Recording and Resources

Formatting

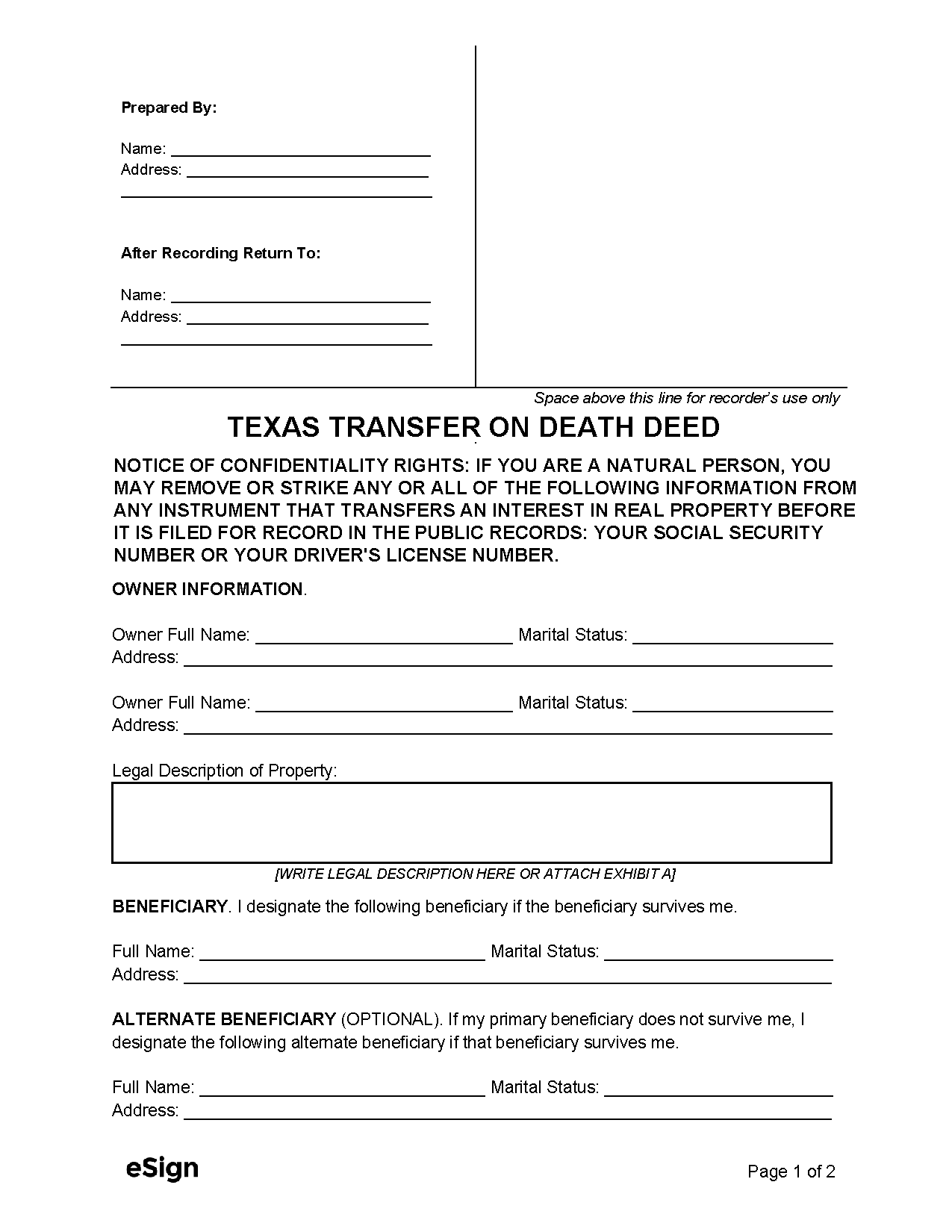

- Paper: 8.5″ x 14″ max.

- Font: 8pt min.[1]

Signing and Recording

- Signing Requirements: Two witnesses or notary[2]

- Where to Record: County Clerk’s Office[3]

- Recording fees: $25 for first page, $4 per additional page (as of this writing)[4]

Resources