Types (2)

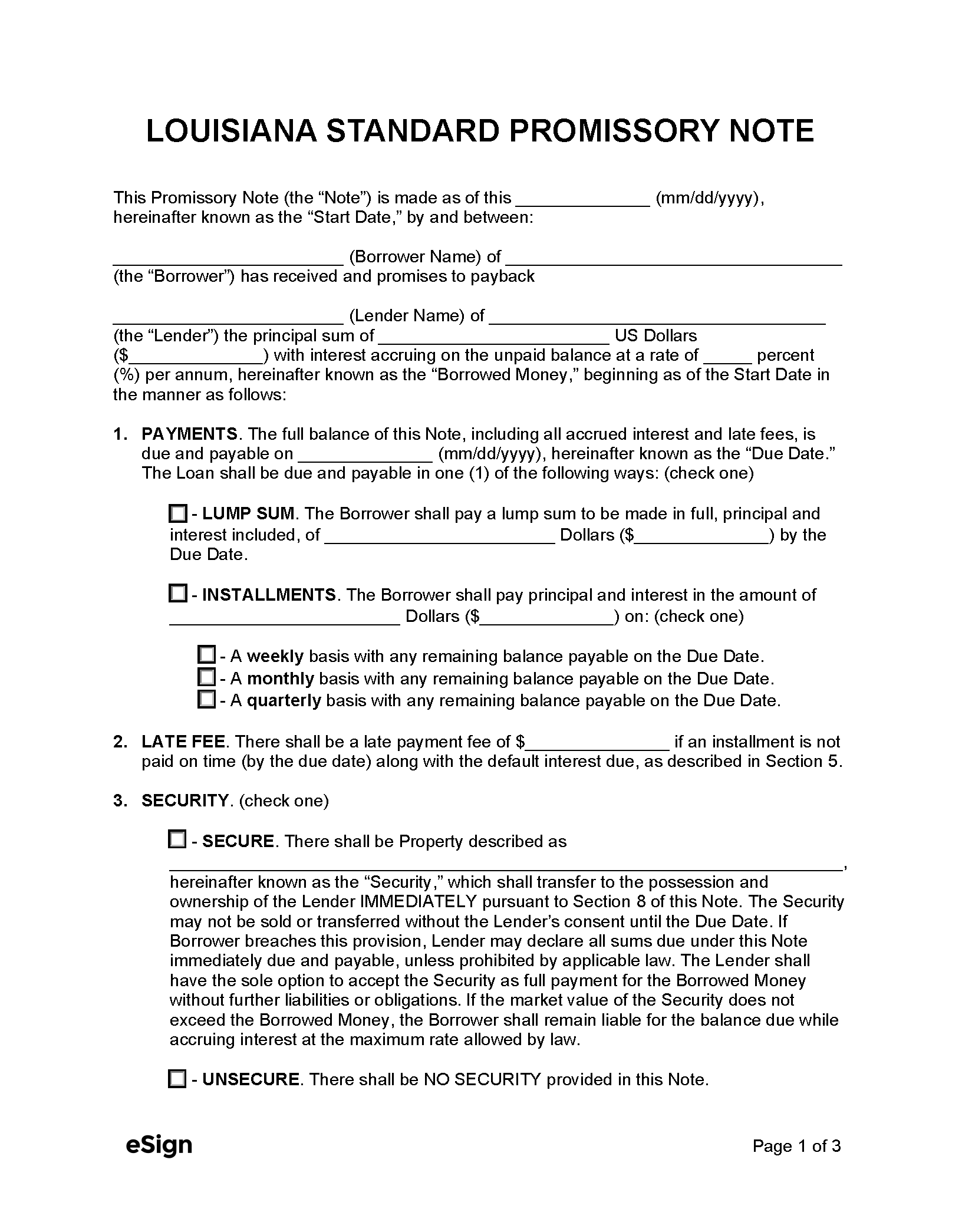

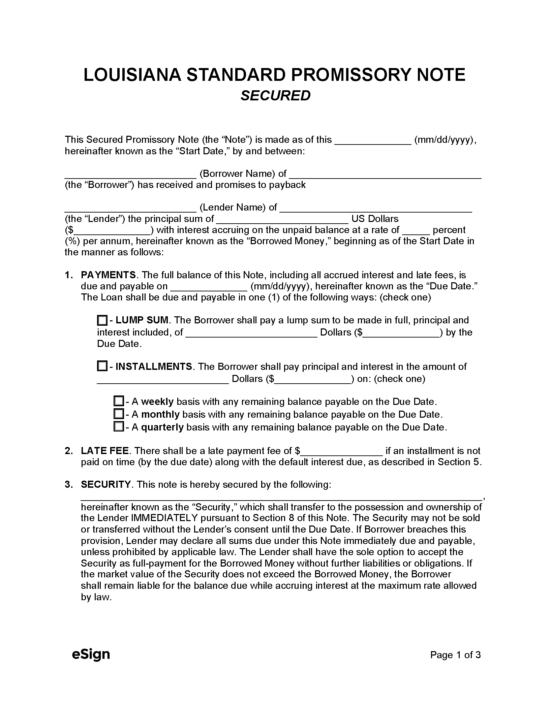

Secured Promissory Note – An agreement to pay back a loan that is protected with collateral.

Secured Promissory Note – An agreement to pay back a loan that is protected with collateral.

Download: PDF, Word (.docx), OpenDocument

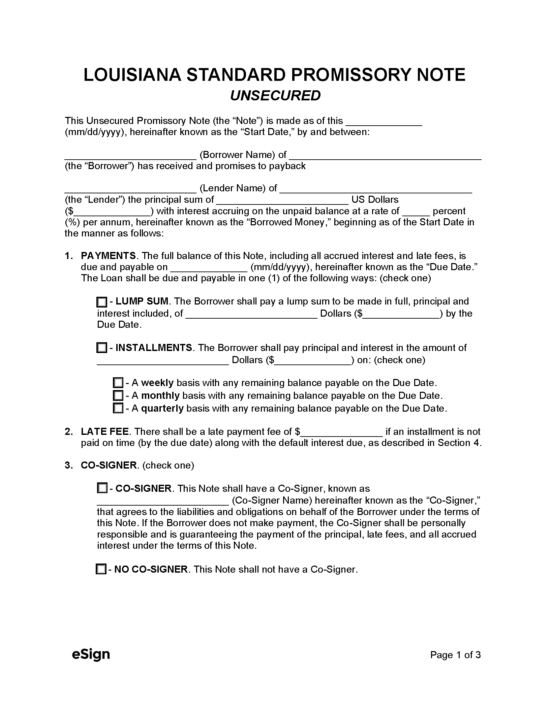

Unsecured Promissory Note – With this note, the borrower is not required to put up valuable assets as collateral.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: RS 9:3500

- Usury Rate In General (RS 9:3500(C)): 12%

- Usury Rate for Judicial Interest (RS 13:4202(B)): The judicial interest rate cannot exceed 3.25% above the federal discount rate, which is the interest rate on loans issued by the Federal Reserve Bank to commercial banks and other depository institutions.

- Usury Rate for Suit Against State or Political Subdivision (RS 13:5112(C)): The interest rate on a claim for personal injury or wrongful death cannot exceed 6%.