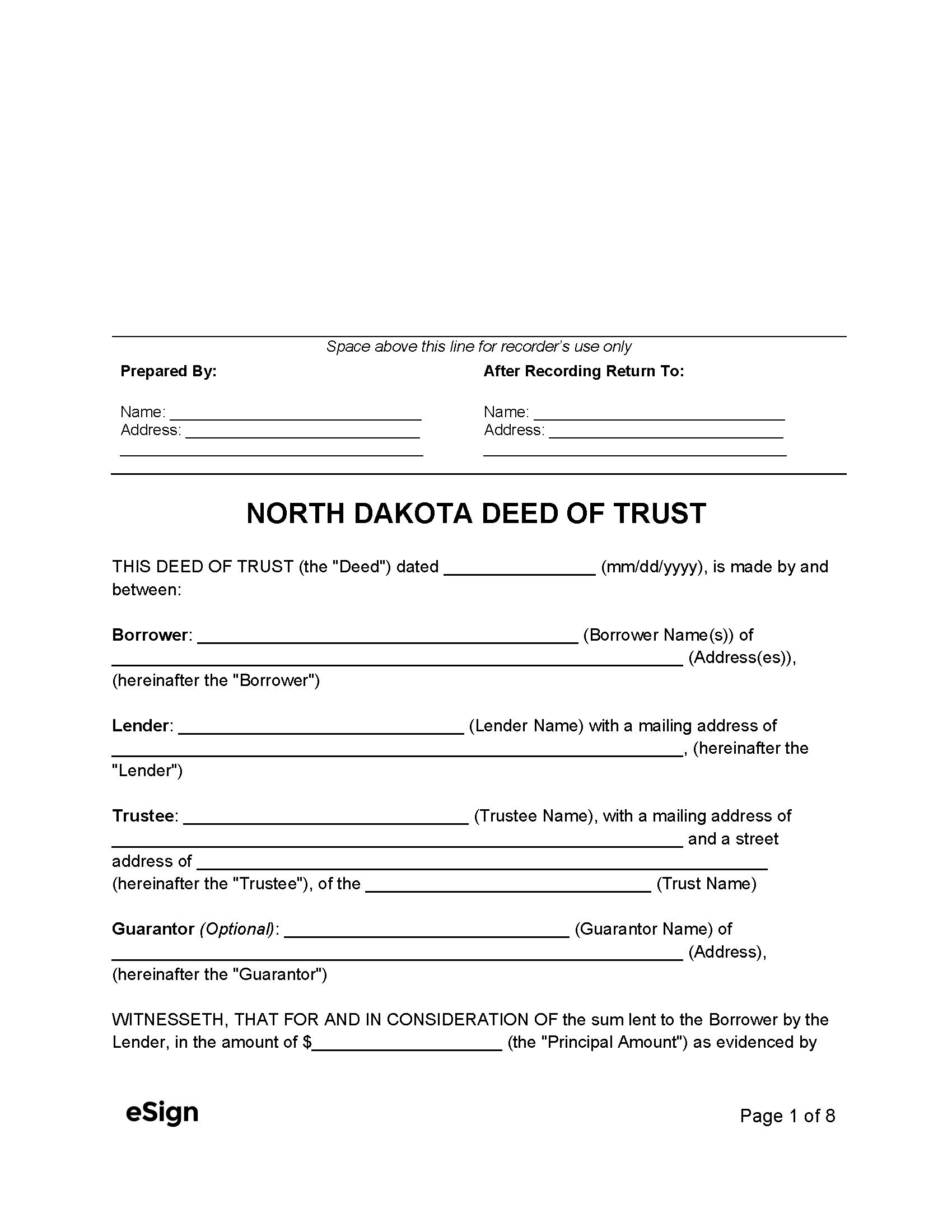

Where to Record

The County Recorder’s Office handles deed filings in North Dakota.[1] The document must be notarized.[2] The following formatting guidelines must be adhered to[3]:

- Max. 8.5″ x 14″ paper

- Font equal or larger than 10pt. Calibri

- First page top margin at least 3″, all other sides 1″

Foreclosure

In North Dakota, the foreclosure process is handled by the court. Trustees cannot foreclose without a judicial process.[4]