Types (2)

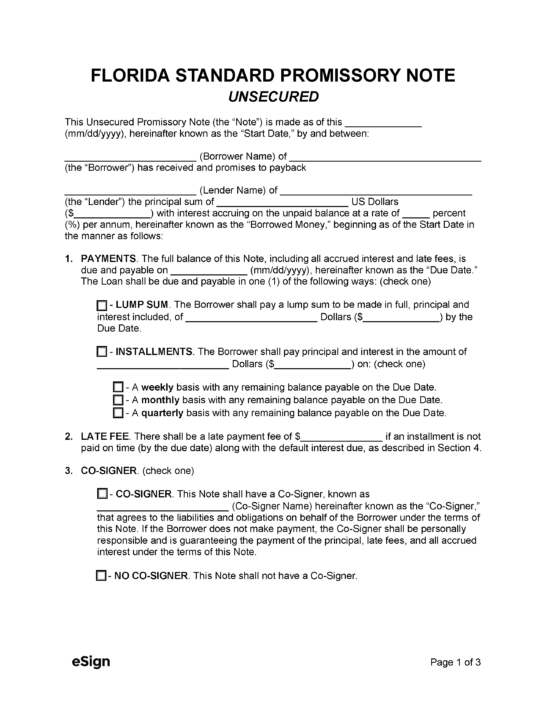

Download: PDF, Word (.docx), OpenDocument

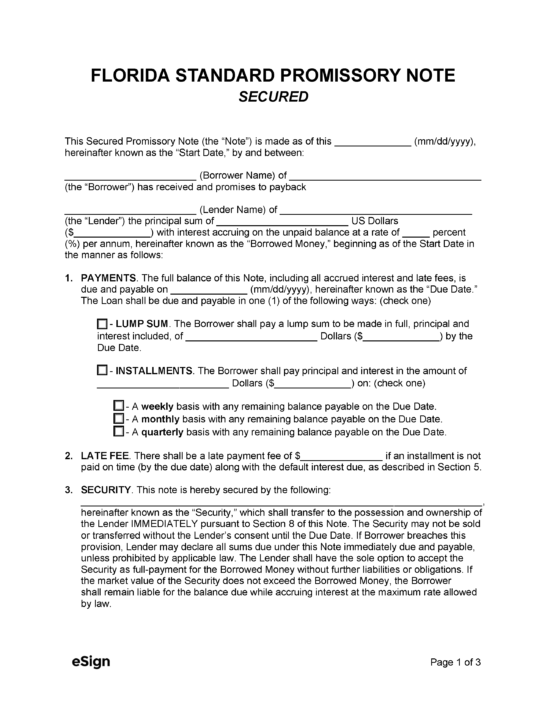

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 687

- Usury Rate (§ 687.03(1)): 18%

- Usury Rate for Loans over $500,000 (§ 687.03(1) and 687.071(2)&(3)): Over 25% is a 2nd degree misdemeanor; over 45% is a 3rd degree felony.

- Usury Rate for Judgments (§ 55.03(1)): 4% above the federal discount rate.

- Usury Rate for Life Insurance Policy Loans (§ 627.4585(2)): 10% or an adjustable maximum interest rate as permitted by law.

- Usury Rate for Consumer Finance Loan (Up to $25,000) (§ 516.02(2)(a)): 18%