Is an Operating Agreement Required?

No – Mississippi law doesn’t require an operating agreement, but without it, state law will govern the operations of the LLC.

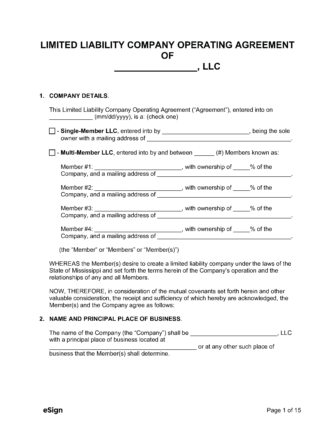

Types (2)

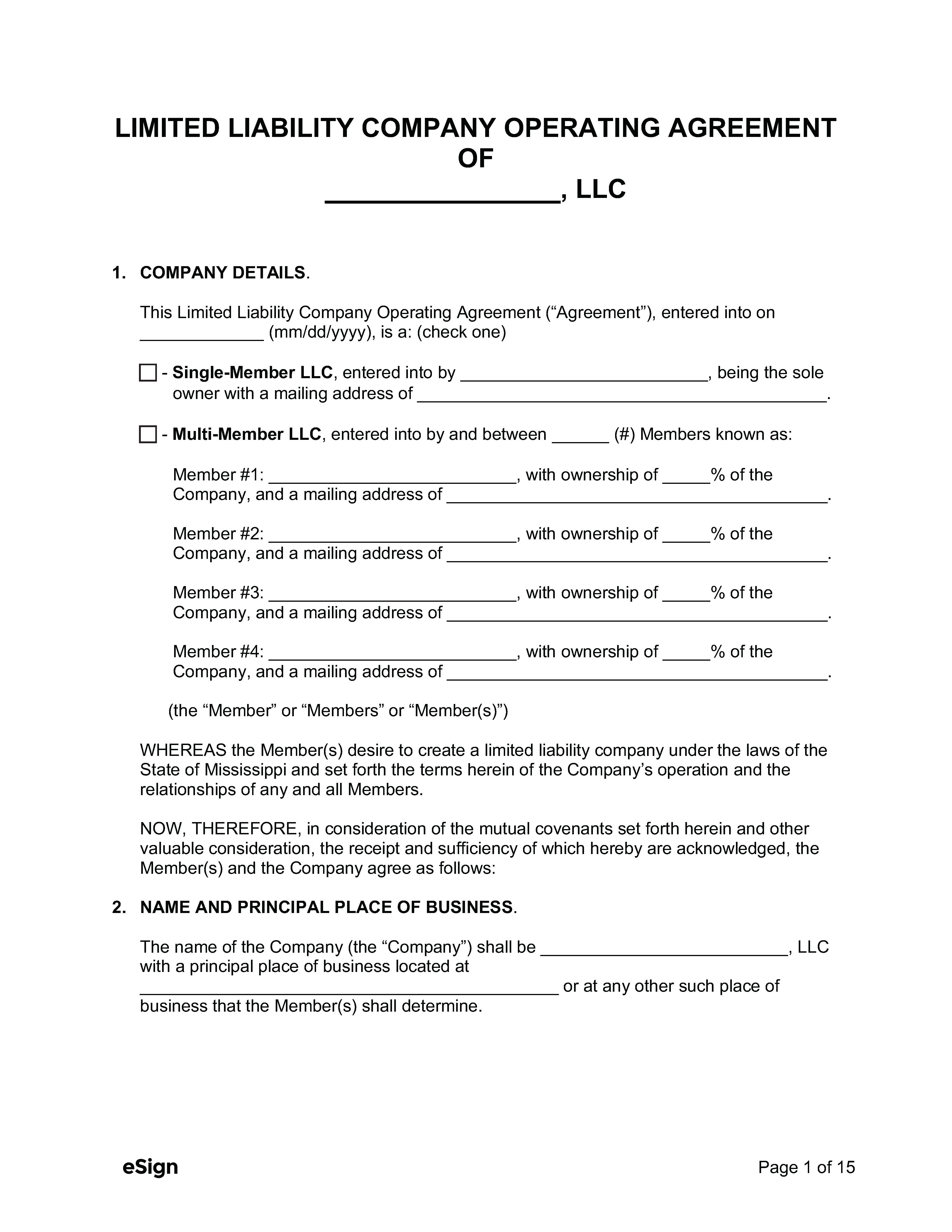

Single-Member LLC Operating Agreement – This document may be used for LLCs with a single owner. Single-Member LLC Operating Agreement – This document may be used for LLCs with a single owner.

|

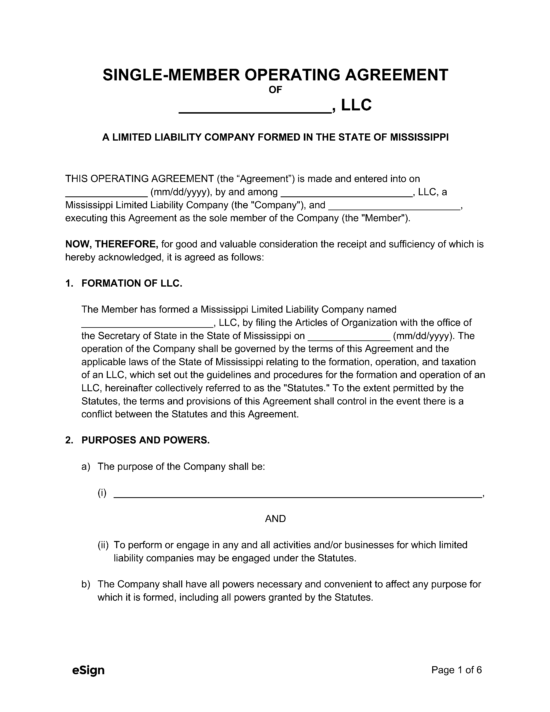

Multi-Member LLC Operating Agreement – This form should be used for a limited liability company with two or more owners. Multi-Member LLC Operating Agreement – This form should be used for a limited liability company with two or more owners.

|