Final Pay Laws

The deadline for when an employee is entitled to receive their final paycheck varies by state. For instance, in South Carolina, employers may withhold an employee’s final pay until all company equipment has been returned to them.[1]

In some cases, penalties are applied if an employer fails to deliver payment by the due date, such as in Arkansas where employers must pay double the wages owed if they’re late with the final paycheck.[2]

Final Paycheck Deadlines (By State)

The table below lists when an employee’s final pay is due, depending on whether they were fired or resigned voluntarily. Local and industry-specific rules may also apply.

View Requirements |

|||

| State | Employee Fired | Employee Resigns | Statute |

| AL | N/A | N/A | N/A |

| AK | 3 workdays. | Next payday (at least 3 days after termination). | §23.05.140(b) |

| AZ | 7 business days or next payday (whichever is sooner). | Next payday. | §23-353(a)-(b) |

| AR | Next payday. | N/A | §11-4-405(a) |

| CA | Immediately. | 72 hours (immediately if given 72 hours’ notice). | §§ 201(a), 202(a) |

| CO | Immediately. | Next payday. | §8-4-109(1)(a)-(b) |

| CT | Next business day. | Next payday. | §31-71c(a)-(b) |

| DE | 3 business days or next payday (whichever is later). | 3 business days or next payday (whichever is later). | §1103(a)(1) |

| FL | N/A | N/A | N/A |

| GA | N/A | N/A | N/A |

| HI | Immediately (or next workday if necessary). | Next payday. | §388-3(a)-(b) |

| ID | 10 workdays or next payday (whichever is sooner), or 48 hours if requested. | 10 workdays or next payday (whichever is sooner), or 48 hours if requested. | §45-606(1) |

| IL | Immediately (or next payday if necessary). | Immediately (or next payday if necessary). | §115/5 |

| IN | Next payday. | Next payday. | §22-2-9-2(a) |

| IA | Next payday. | Next payday. | §91A.4 |

| KS | Next payday. | Next payday. | §44-315(a) |

| KY | 14 days or next payday (whichever is later). | 14 days or next payday (whichever is later). | §337.055 |

| LA | 15 days or next payday (whichever is sooner). | 15 days or next payday (whichever is sooner). | § 23:631(A)(1)(a)-(b) |

| ME | N/A | Next payday. | 26 M.R.S.A. § 626 |

| MD | Next payday. | Next payday. | §3-505(a) |

| MA | Immediately. | Next payday. | M.G.L. c. 149, § 148 |

| MI | Immediately. | Immediately. | §408.475(1)-(2) |

| MN | Immediately. | Next payday (or 20 days if next payday is within 5 days). | §§181.13(a), 181.14(a) |

| MS | N/A | N/A | N/A |

| MO | Immediately. | N/A | §290.110 |

| MT | Immediately. | 15 days or next payday (whichever is sooner). | §39-3-205(1)-(2) |

| NE | 2 weeks or next payday (whichever is sooner). | 2 weeks or next payday (whichever is sooner). | §48-1230(4)(a) |

| NV | Immediately. | 7 days or next payday (whichever is sooner). | §§608.020(1), 608.030 |

| NH | 72 hours. | Next payday (72 hours if given one pay period’s notice). | §275:44(I)-(II) |

| NJ | Next payday. | Next payday. | §34:11-4.3 |

| NM | Immediately (no later than 5 days). | Next payday. | §§50-4-4(A), 50-4-5 |

| NY | Next payday. | Next payday. | N.Y. Lab. Law §191(3) |

| NC | Next payday. | Next payday. | §95-25.7 |

| ND | Next payday. | Next payday. | §34-14-03 |

| OH | N/A | N/A | N/A |

| OK | Next payday. | Next payday. | §165.3(A) |

| OR | Next workday. | 5 days or next payday, whichever is sooner (immediately if given 48 hours’ notice). | §652.140 |

| PA | Next payday. | Next payday. | §260.5(a) |

| RI | Next payday. | Next payday. | §28-14-4(a) |

| SC | 48 hours or next payday (no later than 30 days). | N/A | §41-10-50 |

| SD | Next payday. | Next payday. | §§60-11-10, 60-11-11 |

| TN | 21 days or next payday (whichever is later). | 21 days or next payday (whichever is later). | §50-2-103(g) |

| TX | 6 days. | Next payday. | §61.014 |

| UT | Immediately (no later than 24 hours). | Next payday. | §34-28-5(1)-(2) |

| VT | 72 hours. | Next payday. | §342(b) |

| VA | Next payday. | Next payday. | §40.1-29(A) |

| WA | At the end of the pay period. | At the end of the pay period. | §49.48.010(2) |

| WV | Next payday. | Next payday. | §21-5-4(b) |

| WI | Next payday (no later than 31 days). | Next payday (no later than 31 days). | §109.03(1)-(2) |

