State Insurance Requirements

Drivers in nearly every state must have an auto insurance policy that meets the minimum coverage requirements for operating a vehicle. The only states that don’t require traditional auto insurance are:

- New Hampshire – Insurance isn’t required in New Hampshire, but drivers must be able to prove they have enough money to cover an at-fault accident.

- Virginia – Drivers in Virginia don’t need insurance if they pay an “Uninsured Motor Vehicle Fee” to the DMV.

Sample

Download: PDF, Word (.docx), OpenDocument

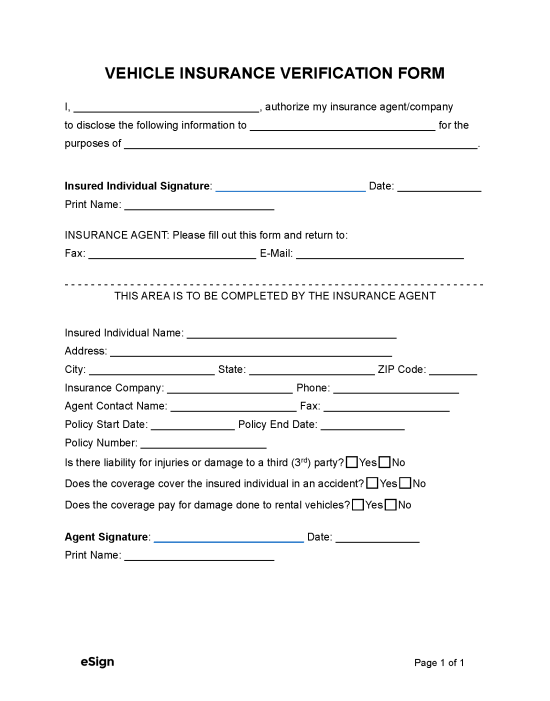

VEHICLE INSURANCE VERIFICATION FORM

I, [NAME OF INSURED PERSON], authorize my insurance agent/company to disclose the following information to [NAME OF THIRD PARTY] for the purposes of [REASON FOR VERIFICATION].

Insured Individual Signature: _________________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME OF INSURED PERSON]

INSURANCE AGENT: Please fill out this form and return to:

Fax: [THIRD PARTY FAX] E-Mail: [THIRD PARTY E-MAIL]

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

THIS AREA IS TO BE COMPLETED BY THE INSURANCE AGENT

Insured Individual Name: ___________________________________

Address: _______________________________________________

City: _____________________ State: _____________________ ZIP Code: ________

Insurance Company: _____________________ Phone: _____________________

Agent Contact Name: _____________________ Fax: _____________________

Policy Start Date: ______________ Policy End Date: ______________

Policy Number: _____________________

Is there liability for injuries or damage to a third (3rd) party? ☐ Yes ☐ No

Does the coverage cover the insured individual in an accident? ☐ Yes ☐ No

Does the coverage pay for damage done to rental vehicles? ☐ Yes ☐ No

Agent Signature: _________________________ Date: ______________

Print Name: _________________________

How to Use the Verification Form

The party requesting proof of insurance must fax or e-mail the verification form to the driver’s insurance provider. Once received, an insurance agent will input the following information in the document:

- Driver’s name and address

- Insurance provider’s name and contact details

- Effective dates of coverage

- Insurance policy number

- The extent of coverage (e.g., whether the policy covers damage to third parties)

After filling out the verification form, the insurance agent will return it to the requesting party to review and verify the driver’s vehicle coverage.

When to Verify Auto Insurance

The following are some everyday situations where a driver’s auto insurance may need to be verified:

- Auto Leasing and Financing – Before leasing or financing a vehicle, lenders typically require insurance verification to ensure drivers are covered in case of an accident or theft.

- Purchasing a Vehicle – Car dealerships will confirm a buyer’s coverage before allowing a vehicle to be driven off the lot.

- Commercial Drivers – Businesses that use vehicles for their operations often demand auto insurance verification for their drivers. This requirement applies to delivery services, taxi companies, and similar businesses.

- Ride-Sharing Companies – Ride-sharing companies like Uber and Lyft will verify a driver’s insurance to confirm compliance with local regulations and company policies.

- Proof in Court – If someone’s license is suspended due to driving without insurance, a court may require proof of insurance as part of the reinstatement process.

- Borrowing a Vehicle – Verifying insurance coverage is helpful before borrowing another person’s vehicle. If the vehicle isn’t insured, the person borrowing it might face fines for driving without proper coverage.