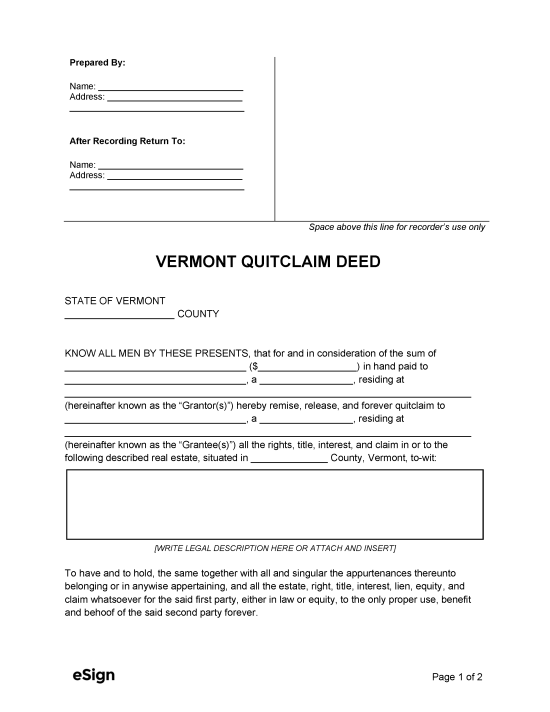

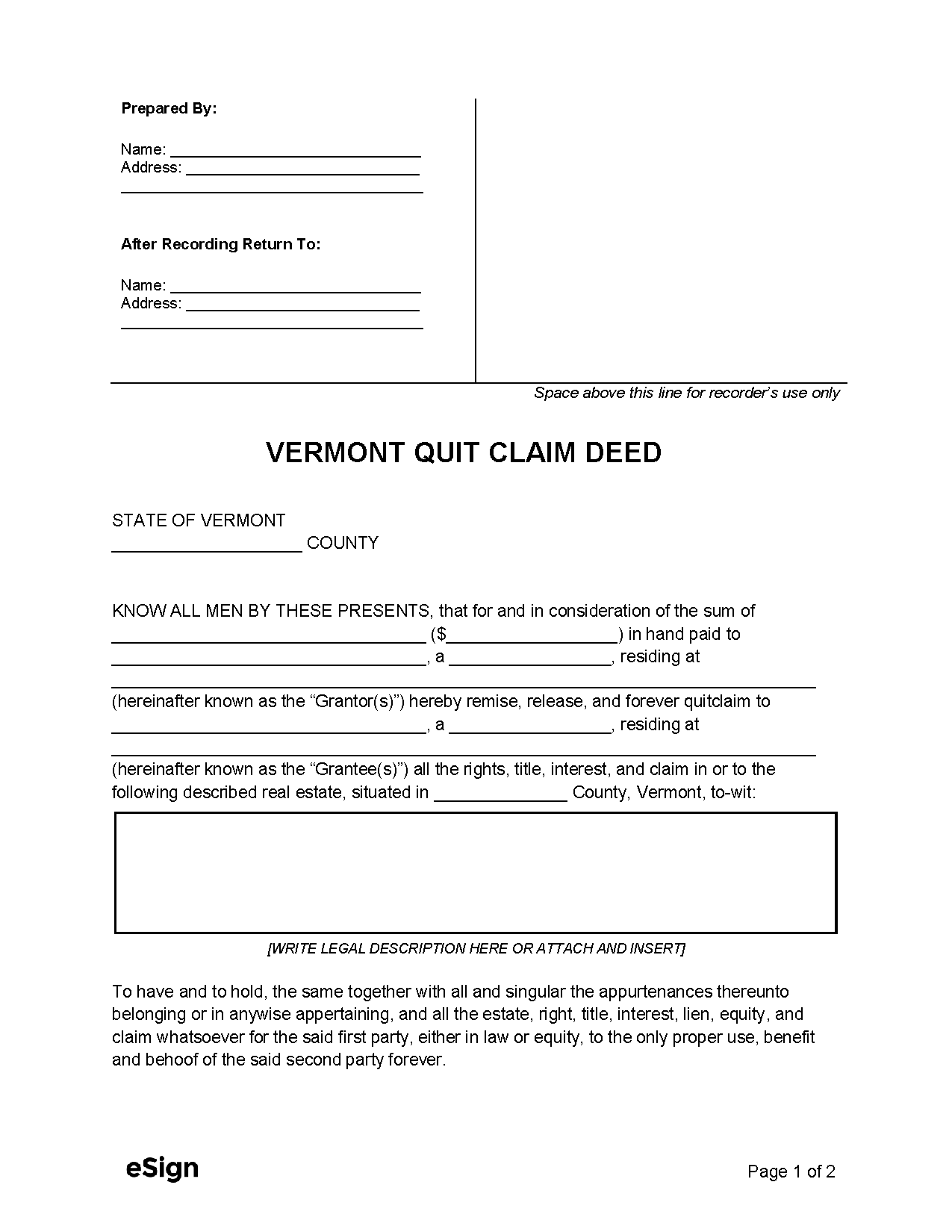

Vermont Quitclaim Deed Form

Last updated May 16th, 2025

A Vermont quitclaim deed transfers an individual’s interest in a property to a new owner but does not provide any warranty that the title is clear. As covenants or warranties are not included in a quitclaim deed, the new owner (grantee) risks receiving a title clouded by liens or finding out that the grantor has no right to transfer the title in the first place.

Recording Details

- Signing Requirements – The grantor must acknowledge their signature in front of a notary public.[1]

- Where to Record – Town/County Clerk’s Office[2]

- Recording Fees – $15 per page (as of this writing)[3]

Formatting Requirements

Vermont has no state-wide formatting standards. Individuals should check with their local clerk for specific formatting requirements.