State Laws

Probate in Arkansas

Petition for Probate of Will

In Arkansas, wills must be submitted to the probate court and granted administration within five years of the decedent’s death.[4]

To begin the probate process, the forms and documentation listed below must be completed and filed with the county court where the decedent resided:[5]

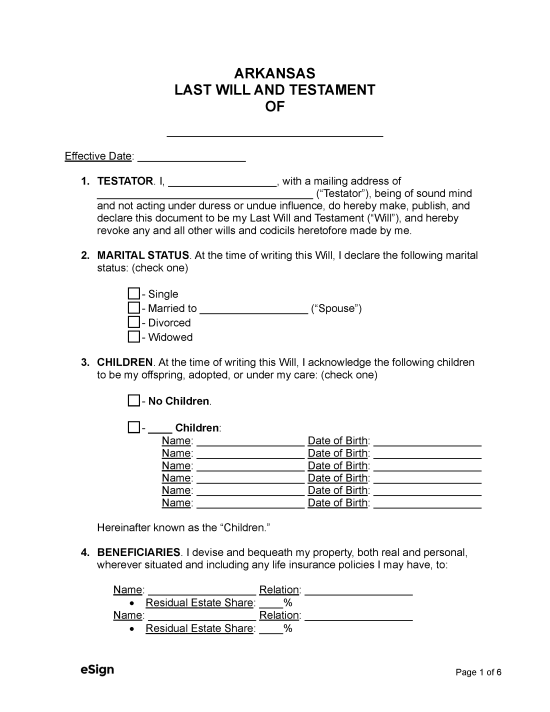

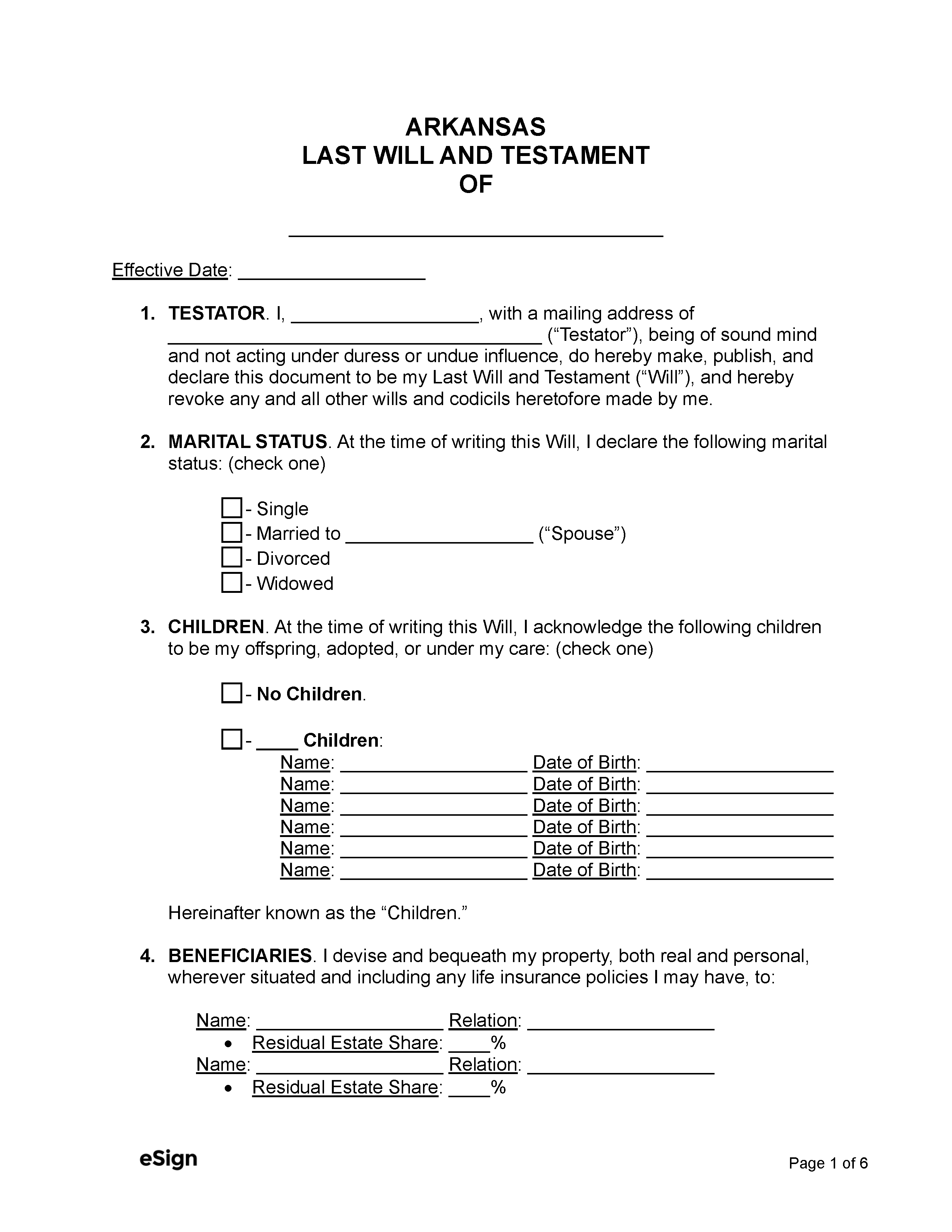

- Decedent’s Last Will and Testament

- Certified copy of the decedent’s death certificate

- Petition for Probate of Will and Appointment of Personal Representative

- Demand for Notice of Proceedings for Probate of Will or Appointment of Personal Representative

- Petition for Appointment of Administrator

- Proof of Will

Through the filing of these forms, a personal representative (called the executor) will be appointed for the estate. If no executor is named in the will, the court will appoint an administrator as personal representative.

In most cases, the executor or administrator will be able to settle any claims and distribute the estate without the need for a court hearing.[6]

Small Estates

If the decedent’s estate has a value of $100,000 or less, the probate process can be entirely avoided with the filing of an Affidavit for Collection of Small Estate by Distributee at least 45 days after the decedent’s death.[7]