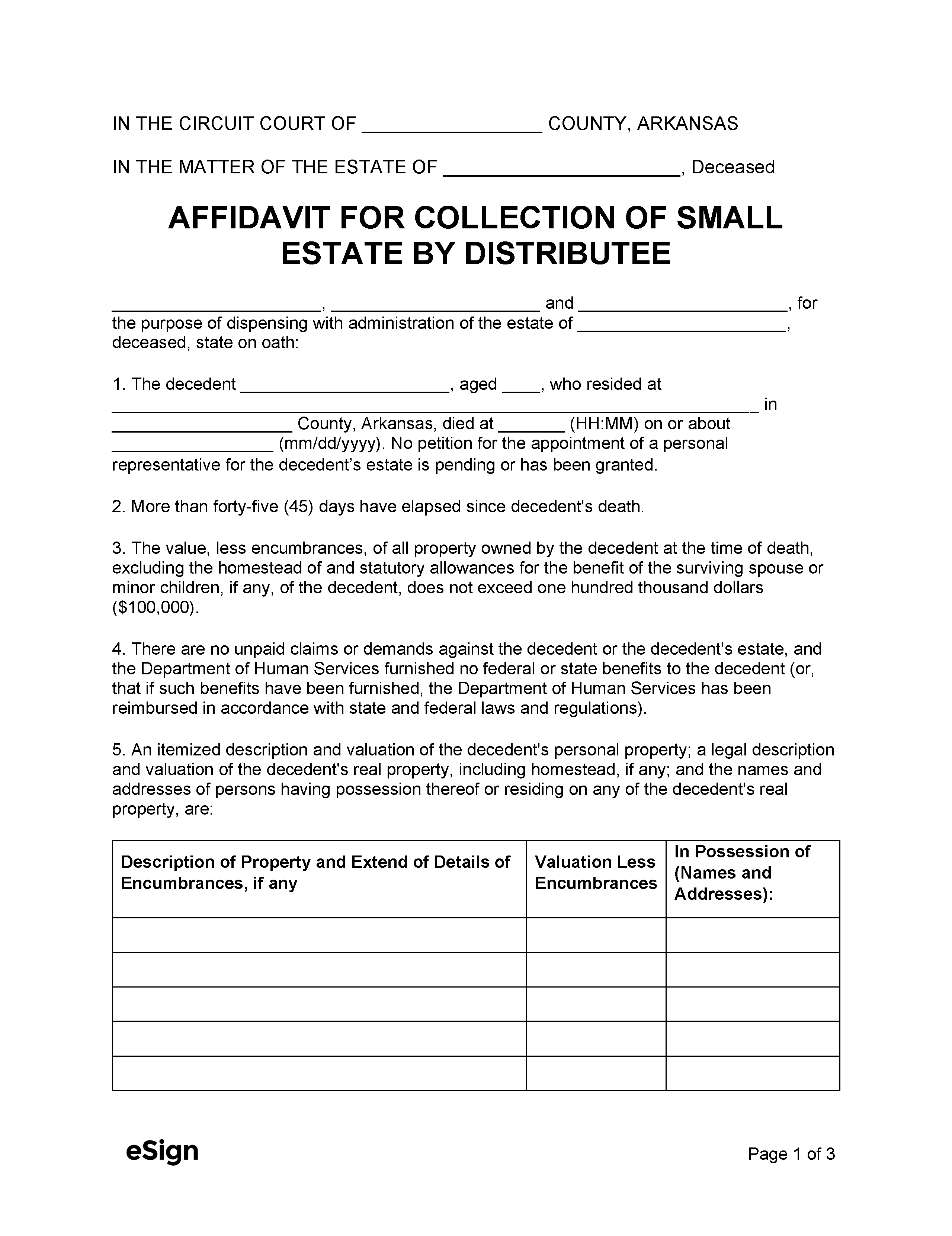

Step 2 – Complete and File Affidavit

One (1) or more distributees must fill out the Affidavit for Collection of Small Estate by Distributee (Form 23) and file it with the circuit court in the county where the decedent resided. The probate clerk will charge a $25 filing fee plus $5 for any additional copies requested by the distributees (a number of which will be required to notify certain parties in Step 4). The clerk will file the document, assign it a number, and record it in the court filing system.

Step 3 – Publish Notice (If Applicable)

Since a small estate affidavit will bypass probate court, the distributees are required to notify the public within thirty (30) days of filing the affidavit to allow claims to be made against the decedent’s real property. (This requirement does not apply if the decedent did not own any real property.) To fulfill this obligation, the distributees must publish in a local newspaper (once a week for two consecutive weeks) a notice stating that the decedent died and a small estate affidavit has been filed. Anyone who believes they have a claim against any property must come forth within three (3) months of the first date of publication or they will be ineligible to stake a claim.

Step 4 – Distribute Assets

The distributees must deliver a certified copy of the affidavit to any individual or business owing any money to the decedent, having custody of any property, or acting as registrar or transfer agent of an interest, indebtedness, property, or right. Once the judge approves the affidavit, and no unwanted claims have been filed, the distributees can collect and distribute the assets of the estate as per the decedent’s will or in accordance with intestate succession laws.