| WY | Next payday. | Next payday. | §27-4-104(a) |

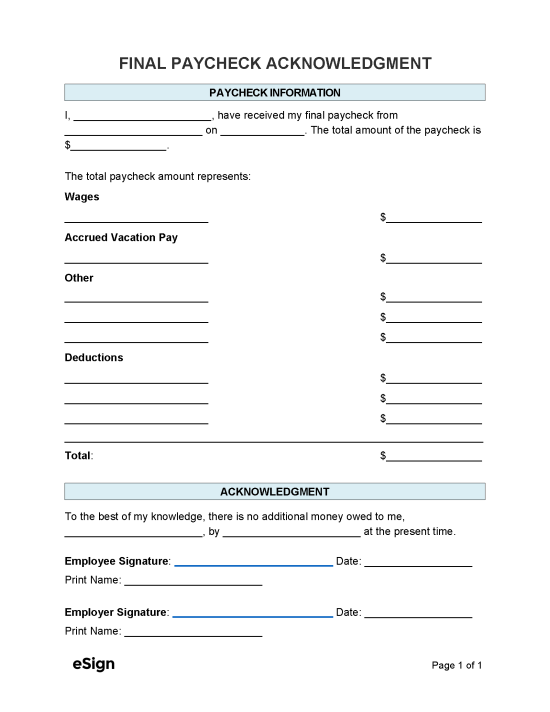

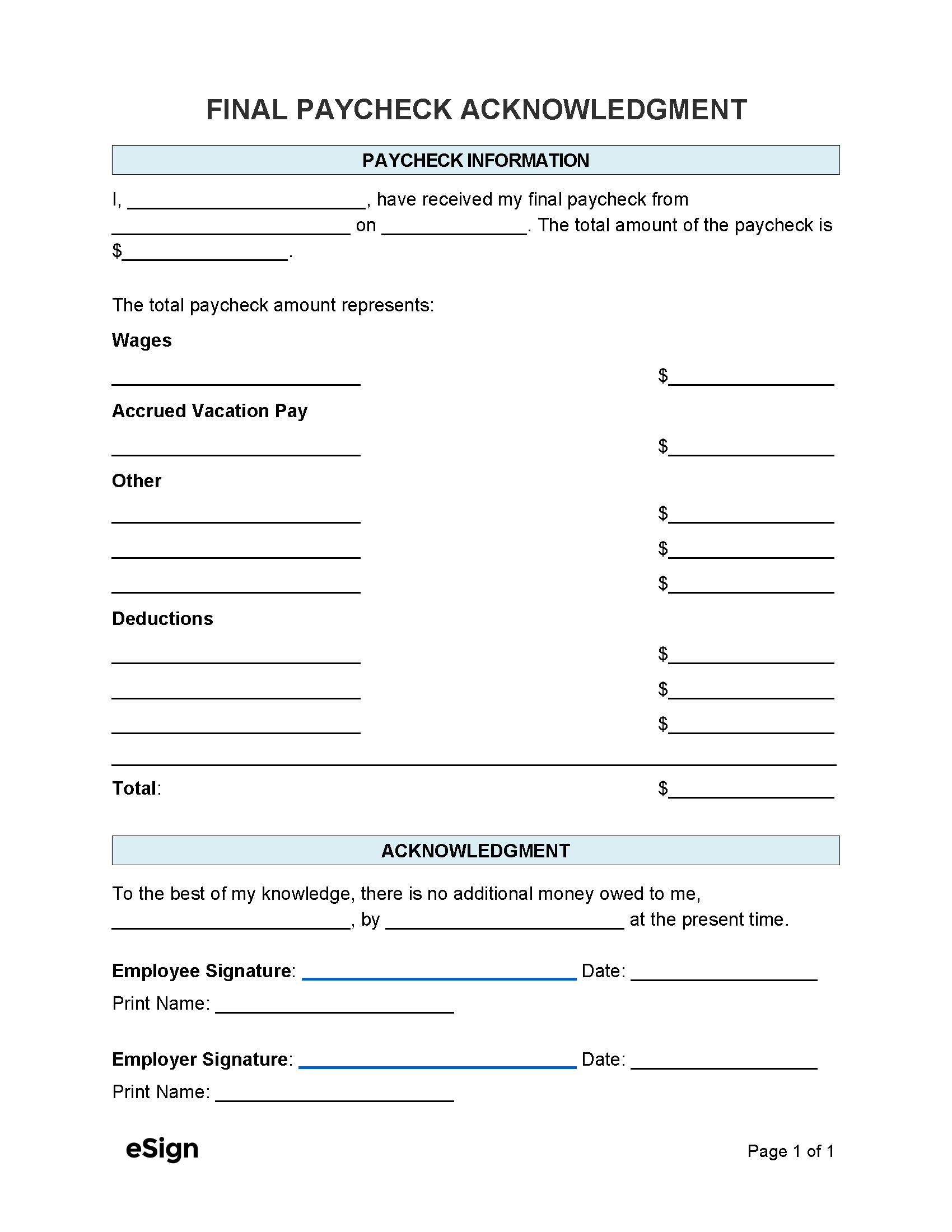

Sample

I, [EMPLOYEE NAME], have received my final paycheck from [EMPLOYER NAME] on [MM/DD/YYYY]. The total amount of the paycheck is [TOTAL AMOUNT].

The total paycheck amount represents:

Wages

[PAY PERIOD]: $[WAGES AMOUNT]

Accrued Vacation Pay

[VACATION TIME ACCRUED]: $[VACATION PAY AMOUNT]

Other

[OTHER PAY REASON]: $[OTHER PAY AMOUNT]

[OTHER PAY REASON]: $[OTHER PAY AMOUNT]

[OTHER PAY REASON]: $[OTHER PAY AMOUNT]

Deductions

[DEDUCTION REASON]: $[DEDUCTION AMOUNT]

[DEDUCTION REASON]: $[DEDUCTION AMOUNT]

[DEDUCTION REASON]: $[DEDUCTION AMOUNT]

Total: $[TOTAL AMOUNT]

To the best of my knowledge, there is no additional money owed to me by [EMPLOYER NAME] at the present time.

Employee Signature: Date: ______________

Print Name:[EMPLOYEE NAME]

Company Signature: Date: ______________

Print Name:[COMPANY REPRESENTATIVE NAME] Title:[COMPANY REPRESENTATIVE TITLE]