Recording Requirements

- The grantor’s signature and notary acknowledgement are required.[1]

- The only formatting requirement specified by Vermont law is an 8pt font size.[2] Each city/town/county clerk may impose additional requirements.

Deeds must be recorded at the City/Town/County Clerk’s Office of the county in which the property is situated.[3] The recording fee is $15 per page (as of this writing).[4]

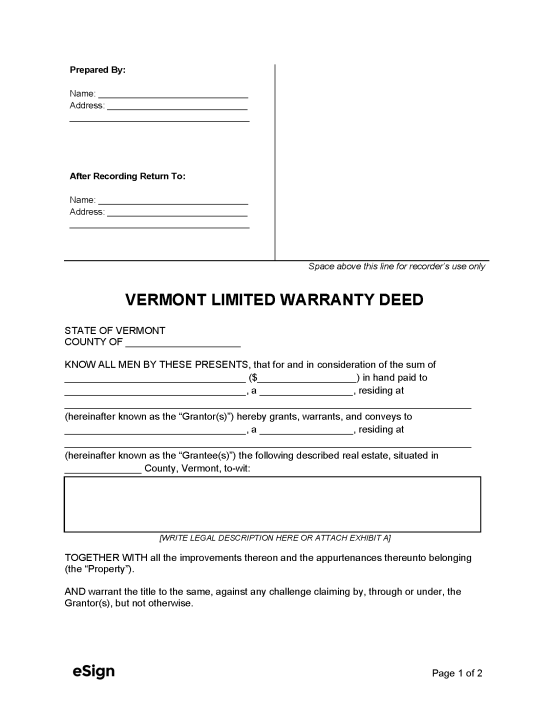

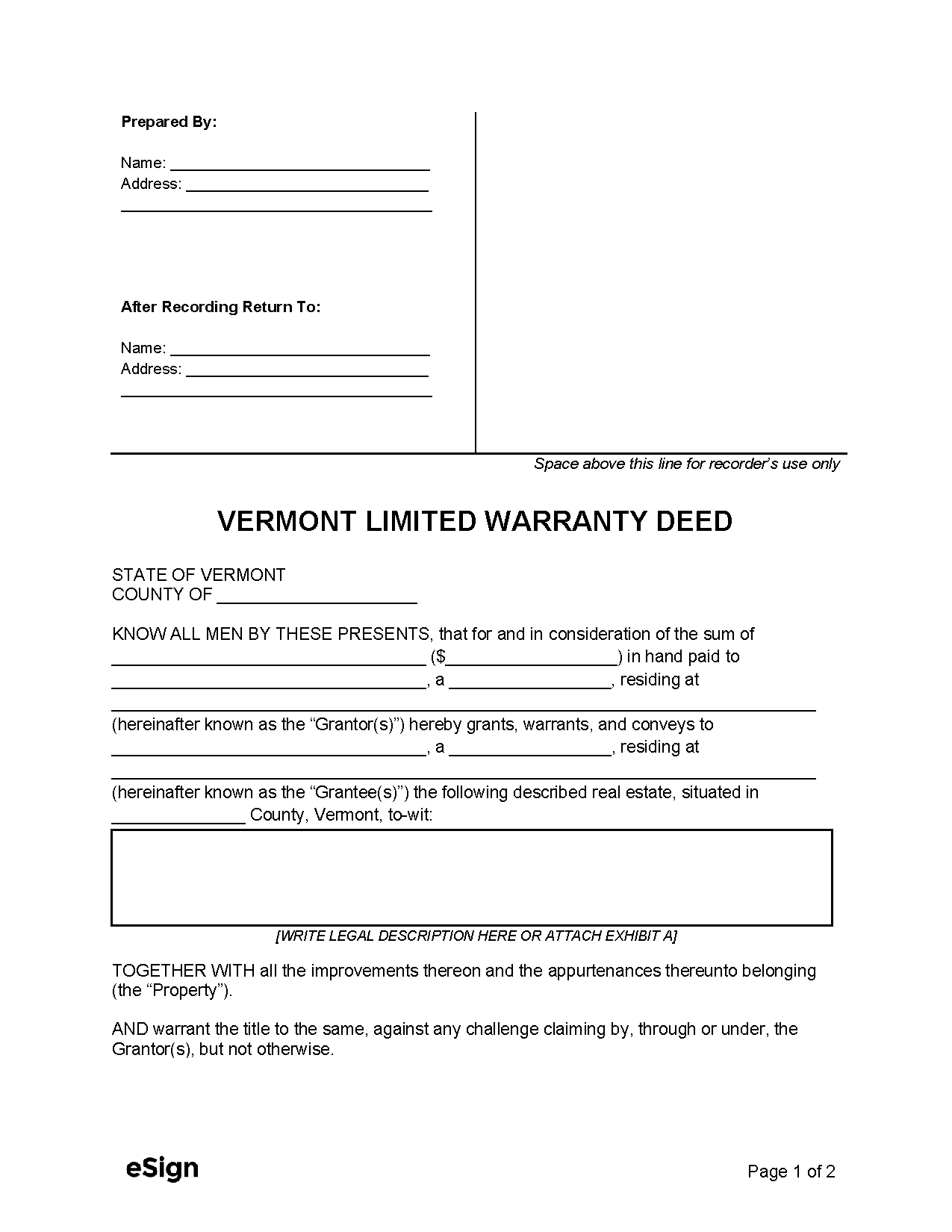

Limited Warranty Deed (Preview)

Additional Forms

Property Transfer Tax Return (Form PTT-172) – Individuals must include this form when filing a deed and pay the Property Transfer Tax by check or online (see instructions).[5]