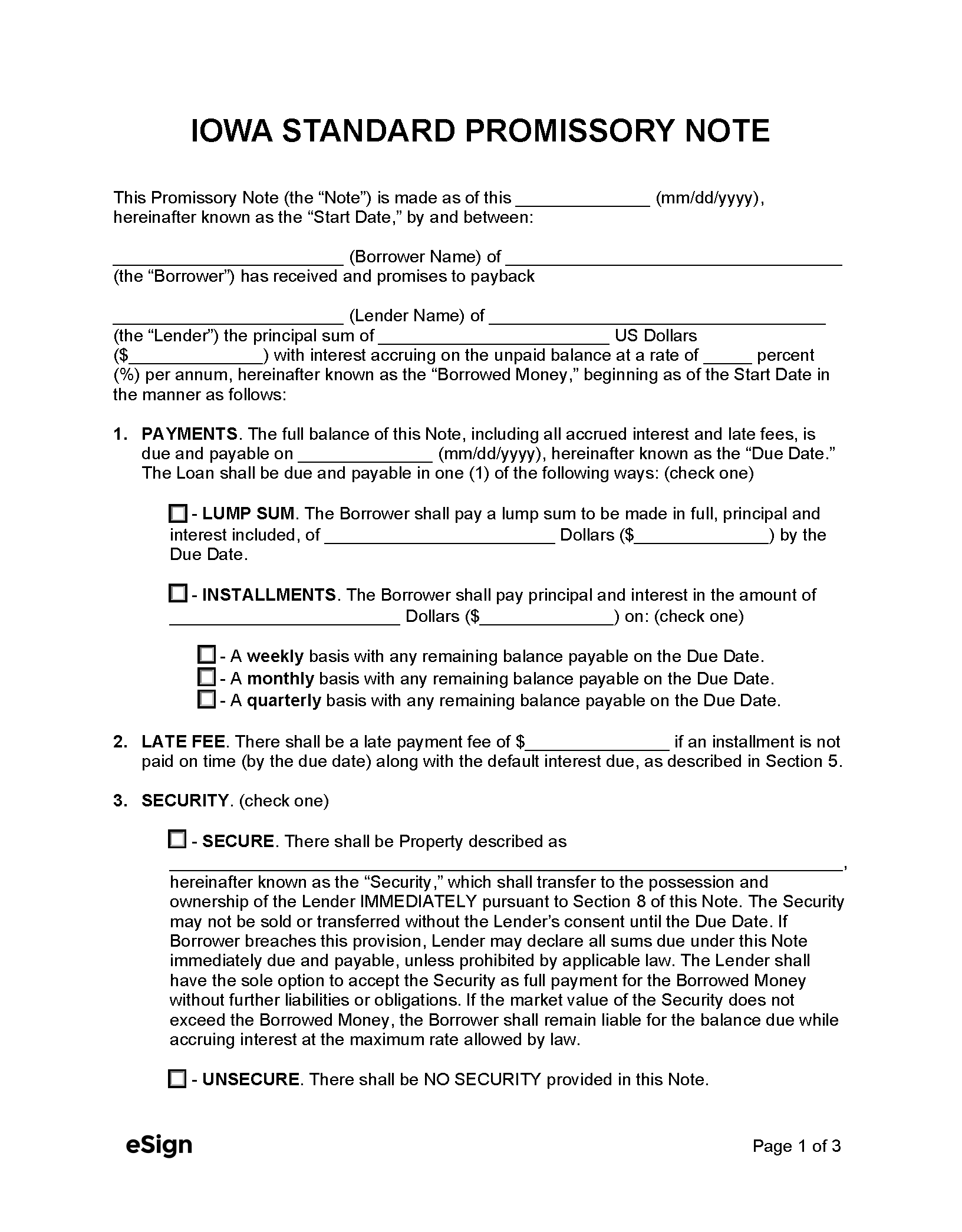

Types (2)

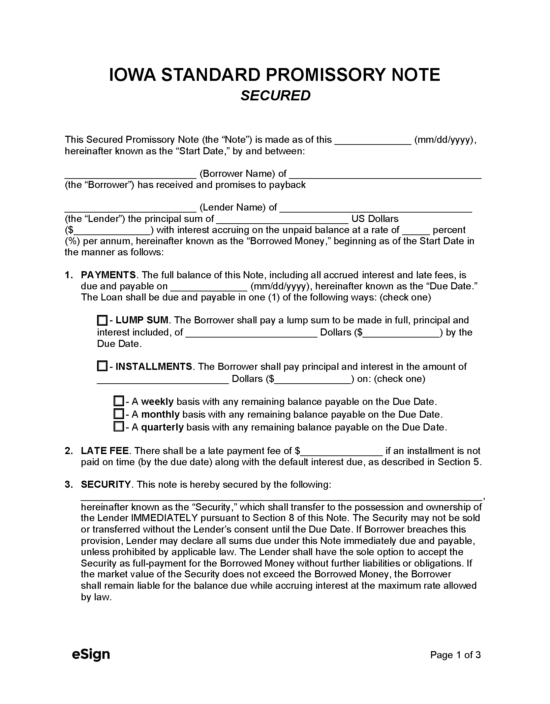

Secured Promissory Note – A lending agreement in which the borrower must offer one (1) or more of their assets as collateral.

