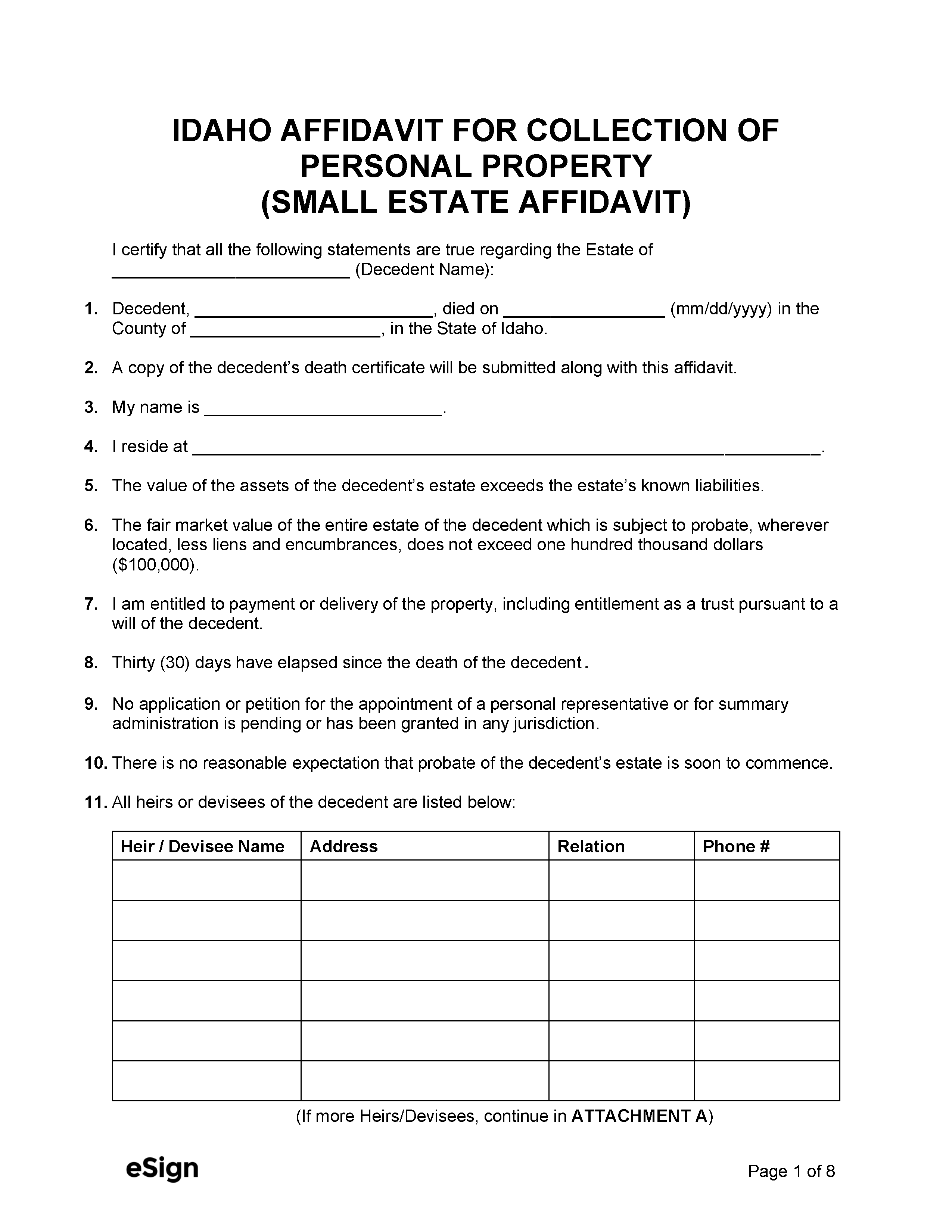

How to Use (3 Steps)

Step 1 – Qualifications

Before preparing an affidavit, the affiant must ensure that their situation meets the following requirements:

- 30 days have passed since the decedent’s date of death

- The estate’s total value does not exceed $100,000 (after liens and debts have been deducted)

- There is no pending or approved application for the appointment of a personal representative or for summary administration

- The estate does not include real estate

- The affiant is an Idaho resident and entitled to collect the decedent’s property

Step 2 – Complete and Notarize Affidavit

The affiant must complete the Affidavit for Collection of Personal Property and present it to a notary public for notarization. The notary will require the affiant to present proof of identification and a copy of the decedent’s death certificate.

Death certificates can be ordered from the Idaho Department of Health and Welfare.

Step 3 – Collect Decedent’s Property

Once notarized, the Affidavit may be used to collect the decedent’s property and funds. If the estate includes motor vehicles, the affiant will need to complete the Idaho Transportation Division’s Small Estate Affidavit and present it at a DMV office to transfer ownership.