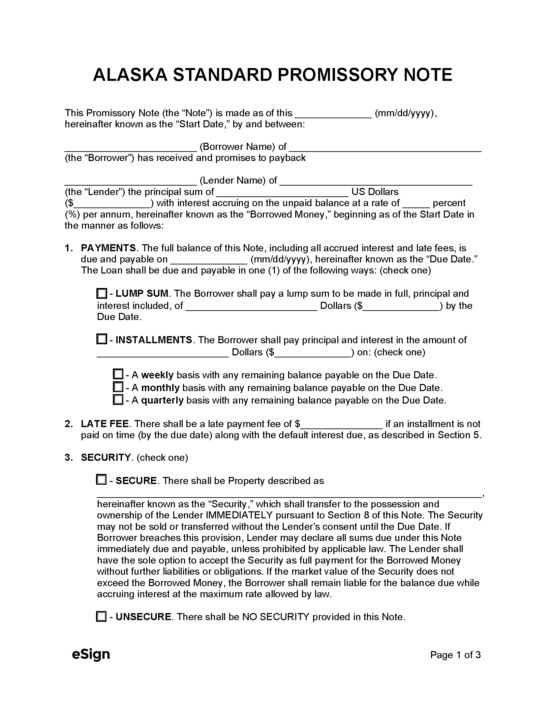

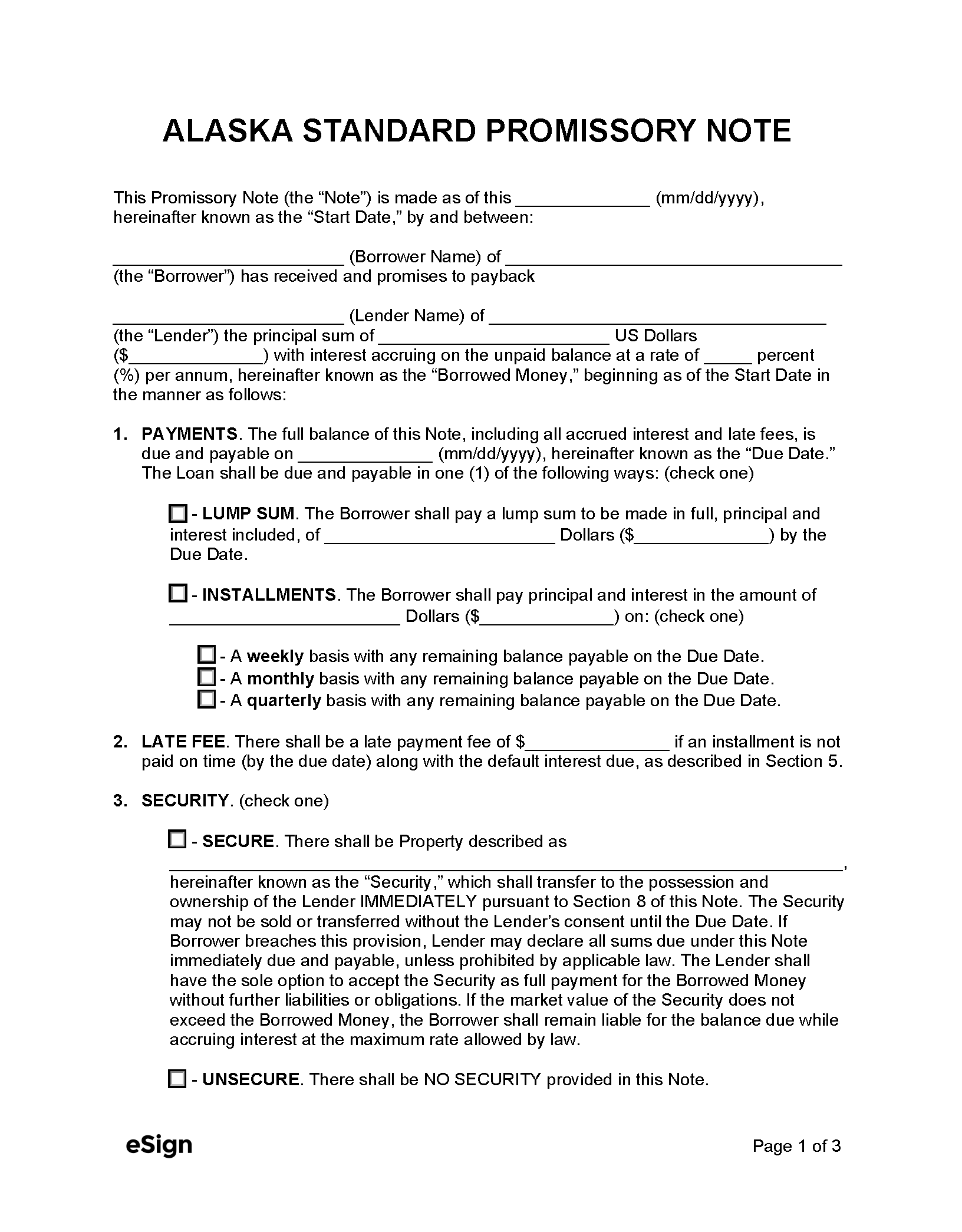

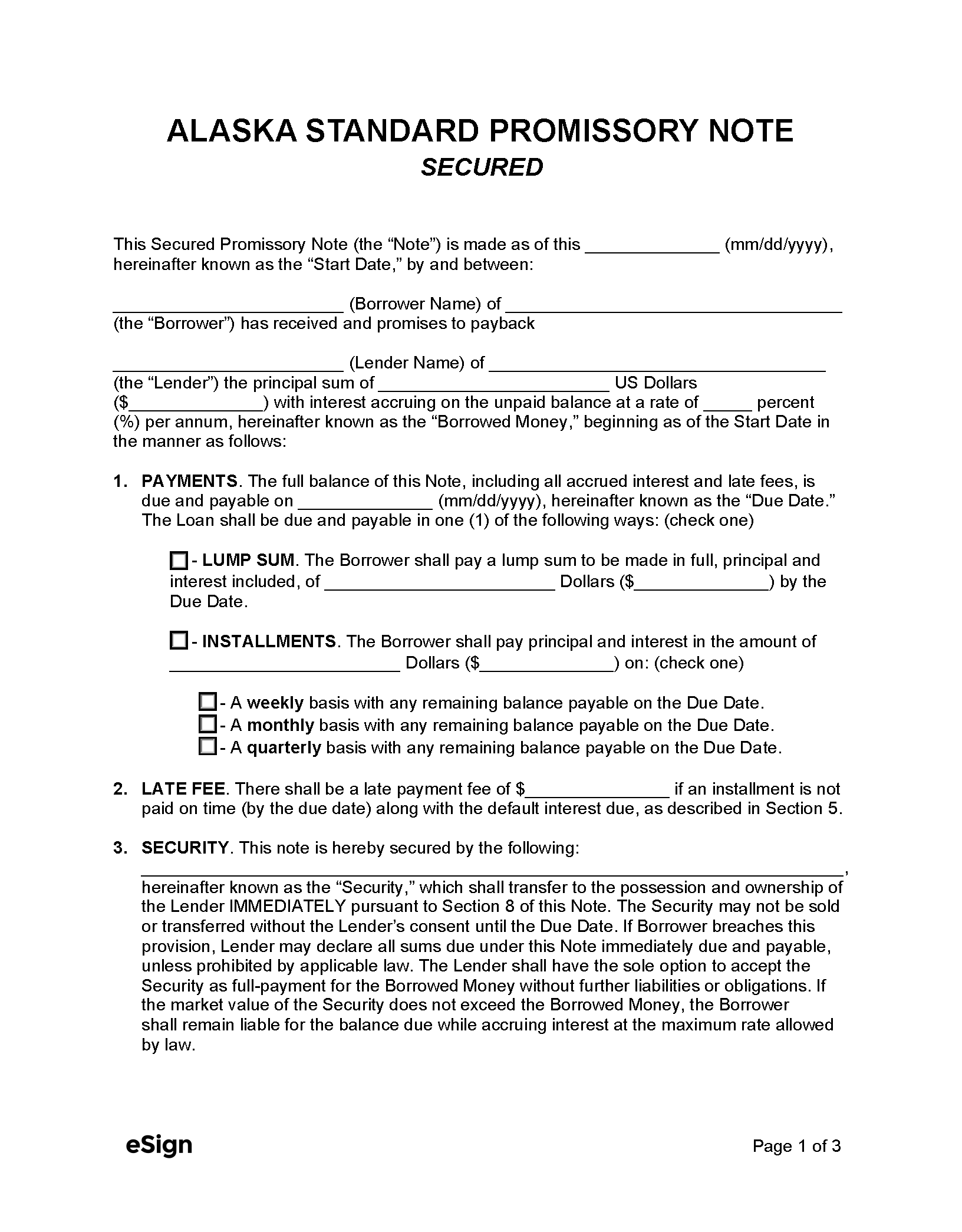

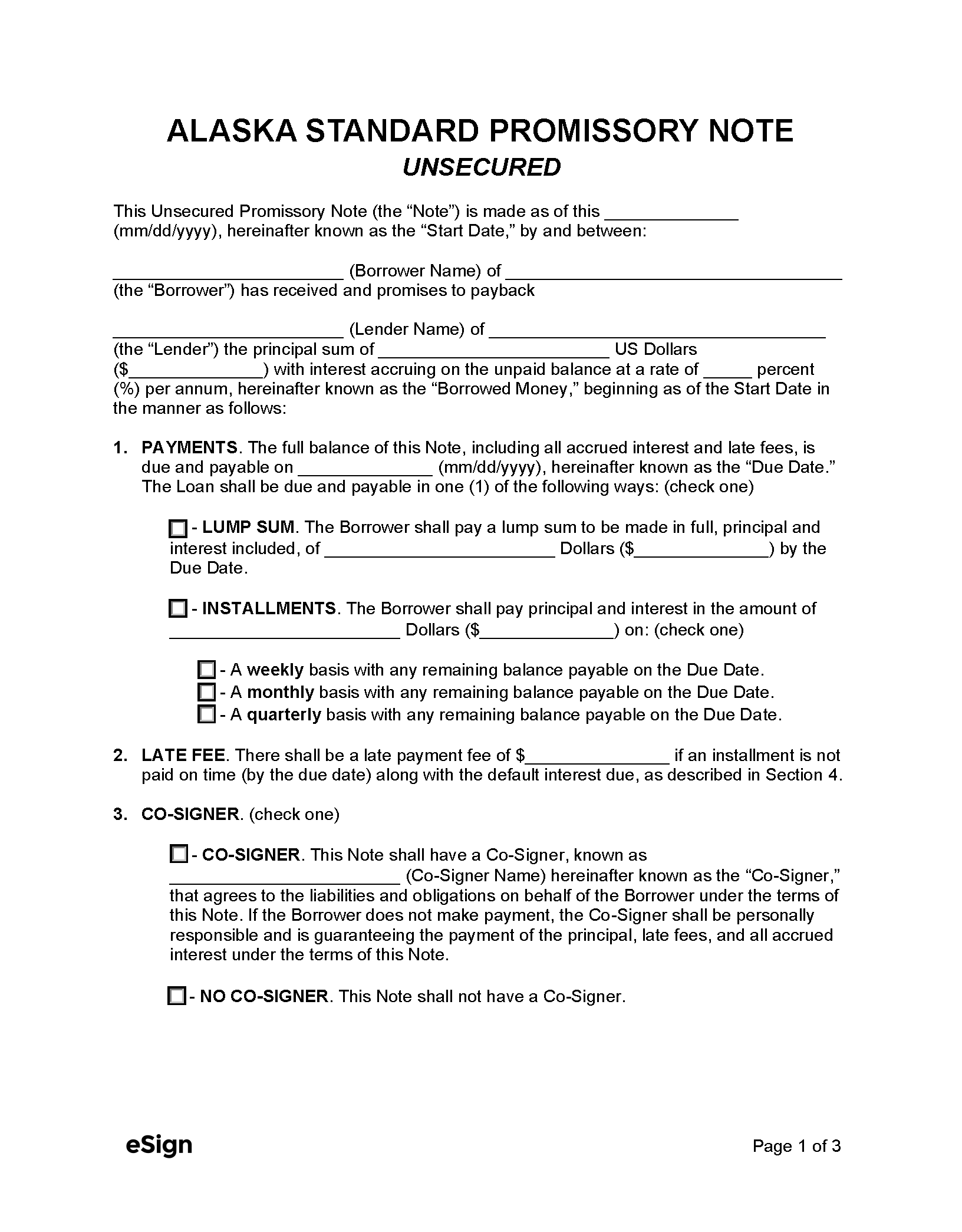

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 45, Chapter 45

- Usury Rate With Contract (Under $25,000) (§ 45.45.010(b)): Maximum is the greater of 10% OR 5% plus the annual rate charged to member banks of the Federal Reserve on the day the loan was made.

- Usury Rate With Contract (Over $25,000) (§ 45.45.010(b)): No maximum.

- Usury Rate Without Contract (§ 45.45.010(a)): 10.5%

- Usury Rate for Small Business Loans (§ 45.81.210(a)): 75% of value of collateral.

- Usury Rate for Small Loans ($25,000 or less) (§ 06.20.230): 3% per month on $850 or less; 2% per month on $850 – $10,000; and at a rate agreed by contract on the remaining balance between $10,000-$25,000.

- Usury Rate for Credit Union Loans (§ 06.45.060(a)(5)(A)(vi)): Maximum is the greater of 15% or the rate specified in § 45.45.010(b).

- Usury Rate on Judgments (§ 09.30.070): 3% above Federal Reserve District discount rate (no maximum if the rate is established in a contract).