Gift Tax

While Texas does not impose a gift tax, donors are generally required to report the transfer to the IRS if the property’s value exceeds the annual gift limit ($19,000 as of 2025).[1]

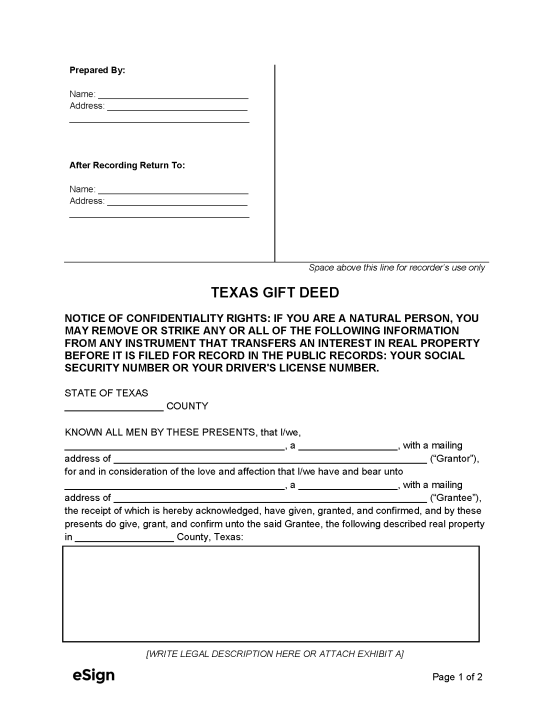

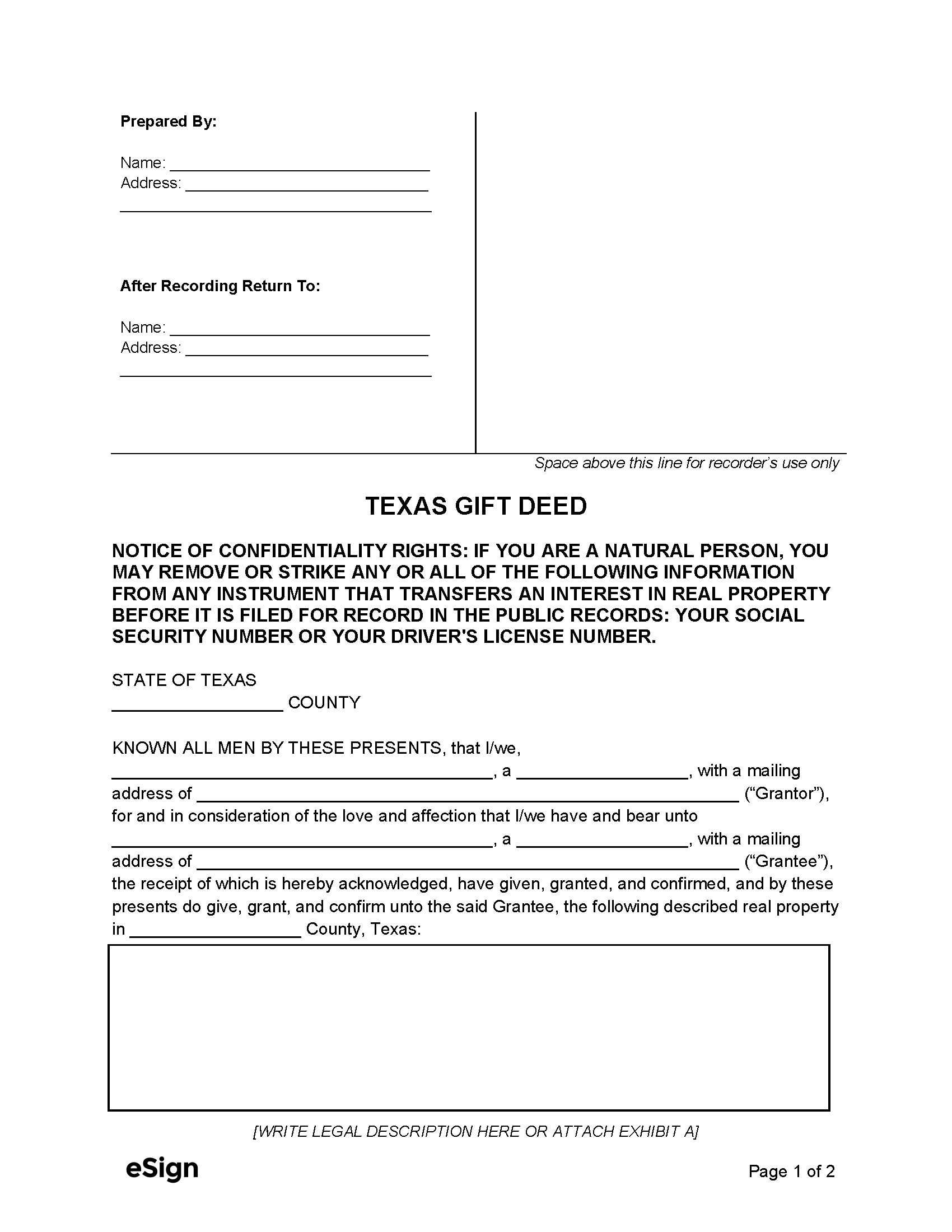

Texas Deed Requirements

Signing – In Texas, a gift deed must be signed by the person donating their property (called the “grantor”) and either notarized or signed by two witnesses.[2]

Formatting – Deeds must be printed in at least 8-point font on paper no larger than 8.5 inches wide by 14 inches long.[3] Additional county-specific formatting requirements may apply.

Recording – The completed deed must be recorded at the County Clerk’s Office in the county where the gifted property is located.[4]

Fees – At the time of this writing, the recording fees are $5 for the first page and $4 for each additional page.[5] The county clerk may charge an extra $10 record management fee and a $10 archive fee.[6]