Recording Requirements

- A notary must take the grantor’s acknowledgment of their signature.[1]

- Deeds must be no greater than 8.5″ x 14″ to be valid for recording.[2]

Once a deed has been properly executed, it can be submitted to the County Clerk for recording.[3] The recording fee is $40 for the first page and $10 for each additional page.[4]

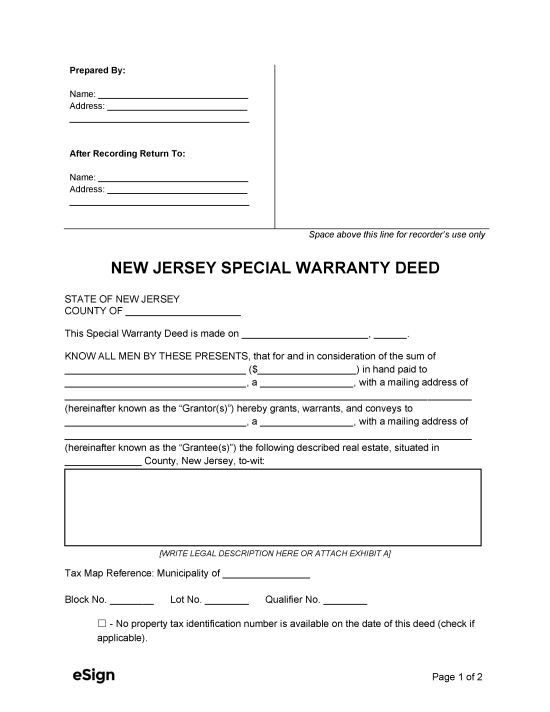

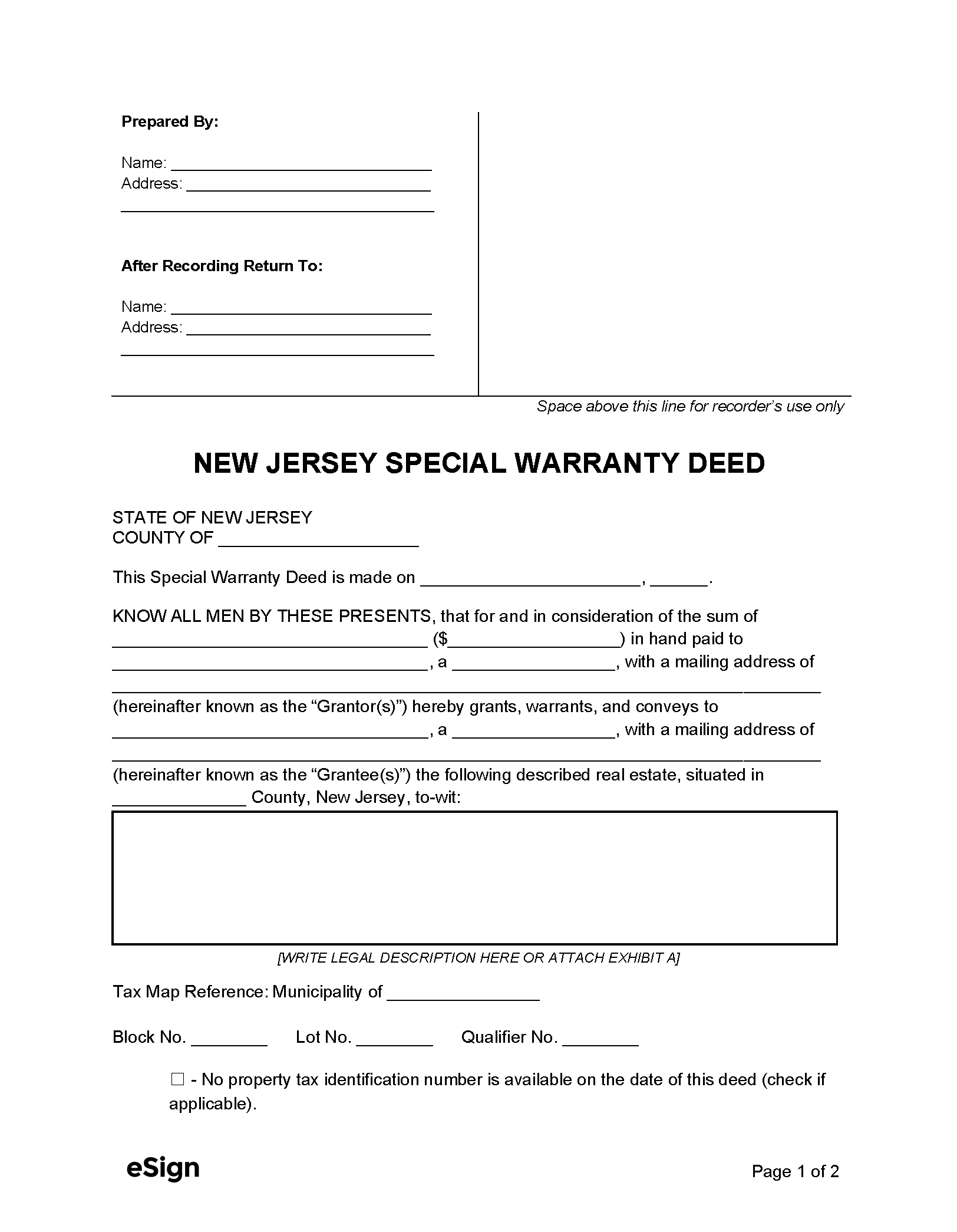

Special Warranty Deed (Preview)

Additional Forms

Each county has their own cover sheet that must be included when recording a deed.[5] The following documents may also be required:

GIT/REP-1: Nonresident Seller’s Tax Declaration – This form must be used by non-resident sellers to declare income tax before a deed is recorded.[6]

GIT/REP-2: Nonresident Seller’s Tax Prepayment Receipt – Non-resident sellers may pay their tax before a deed is filed by completing this form (instead of Form GIT/REP-1) and filing it with the Dept. of Taxation. Once certified, this form is then filed with the deed.

GIT/REP-3: Seller’s Residency Certification/Exemption – Sellers who are NJ residents (or any resident selling their primary residence) must complete this form to claim exemption from the tax prepayment and provide it to the buyer for filing with the deed.

RTF-1: Affidavit of Consideration for Use by Seller – For sellers to claim exemption from the realty transfer fee (if applicable).[7] Otherwise, the fee is due at the time of recording.