Sample

Download: PDF, Word (.docx), OpenDocument

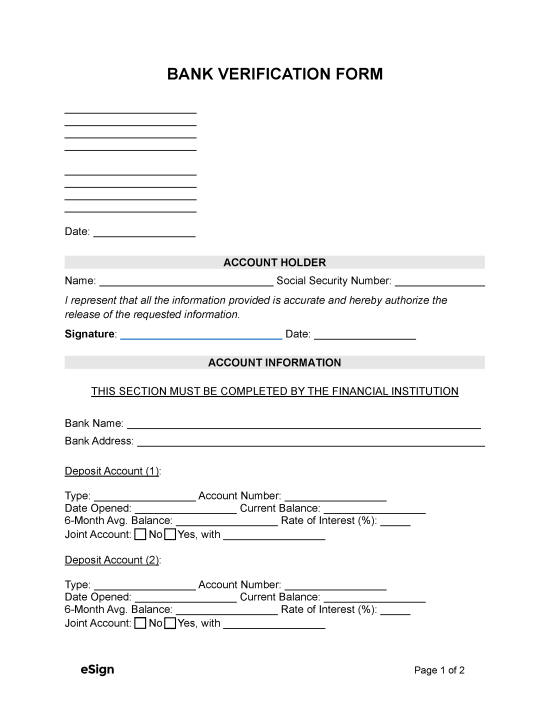

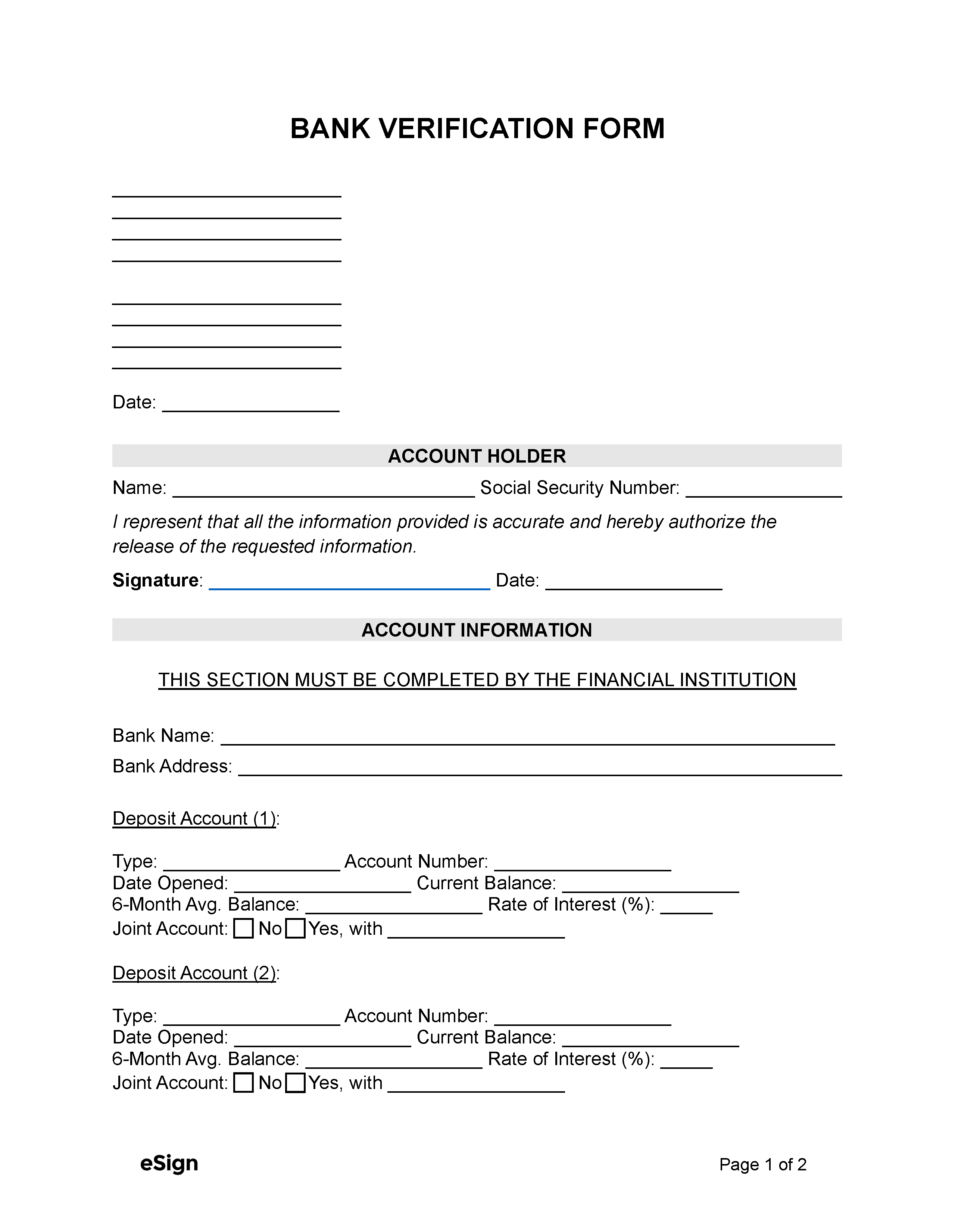

BANK VERIFICATION FORM

[RECIPIENT NAME]

[RECIPIENT STREET ADDRESS]

[RECIPIENT CITY, STATE, ZIP]

[RECIPIENT PHONE]

[SENDER NAME]

[SENDER STREET ADDRESS]

[SENDER CITY, STATE, ZIP]

[SENDER PHONE]

Date: [MM/DD/YYYY]

Account Holder Name: [NAME]

Social Security Number: [SSN]

I represent that all the information provided is accurate and hereby authorize the release of the requested information.

Signature ________________________ Date: [MM/DD/YYYY]

THIS SECTION MUST BE COMPLETED BY THE FINANCIAL INSTITUTION

Bank Name: [NAME] Bank Address: [ADDRESS]

Phone Number: [PHONE #] Email: [EMAIL ADDRESS]

Deposit Account:

Type: [ACCOUNT TYPE] Account Number: [ACCOUNT NUMBER]

Date Opened: [MM/DD/YYYY] Current Balance: [BALANCE ($)]

6-Month Avg. Balance: [AVG. BALANCE ($)] Rate of Interest: [%]

Joint Account: ☐ No ☐ Yes, with [NAME]

Asset Account:

Type: [ACCOUNT TYPE] Account Number: [ACCOUNT NUMBER]

Date Opened: [MM/DD/YYYY] Current Balance: [BALANCE ($)]

6-Month Avg. Balance: [AVG. BALANCE ($)] Rate of Interest: [%]

Cash Value: [VALUE ($)] Joint Account: ☐ No ☐ Yes, with [NAME]

Line of Credit:

Type: [ACCOUNT TYPE] Account Number: [ACCOUNT NUMBER]

Date Opened: [MM/DD/YYYY] Approved Amount: [LIMIT ($)]

Current Balance: [BALANCE ($)] Rate of Interest: [%]

Secured: ☐ No ☐ Yes, by [COLLATERAL]

Additional Information: [ADDITIONAL COMMENTS]

Signature ________________________ Date: [MM/DD/YYYY]

Representative Name: [NAME] Representative Title: [TITLE]

Phone Number: [PHONE #] Email: [EMAIL ADDRESS]

Common Uses

Direct Deposits: Bank verification may be required by employers or government agencies (including the IRS) to establish direct deposits for income, benefits, social security, tax refunds, and other payment plans.

