Laws

- Maximum Estate Value: $50,000[1]

- Mandatory Waiting Period: 40 days

- Where to File: No filing required.

How to Use (3 Steps)

Step 1 – Requirements and Waiting Period

To be eligible for a small estate affidavit, the decedent’s estate must be valued at $50,000 or less and contain no real property. Additionally, all debts must be paid or provided for in the affidavit, and no estate administration may be pending.[2]

If an estate meets those requirements, the successor will need to wait 40 days from the date of death before they can execute and use an affidavit.

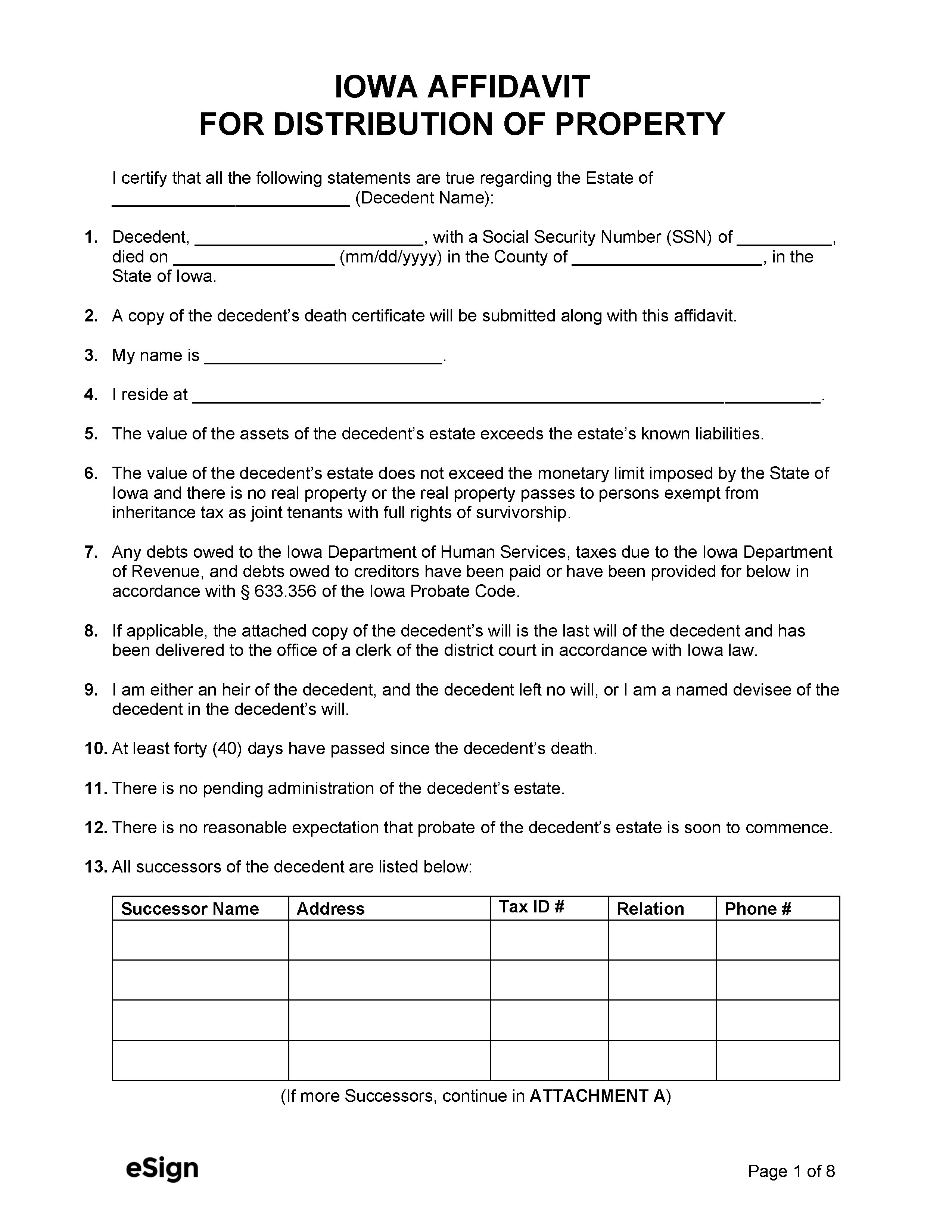

Step 2 – Small Estate Affidavit

Once the mandatory waiting period has passed, the successor must fill out the Affidavit for Distribution of Property and have it notarized.

The notary may require a certified copy of the decedent’s death certificate. Death certificates can be requested from Vital Records by mail, telephone, online, or in person.

Step 3 – Obtaining Assets

Once the Affidavit has been notarized, the successor will be able to use it to collect assets, including physical property, records, funds, and bank accounts. The asset holder may require evidence of the decedent’s ownership before surrendering property to them.[3]

If any party refuses to transfer the decedent’s property, legal action may be brought against them, and they may be required to pay the successor’s attorney fees.[4]