Laws

- Statute: § 3B:10-3 & § 3B:10-4

- Maximum estate value (§ 3B:10-3 & § 3B:10-4): $50,000 for surviving spouses or domestic partners; $20,000 for all other heirs.

- Mandatory waiting period: Not mentioned in state statutes.

- Where to file: County Surrogate Court or Superior Court

How to File (3 Steps)

Step 1 – Check Affidavit Requirements

An Affidavit of Assets and Administration can only be used if:

- The decedent died intestate.

- The decedent’s total estate value is $50,000 or less if the decedent has a surviving spouse or domestic partner.

- The decedent’s total estate value is $20,000 or less if the affiant (person completing the form) is not the decedent’s spouse or partner.

- If the affiant is not the decedent’s spouse or domestic partner, they have received the written consent of any other remaining heirs.

The written consent from the remaining heirs must be recorded in the office of the Surrogate Court or the Superior Court clerk’s office, along with the affidavit in the following step.

Step 2 – Record Affidavit

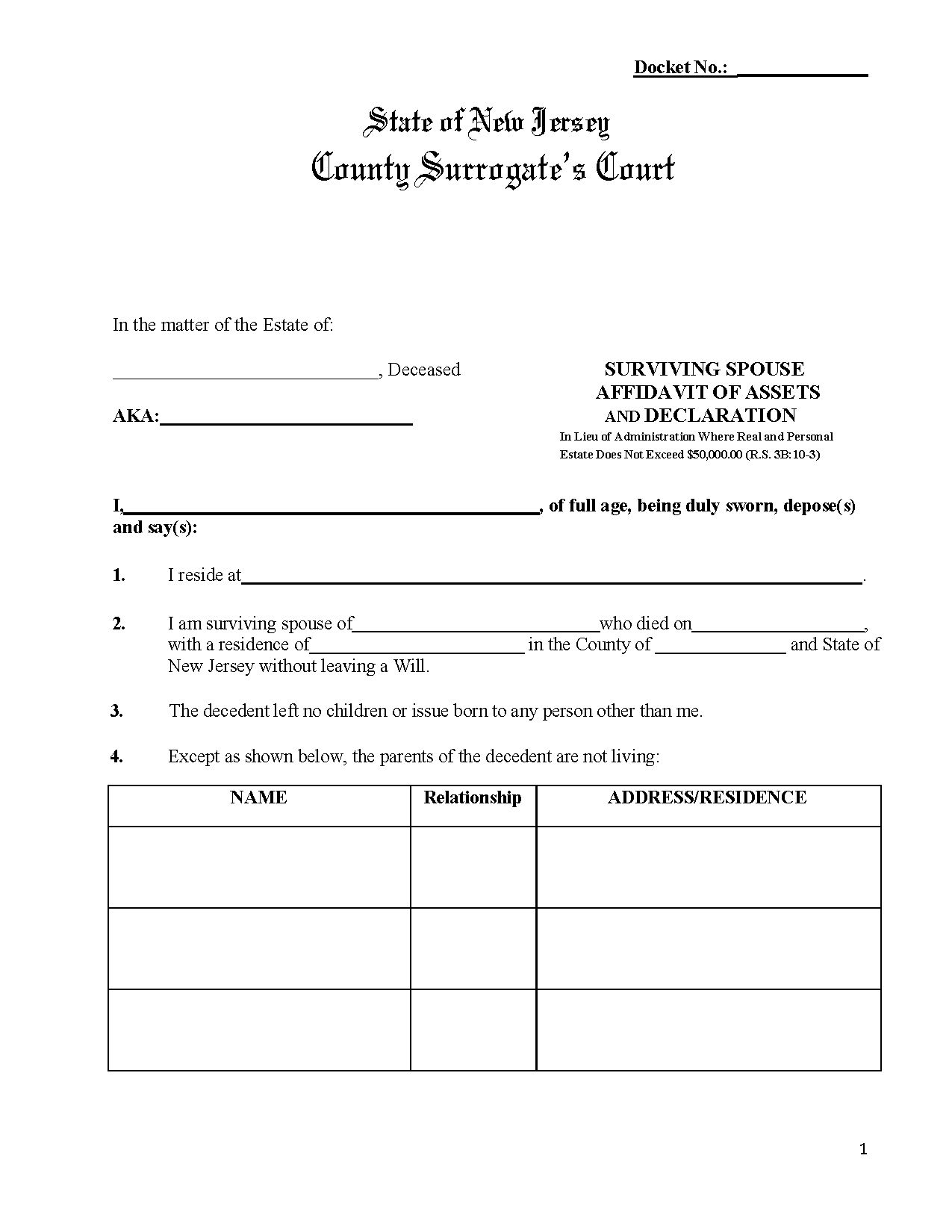

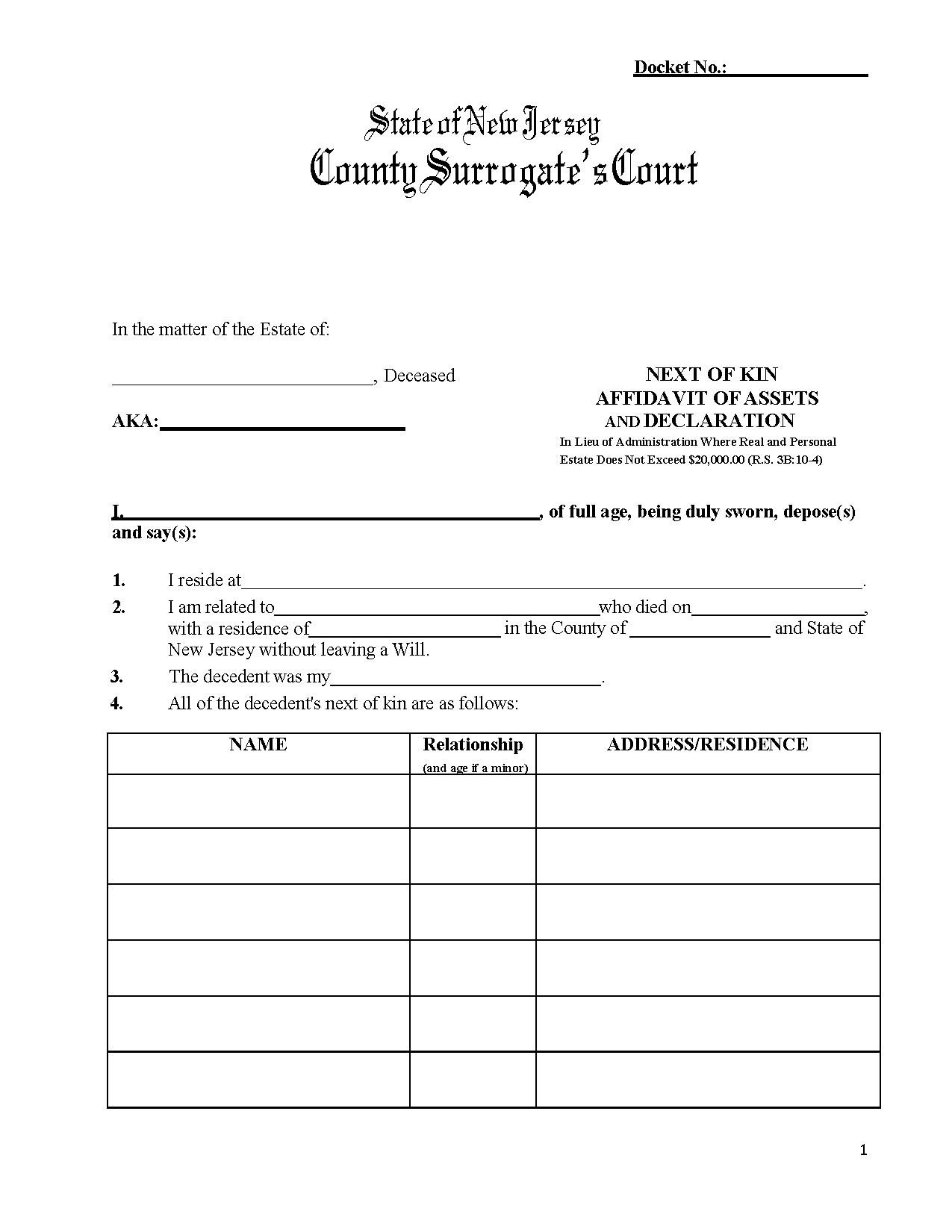

The surviving spouse or partner must complete the Surviving Spouse Affidavit of Assets and Declaration and list the decedent’s assets with their values. If the affiant is not the decedent’s spouse or partner, the Next of Kin Affidavit of Assets and Declaration should be completed. Assets can include bank accounts, stocks, vehicles, real estate, etc.

The form should be filed in the office of the Surrogate Court of the county where the decedent resided at the time of death. If the decedent was not a resident of the state in which they passed away, the affidavit may be filed in the office of the Surrogate Court of the county in which any of their assets are located or in the Superior Court Clerk’s office.

If the affiant is out of the state, they may record the affidavit in the presence of any officers listed in § 46:14-6.1 (if authorized by the Surrogate Court).

Step 3 – Distribute Estate

Once the affidavit is approved, the affiant may inherit the decedent’s estate without any administration process or bond. If the affiant is a surviving spouse or domestic partner, they are entitled to $10,000 of the estate before any debts are settled with creditors. The estate can be distributed to the remaining heirs, if any.

Related Forms

Download: PDF