International Money Transfers: Verification may be requested by financial entities or money transfer services when overseeing the accuracy of international wire transfers.

Loans and Mortgages: Loan entities often need to verify a potential borrower’s finances before entering into a loan agreement.

Payment Authorization: A company, service provider, or vendor may need to verify a customer’s banking information before processing a payment charge or setting up recurring billing. This verification process also applies to the authorization process for automated clearing house (ACH) payments.

Rental Agreements: Before accepting a potential tenant, property managers and landlords may have them complete a bank verification form to confirm their ability to pay rent.

Verification Process

Step 1 – Account Holder Information

When a requesting party sends a bank verification form to the account holder, the account holder must complete the appropriate section of the document and sign it before sending it to their bank. By signing the verification form, the account holder agrees to release sensitive banking information to the requesting party.

Step 2 – Bank Account Details

Upon receiving the form, the account holder’s bank will enter all applicable bank account details:

- Bank name and contact information

- Types of accounts

- Account numbers

- Activation dates

- Current and average 6-month balance

- Joint account information

- Interest rate (if applicable)

- Cash value (if applicable)

- Security type (if applicable)

The bank representative must sign their name and enter the date, their printed name, and title.

Step 3 – Delivery

The financial institution may send it back to the account holder who will then deliver it to the requesting party, or they may send it straight to the requesting party. The requesting party is bound to maintain the confidentiality of the information and only use it for their stated purpose.