Types (2)

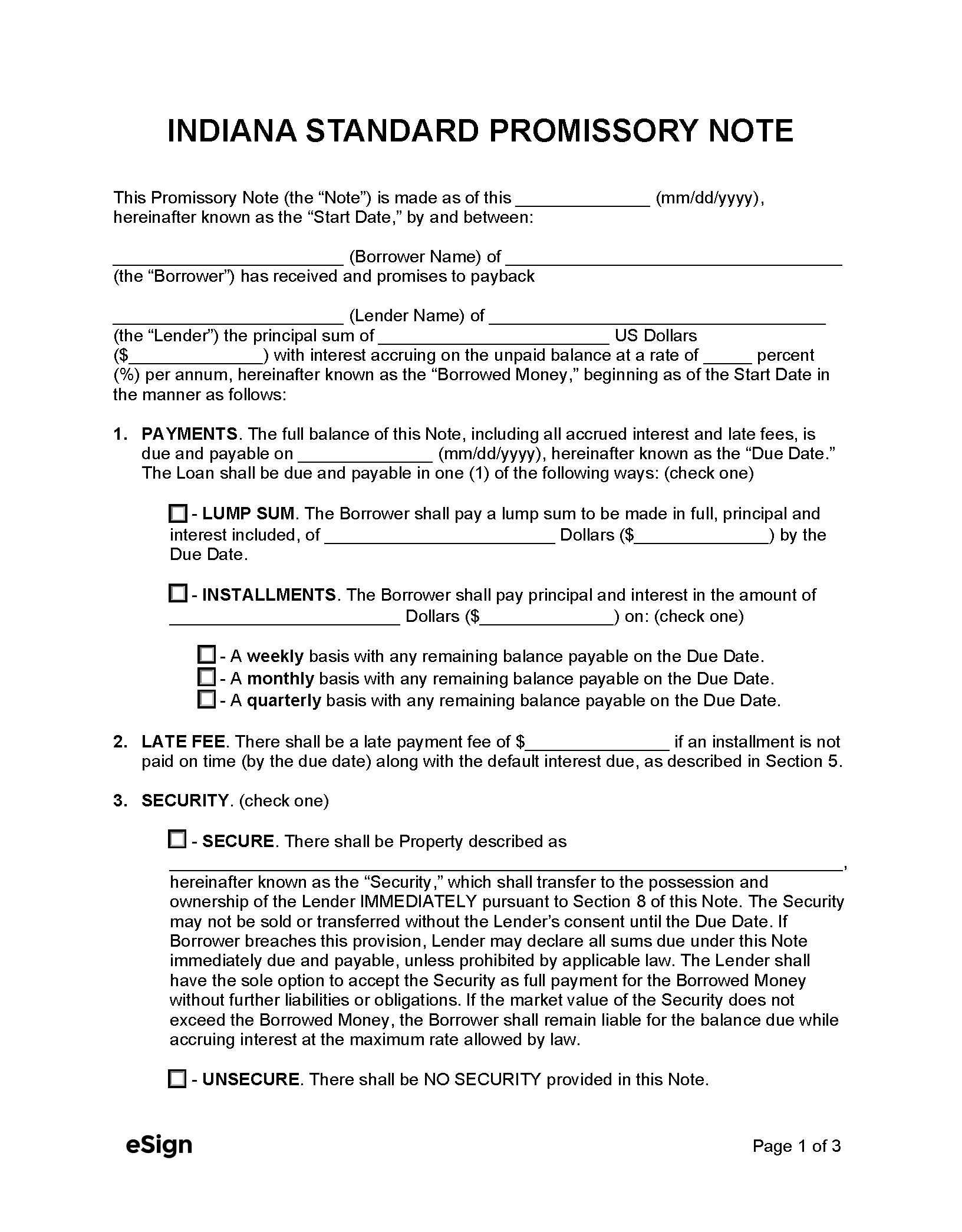

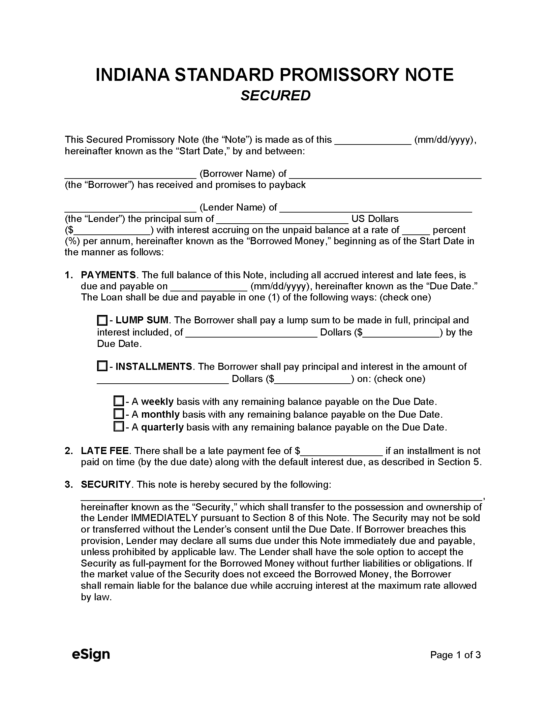

Download: PDF, Word (.docx), OpenDocument

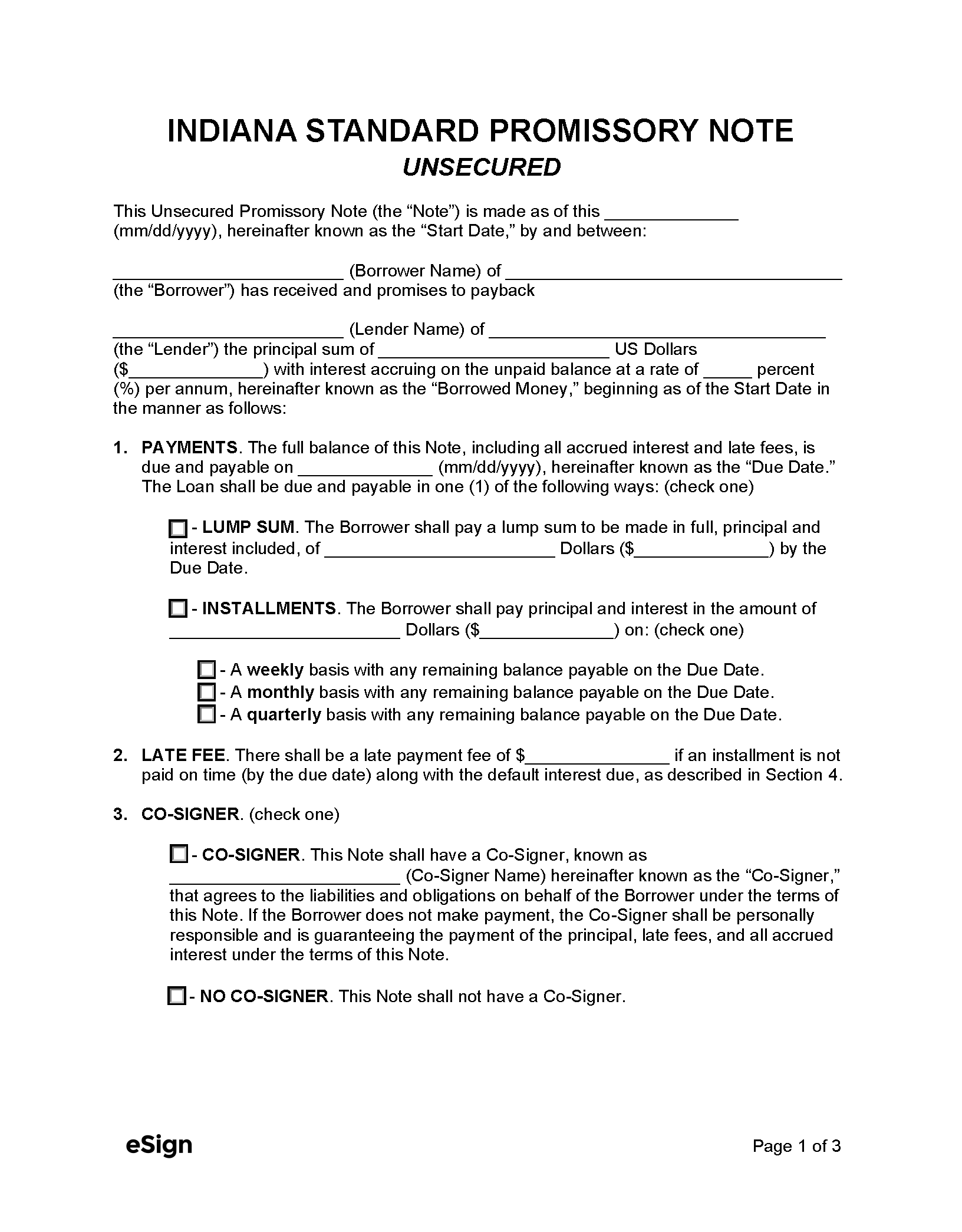

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 24, Art. 4.5, Ch. 3

- Usury Rate for Unsupervised Loan (IC 24-4.5-3-201(1)): 25%

- Usury Rate for Supervised Loans (IC 24-4.5-3-508(2)): 15%-36% depending on loan amount.

- Usury Rate for Monetary Judgments (IC 24-4.6-1-101): 8%

- Usury Rate for Monetary Judgements in Absence of Agreement (IC 24-4.6-1-102): 8%

- Usury Rate for Monetary Judgements Against State (IC 34-54-8-5): 6% starting on the forty-fifth (45th) day after judgment.