Types (2)

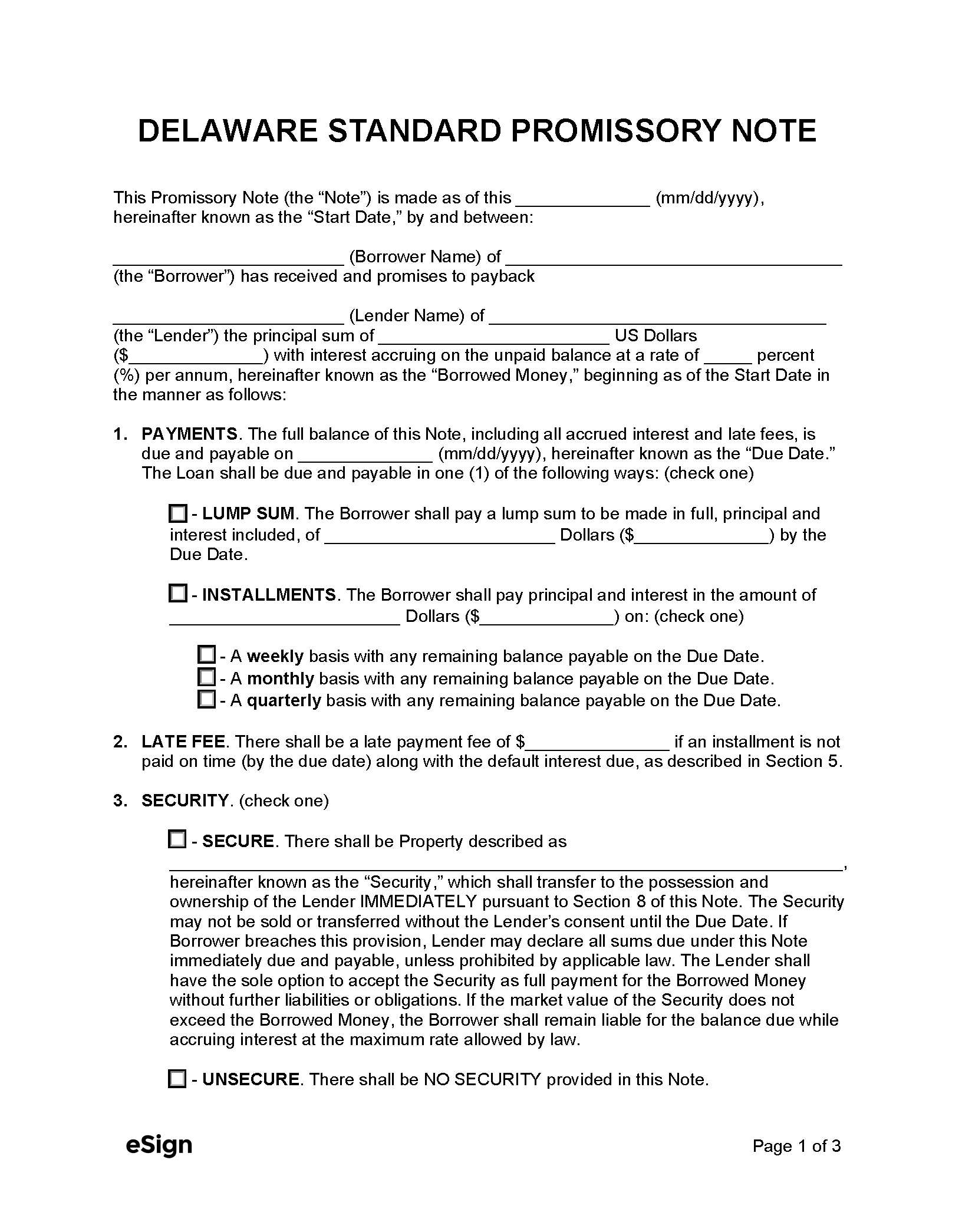

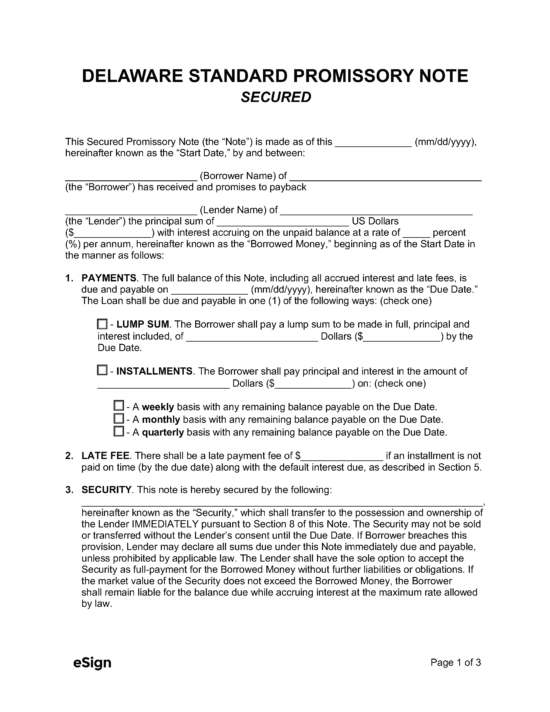

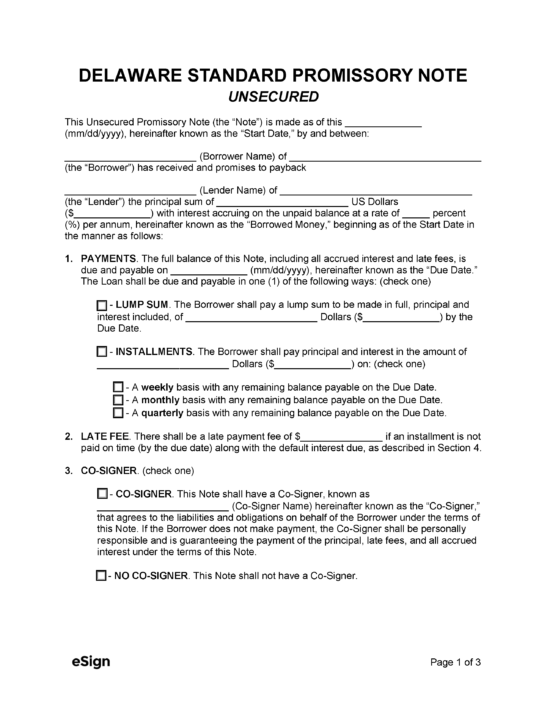

Secured Promissory Note – A loan granted to a lender under the condition that the lender puts up personal assets as collateral.

Secured Promissory Note – A loan granted to a lender under the condition that the lender puts up personal assets as collateral.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 6, Chapter 23

- Usury Rate (§ 2301(a)): In excess of 5% over the Federal Reserve discount rate.

- Usury Rate for Unsecured Loans over $100,000 (§ 2301(c)): No maximum.

- Usury Rate for Life Insurance Policy Loans (§ 2911(b)(1)): 8% or an adjustable maximum interest rate as permitted by law.

- Usury Rate for Secured Pawnbroker Loans (§ 2316): 30% per month.