Download: PDF, Word (.docx), OpenDocument

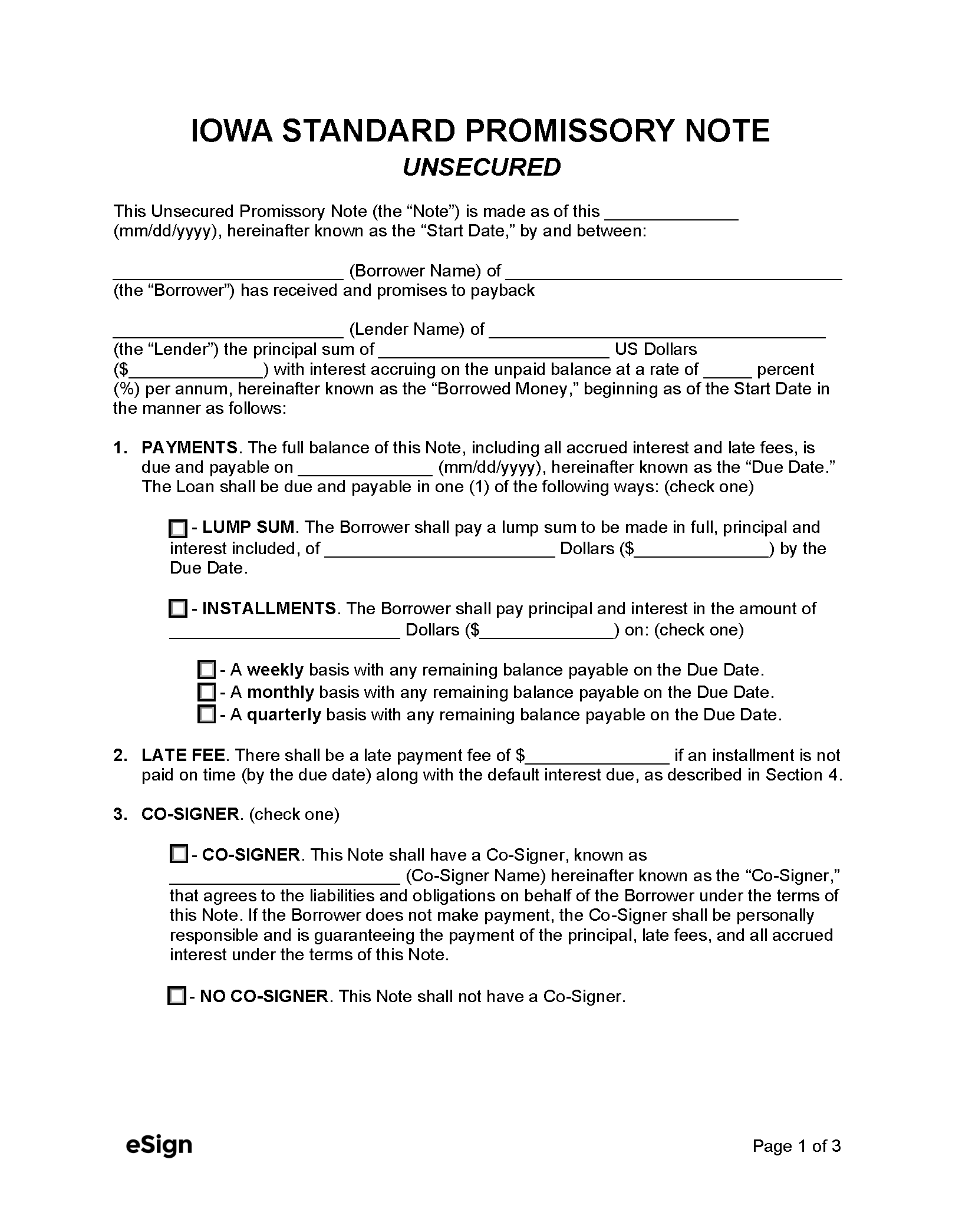

Unsecured Promissory Note – For use when the borrower is not required to secure the loan with collateral.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title XIII, Ch. 535

- Usury Rate In General (§ 535.2(1) & § 535.2(3)(a)): *5% per year, unless a different rate is agreed to in writing, in which case the interest rate cannot exceed the limit set by the Superintendent of Banking.

- Usury Rate for Monetary Judgments (§ 668.13(2) & § 668.13(3)): The contract rate applies; cannot exceed the rate permitted by § 535.2. In the absence of a contract, the maximum interest rate is 2% more than the one-year treasury constant maturity designated by the Federal Reserve.

*Any rate of interest may be applied to loans for real property, business or agricultural purposes, or any other transaction stated in § 535.2(2).